This year, Ethereum‘s price has experienced a significant downturn following strong opposition it faced near the $4,000 mark in December.

Over the past few days, Ethereum (ETH) has dropped by almost 20%, mirroring a widespread selling trend in Bitcoin and other alternative cryptocurrencies that started around December’s peak.

The decline can partly be linked to withdrawals from Ethereum-based spot exchange-traded funds. Specifically, these funds experienced outflows totaling $159 million on Wednesday, adding to the $86 million withdrawn the day before. Yet, despite these recent withdrawals, Ethereum ETFs have managed to garner a total inflow of approximately $2.5 billion since their approval in 2024.

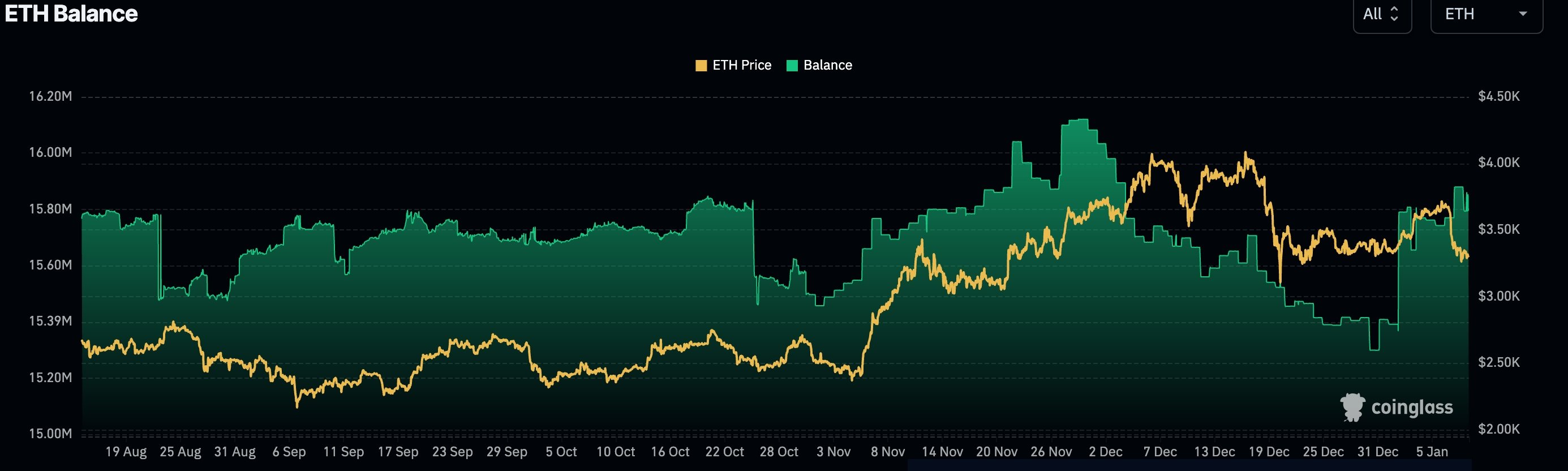

The drop in ETH’s value has happened at the same time as an uptick in the amount of ETH stored on exchanges. As per CoinGlass, the quantity of ETH kept on exchanges climbed to 15.85 million on January 9th, which is higher than the 15.3 million recorded on December 30th. An increase in exchange storage frequently suggests that investors are cashing out their Ethereum holdings.

Looking at the broader economic viewpoint, Ethereum (ETH) has been influenced by escalating U.S. long-term bond rates, coupled with a more aggressive monetary policy stance from the Federal Reserve. The yield on the 30-year bond recently peaked at 4.96%, which is its highest since October 2023. Moreover, both short-term and intermediate-term bond yields have also witnessed a steady increase.

As a researcher, I’m noticing an uptick in market yields, which seems to indicate that investors anticipate the Federal Reserve will continue with its aggressive stance, given ongoing worries about inflation.

Ethereum price analysis

Over the past week, it’s clear that Ethereum (ETH) has faced strong opposition near the $4,000 mark, a hurdle it hasn’t been able to overcome since March of the previous year.

Although there’s been a recent drop, the cryptocurrency is currently higher than both its 50-week and 100-week average lines, suggesting that the bullish sentiment has not entirely waned.

Significantly, Ethereum is progressively shaping an upside-down head and shoulder pattern, a well-known indicator of a bullish reversal. The “head” can be found at approximately $2,155, while the “left shoulder” was formed around $2,825. As long as Ethereum maintains its value above the shoulders ($2,825), the optimistic forecast for this cryptocurrency remains valid.

If ETH surpasses the resistance level at $4,085 (its neckline), we’d witness an actual breakout. In such a case, significant levels to monitor are the previous all-time high of $4,865 and the psychologically important level of $5,000. But, falling below the right shoulder at $2,825 would contradict the bullish outlook.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-01-09 19:25