As a seasoned cryptocurrency analyst with over a decade of experience in the industry, I have witnessed numerous price swings and market trends in Ethereum (ETH). And based on my observation and analysis of the current market conditions, I am bullish on ETH’s short-term prospects.

Ethereum price is up four consecutive days, reaching its highest point since July 3rd.

As a crypto investor, I’ve observed a significant 20% surge in ETH‘s price since its monthly low. This uptrend has propelled ETH into a technical bull market. The primary factors fueling this rally are threefold. Firstly, there’s growing optimism that Donald Trump may secure the U.S. presidency in November, and his administration could potentially be more favorable towards cryptocurrencies than previously anticipated. Secondly, the ongoing development of Ethereum 2.0, which brings improvements like staking and scalability, has created excitement among investors. Lastly, the increasing popularity and adoption of decentralized finance (DeFi) solutions built on the Ethereum network have contributed to this price increase.

As a crypto investor following the developments closely, I’ve noticed an intriguing shift in the odds since the first presidential debate two weeks ago. These odds began to climb steadily after that event and gained even more momentum following a shocking assassination attempt on the former president over the weekend. The endorsement of high-profile figures like Elon Musk and Bill Ackman, who have officially expressed their support for the former president, further fueled this trend.

As a researcher studying the intersection of politics and cryptocurrency, I’ve observed that Trump’s stance towards the crypto industry has earned him a favorable reputation within the community. He has taken several actions that resonate with crypto enthusiasts, such as selling NFTs post-presidency and expressing skepticism towards Central Bank Digital Currencies (CBDCs). Furthermore, his commitment to safeguarding non-custodial wallets aligns with the decentralized ethos of cryptocurrency.

The SEC’s growing tendency to greenlight various spot ETF proposals is the second significant catalyst. Major players in the industry, including VanEck, Blackrock, and Invesco, have already submitted their final applications. Analysts forecast that approvals could be handed down as early as this week.

The approval of an Ethereum ETF is noteworthy given that Ethereum is the second largest cryptocurrency in the market. Yet, it’s important to remember that this comes with a cost for investors in the form of fees and the relinquishment of staking rewards associated with holding Ether.

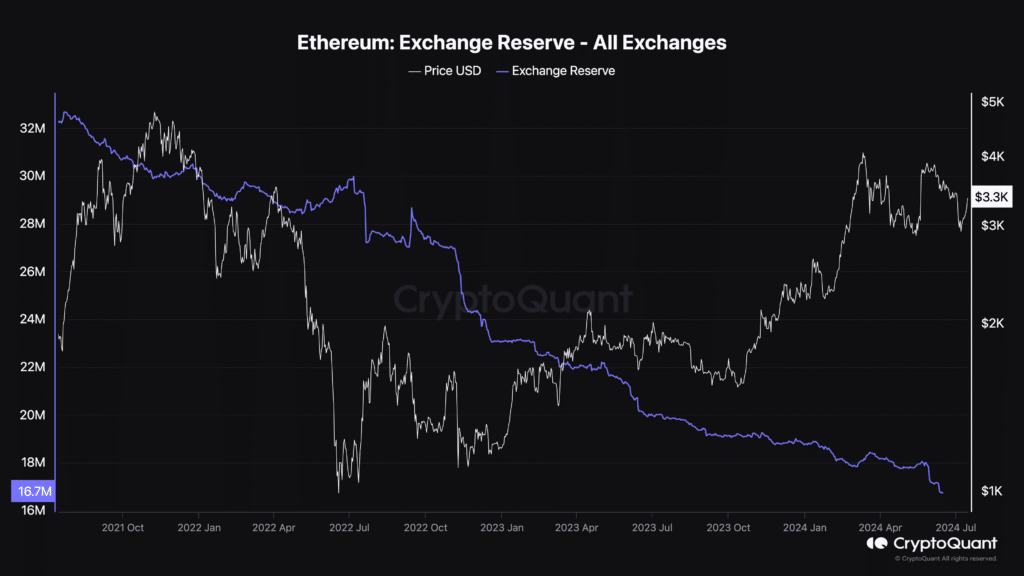

Thirdly, Ether’s price is climbing while the quantity of the token traded on exchanges decreases. The supply reached a record low of 16.76 million tokens, a significant decrease from over 32.5 million in July 2016. This indicates that Ethereum is becoming increasingly scarce as the anticipated ETF approval approaches.

ETH balances in exchanges

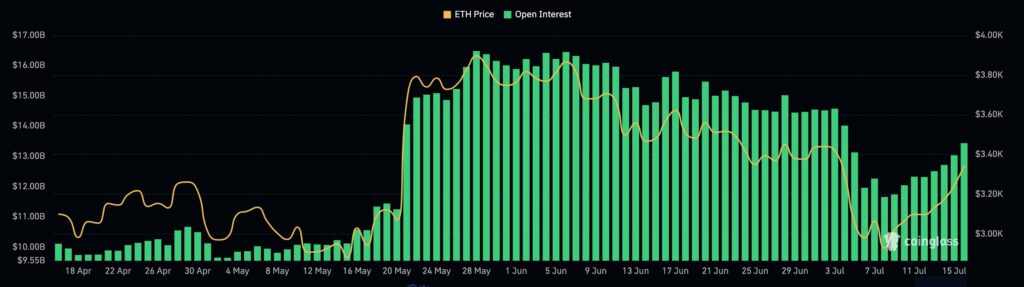

The price of Ethereum surged further as evidenced by a significant increase in open interest for its futures contracts. According to CoinGlass, the total open interest reached approximately $13.4 billion on Monday, exceeding the monthly minimum of $11.66 billion recorded earlier this month. Notably, most of this increased interest came from the trading platforms Binance, Bybit, and Bitget.

ETH open interest

Ethereum price found strong support

The price of Ethereum bounced back in May after hitting significant support around $2,850. This level was particularly important because it represented the lowest point for the coin on three separate occasions – April 13th, May 1st, and May 14th. Additionally, this price was just slightly above the 50% Fibonacci Retracement mark.

As an analyst, I’ve noticed that the token’s price flip has caused traders to anticipate further rallying, given the recent reversal of the 200-day Exponential Moving Average (EMA). Additionally, the accumulation and distribution indicator’s persistent upward trend indicates that investors have been actively purchasing during dips. The next significant level to keep an eye on is the psychological mark at $3,500.

#Bitcoin and Ethereum’s four-hour closing prices have surpassed their 200-day moving averages (MA) and exponential moving averages (EMA) for the first time in a month. These indicators often reflect market trends and may suggest a change in the short-term to medium-term direction. The market appears favorable as long as prices remain above these benchmarks.

— Daan Crypto Trades (@DaanCrypto) July 15, 2024

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-07-15 15:48