As a seasoned analyst with over two decades of experience observing the cryptocurrency market, I must say that the recent surge of Ethereum (ETH) breaking the $4,000 barrier is nothing short of captivating. The increased accumulation from retail investors is a testament to their growing faith in the potential of blockchain technology and decentralized finance.

Following several challenging months, Ethereum managed to surpass the $4,000 mark for the first time on December 7, primarily due to a rise in buying from individual investors.

Over the weekend, Ethereum (ETH) hit a new local peak at $4,100, and it’s been holding near that price for the last two days. However, in the past 24 hours, there was a slight 0.8% drop, and currently, Ethereum is being traded at approximately $3,950 as we speak.

The asset’s market cap is hovering at $475 billion. Ethereum recorded a 21% rise in its daily trading volume to $24.5 billion.

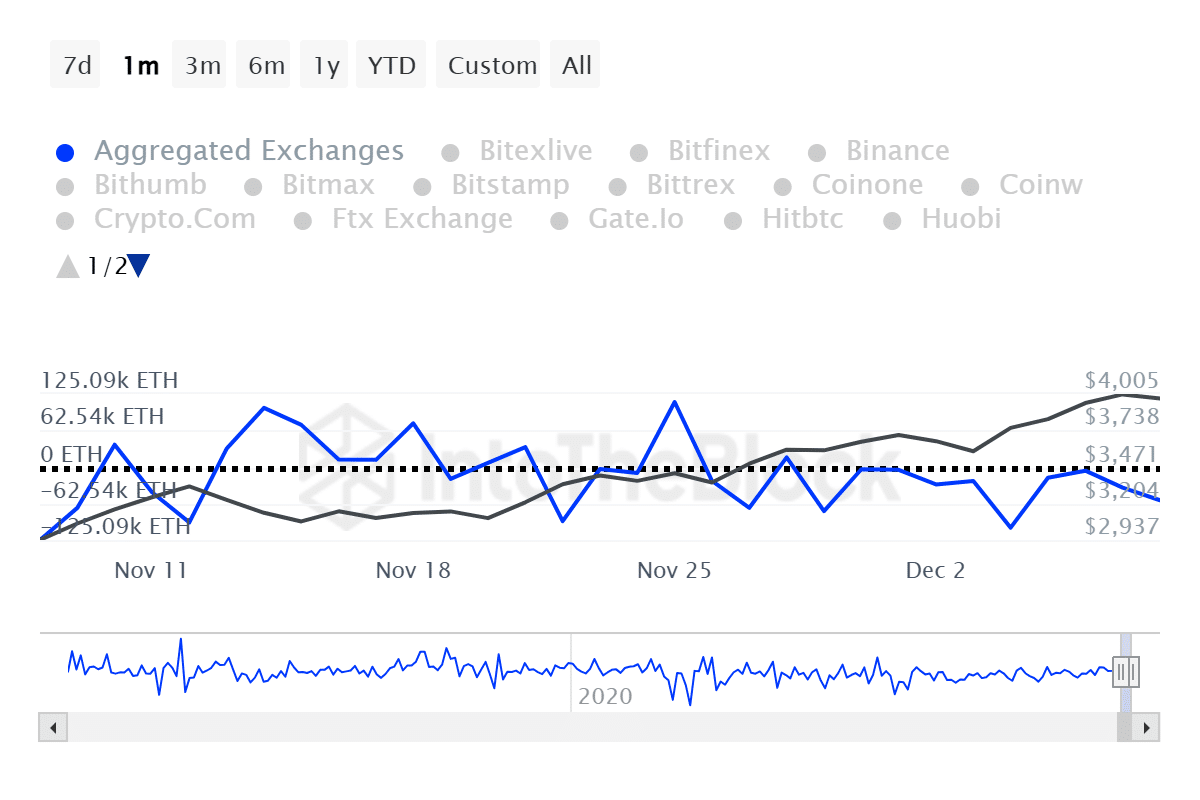

During the previous week, a significant increase in Ethereum’s price occurred as investors accumulated approximately $1 billion worth of ETH. This information is derived from data provided by the analytics platform IntoTheBlock. Moreover, it was noted that the largest exchange outflow of nearly 104,000 ETH took place on Dec. 4.

Based on ITB data, the current ratio of trader-to-exchange outflows stands at approximately -0.65%. This indicates that retail investors are more actively trading compared to large ‘whale’ investors in the market.

According to ITB’s data, the inflow of large Ethereum holders reached a one-month low of 197,160 ETH on Sunday, resulting in an overall outflow of 4,550 ETH from whale wallets. Such a trend often suggests that whales are selling off their Ethereum, which could lead to a temporary market correction.

Additionally, it’s important to note that the amount of whale transactions involving over $100,000 in Ethereum (ETH) dropped significantly, decreasing from approximately $17 billion to $4.8 billion, as per data from ITB, between December 6th and 8th.

One significant factor fueling Ethereum’s surge towards the $4,000 range was the introduction of U.S.-based spot ETH Exchange Traded Funds (ETFs). During the past week, these investment vehicles attracted a total of $836.8 million in new investments.

The Decentralized Finance (DeFi) segment associated with Ethereum saw robust development recently. On Monday, the total value locked in ETH DeFi hit a new high of $77 billion since April 2022, as shown by information from Defi Llama.

What’s next for Ethereum? Depends on the data you’re looking at.

A decrease in whale activity might cause anxiety, confusion, and apprehension among individual investors, possibly leading to an adjustment in the market before another significant surge.

crypto-analyst-and-influencer-Crypto Rover noted that Bitcoin‘s (BTC) surge toward the $100,000 level bears a striking resemblance to Ethereum’s present market behavior.

Although the trends in Ethereum (ETH) and Bitcoin (BTC) prices for the past four years appear analogous, unpredictable shifts in investor attitudes and economic conditions can steer the unstable cryptocurrency market towards unforeseen paths.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-12-09 10:42