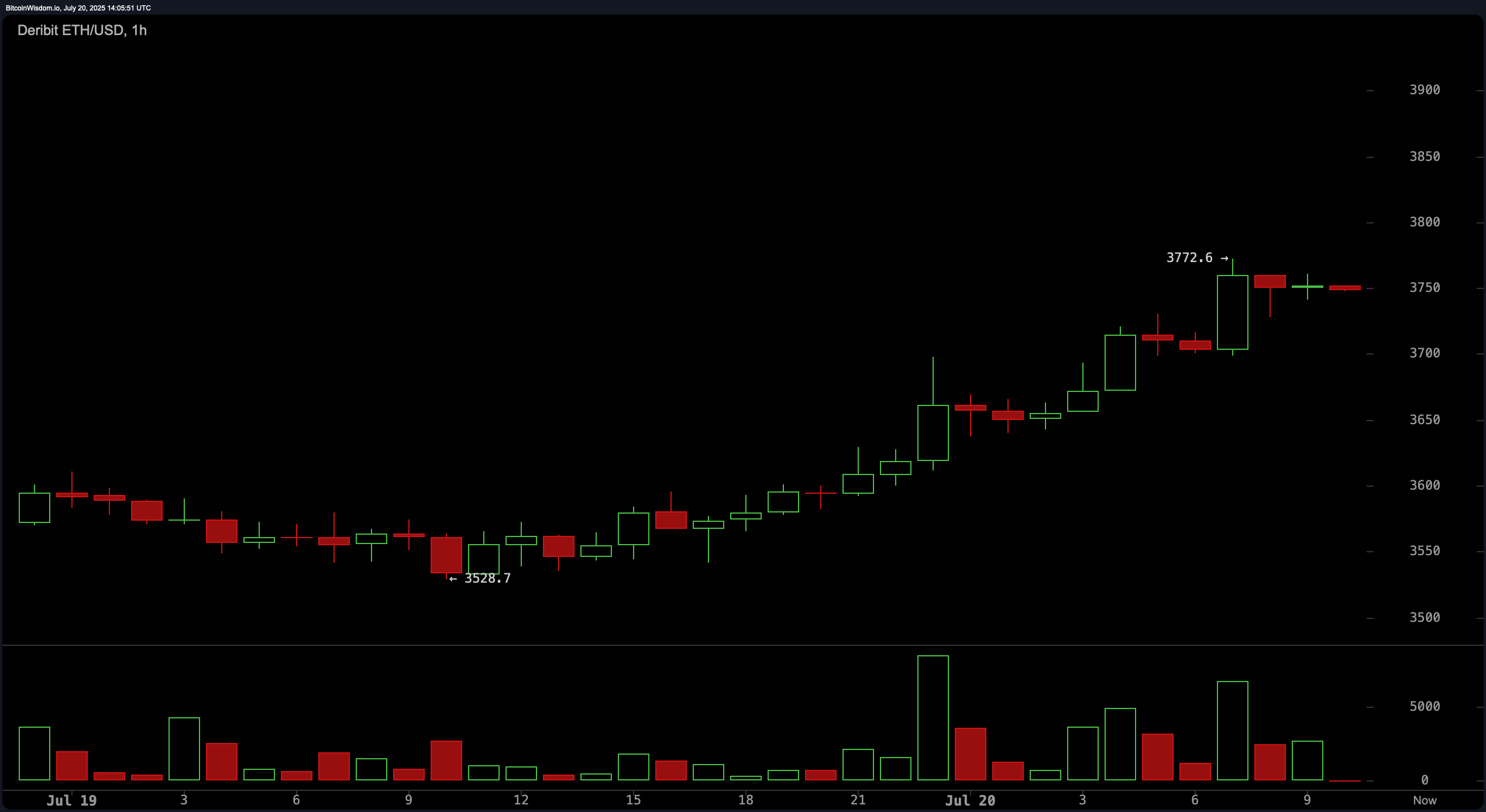

Ethereum (ETH) just shot up to a fresh high of $3,772 per coin on Deribit, against the U.S. dollar, and it’s not stopping. Its slice of the $3.9 trillion crypto pie has surged from a humble 10.9% just three days ago to a whopping 11.6% today. And guess what? It’s sitting pretty with a market cap of $452.66 billion. Not bad for a coin, huh?

Traders Bet Big on Ethereum

As of Sunday, July 20, Ethereum (ETH) is cruising at $3,745 each, a 25.5% surge this week alone. Just three days ago, one ether was worth a measly 0.029 BTC, and now it’s cruising at 0.03173 BTC. No wonder ETH fans on social media are cheering like it’s the beginning of something huge.

“The run Ethereum is about to go on is gonna be glorious,” one X user posted. “BTC dominance is down, and alts are getting stronger by the day,” added the optimistic soul.

As of today, BTC’s market share is at 60.2%, while ETH has jumped to 11.6%. The reason? Public companies are warming up to ETH for their treasury plans, and spot ETH ETFs are raking in major cash.

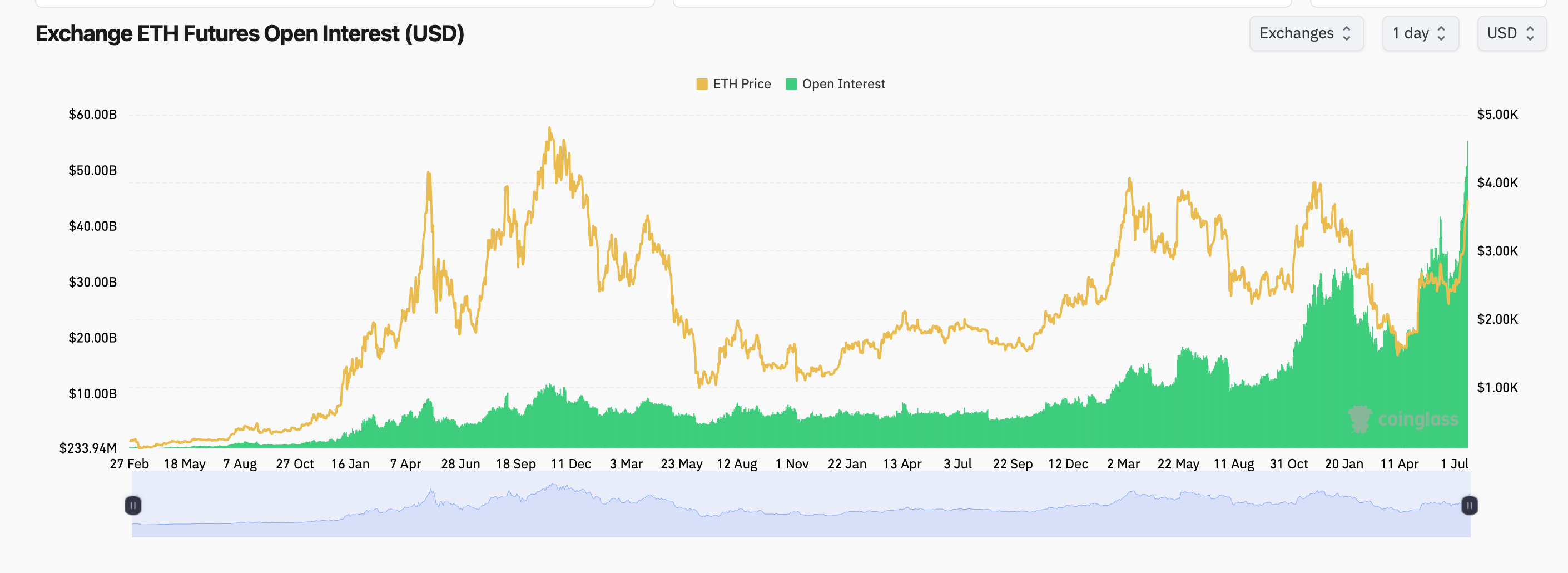

Ethereum futures open interest (OI) has surged past $55 billion, reaching an all-time high. The excitement is so thick, you could cut it with a knife. As ETH charges toward $4,000, the growing number of open contracts is definitely drawing attention. The data shows a perfectly synchronized tango between price and open interest, both on a tear since mid-April.

It’s a crystal-clear sign that traders are jumping in with both feet, betting on Ethereum’s next move. CME and Binance are leading the charge, with Binance holding the largest stake—2.64 million ETH in open interest, valued at a cool $9.88 billion. CME is trailing closely behind with $7 billion in OI, while Gate quietly adds $7.15 billion to the pot, claiming the second-largest position by dollar value.

Interestingly, MEXC and BingX are seeing explosive growth in the last 24 hours, with increases of 6.86% and 11.18%, respectively. However, not everyone’s on the same page—Kucoin and BingX are showing stark differences between short-term gains and daily drops, hinting at a little chaos behind the curtain.

Ethereum options markets are red-hot, with data screaming bullish vibes all over the place. On Deribit, the most popular contracts are heavy on upside bets. For example, the Sept. 26, 2025 $4,000 call leads with nearly 100,000 ETH in open interest. Traders are even eyeing the $6,000 December 2025 strike, clearly unafraid to reach for the stars. And wait for it—the $12,000 calls had the most volume over the last 24 hours. Yes, you read that right—$12,000. That’s some serious “moonshot” talk.

Calls are completely overshadowing puts, with open interest leaning 66.43% to 33.57%. That’s 2.29 million ETH stacked on bullish bets versus 1.15 million ETH for the downside. The trend is clear: traders are betting on a massive upward move rather than hedging against a crash.

traders are loading up on spot

ETH

, futures, and options across the board. With the spot price and open interest both climbing, the market is eagerly awaiting the next big move.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Every Upcoming Zac Efron Movie And TV Show

- PUBG Mobile heads back to Riyadh for EWC 2025

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Gods & Demons codes (January 2025)

- USD CNY PREDICTION

2025-07-20 18:38