You could almost taste the slow burn on the air these past months, the way a prairie grass fire smolders long after the spark. Ethereum—the big, creaking wagon on the blockchain trail—has found itself sputtering, user activity sagging like an old man’s trousers. Less hustle means fewer coins thrown to the smoldering fire, and that burn rate, once a proud hero, now lounges on the porch, counting its remaining teeth. 🔥🪑

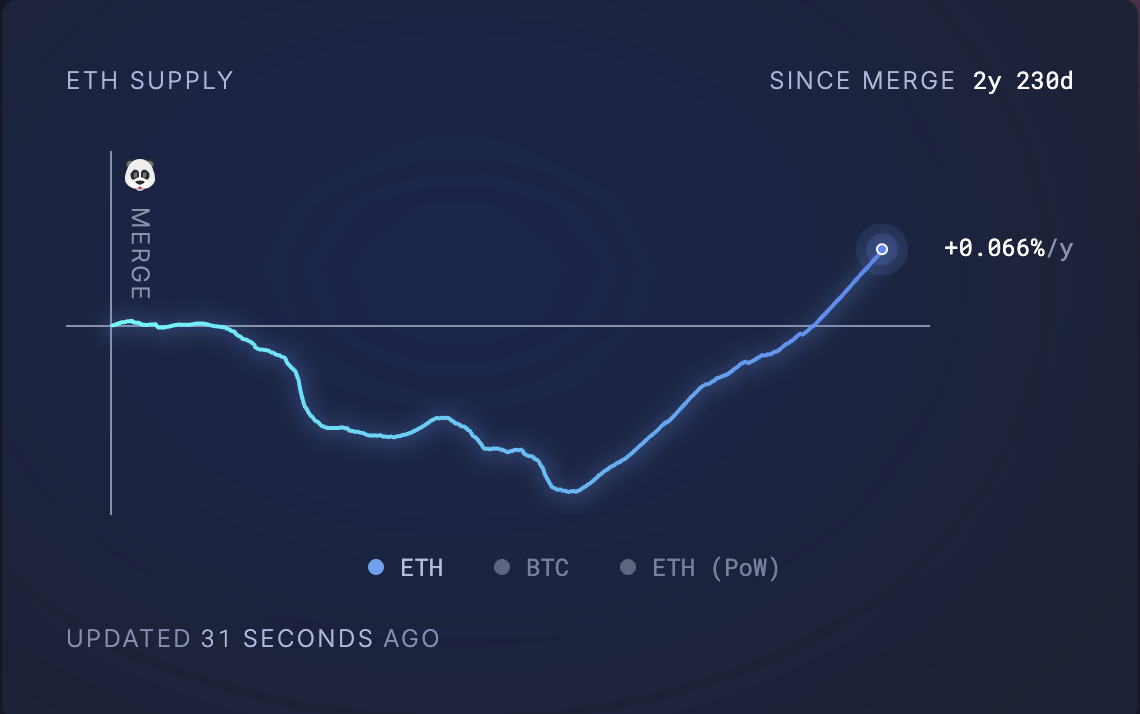

With so few coins making the ultimate sacrifice, ETH’s supply grows like rabbits on a hopeful spring day. Inflation comes loping in, clumsy and wide-eyed, putting downward weight on prices. Just ask anyone watching its stubborn wobble, as ETH barely clings to the $2,000 mark—like a prospector holding onto the last piece of jerky until payday.

The Burn Rate: Slimmer Than Depression-Era Soup

Sharpen those pencils: Ultrasoundmoney says 72,927 ETH—worth about $134 million, if you must know—has wandered back into the wild in the past month alone. That’s enough to make Satoshi himself whistle. Circulating supply? Now a sprawling 120,730,199 ETH. In the old days—before the “merge,” back when crypto folks could still sleep at night—it was a much more humble affair.

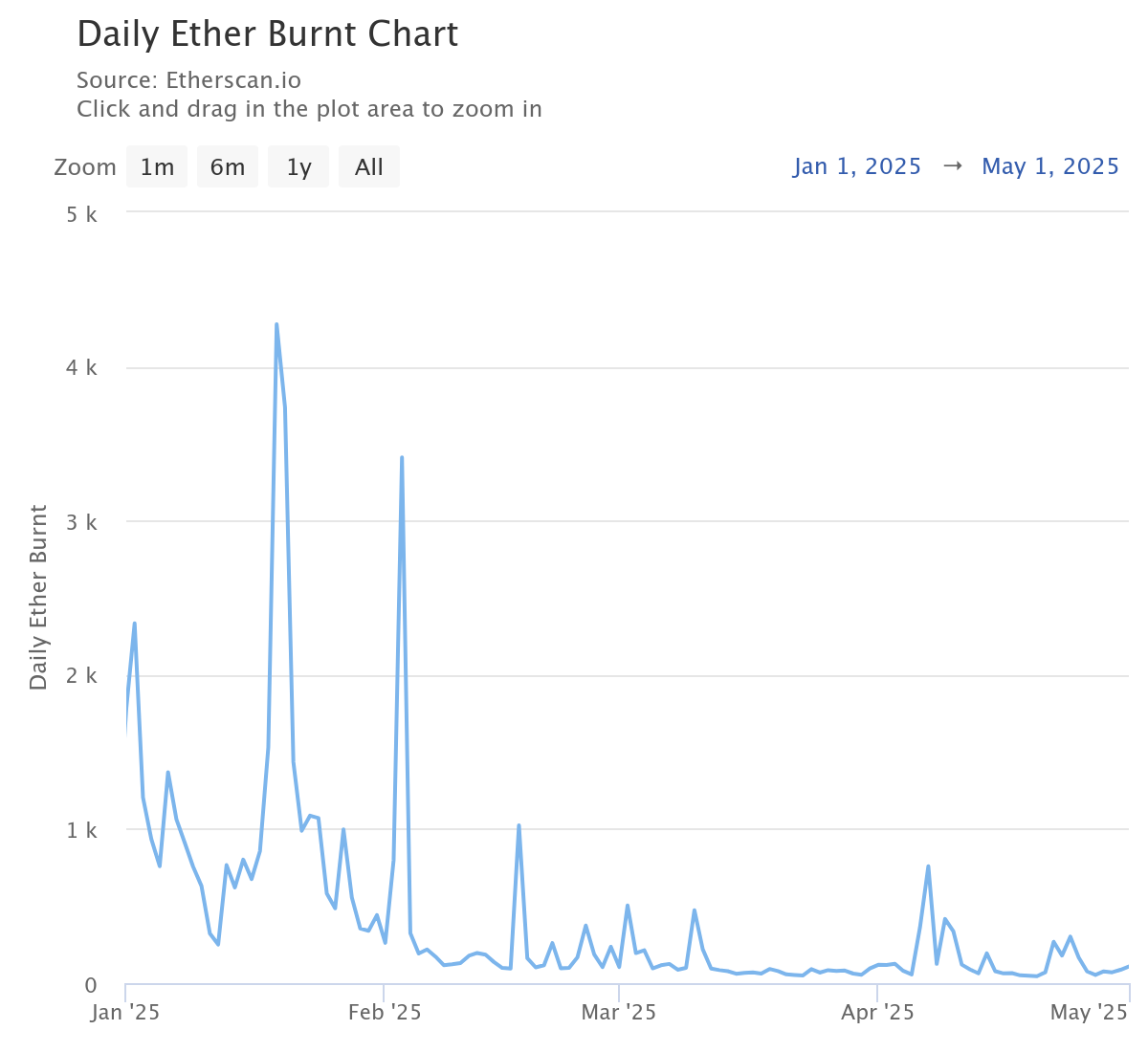

This runaway supply is no mystery: the blockchain’s main street sits empty, tumbleweeds rolling past Ethereum’s burn mechanism. The EIP-1559 innovation was meant to keep the supply leaner than a cowboy’s wallet, burning up transaction fees. But if nobody’s making transactions, the bonfire starves, and suddenly there’s extra ETH all over the place—like unsold lemonade on a rainy day. 🍋🌧️

Ring up Etherscan and you’ll hear the blues: daily burned ETH is down 95% since the year started. The nadir? April 20th—least coins burnt all year. Must’ve been a slow day, even for the bots.

Where’d All the Cowboys Go? (Or: Why Are Ethereum Users Vanishing?)

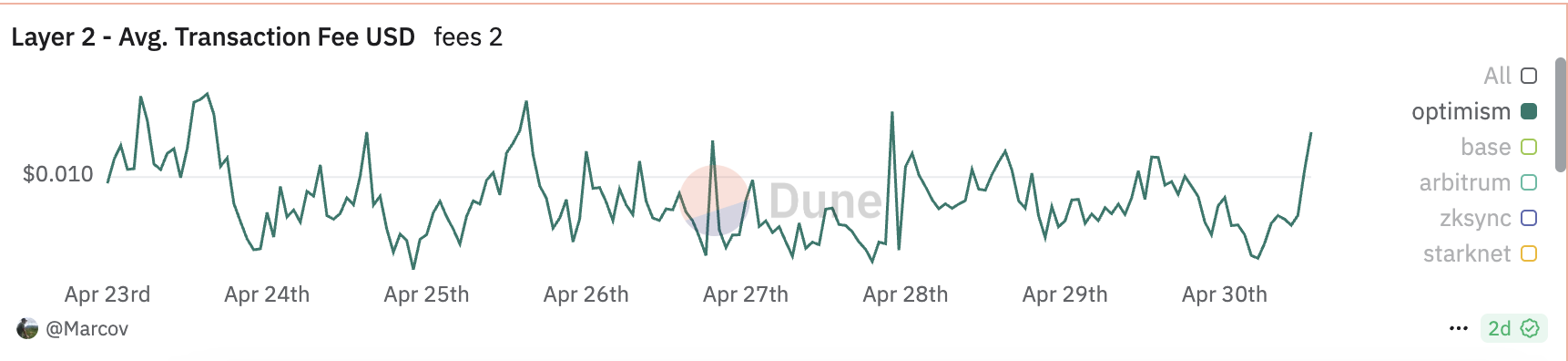

Turns out, folks are heading for newer, slicker towns—Optimism, Arbitrum, and other L2 settlements where the drinks are cheap and there’s less dust in your teeth. These Layer-2 shindigs offer fees so low they’re practically giving transactions away. Take Optimism, for example: you could send a transaction for $0.024, which is less than you’d tip a surly bartender. Meanwhile, Ethereum mainnet charges $0.18— highway robbery by comparison.

And don’t forget about Solana and other “Ethereum killers,” storming the saloon with their no-nonsense swagger and meme coin shenanigans. Everybody loves a good party—until the whiskey runs out, or so they say.

So down go Ethereum’s transaction numbers, and with them, the burn rate shrivels. There’s a lesson there, somewhere, probably about supply and demand or not overstaying your welcome at the poker table.

Peeking Under the Hood—Are Ethereum’s Guts Still Intact?

So, what of Ethereum’s heart and soul? Lower user demand and higher supply have folks squinting, wondering if the engine still has any horsepower left. Someone tapped Vincent Liu, the chief coin-wrangler at Kronos Research, for a verdict.

“Ethereum’s fundamentals remain strong relative to other Layer 1s, particularly when you consider its total value locked (TVL) of $368.921 billion, which positions it at the top of the leaderboard,” Liu said.

(Leaderboard, you say? My apologies to Mario Kart racers.) Liu admits, though, that Ethereum barely cracks the top five in daily fees, trailing behind Tron, Solana, HyperLiquid, Bitcoin, and BNB Chain. It’s not all doom and gloom: plenty of folks are still hanging around, just not as many as before.

Meanwhile, Temujin Louie of Wanchain chimes in:

“Compared to other Layer 1s, fundamentals remain Ethereum’s strength. Unlike many Layer 1s with aggressive inflation as part of their design, Ethereum’s post-merge architecture makes it potentially deflationary. However, the benefits of EIP-1559 depend on on-chain activity. Nevertheless, this is a structural advantage over most competing Layer 1s.”

Layer-2 upstarts and Solana’s party bus may have drawn the crowds, but Louie figures Ethereum remains the most decentralized rootin’-tootin’ show in town, at least for now.

So, Will That Be Bullish or Just More Bull?

You’ve got the makings of a Greek tragedy here: strong bones, but not enough business in the shop. Fewer transactions mean weaker support for ETH. Add to this the rising tide of new coins and, well, the deflationary fairy starts looking for other jobs.

“If Ethereum experiences an extended decrease in usage, the price could fall considerably depending on how much use drops, especially if the Fed continues its policy of quantitative tightening compared to quantitative easing. Short-term, this could mean price drops down to the $2,000 range. If the trend continues, however, then Ethereum could find itself in a prolonged consolidation period or outright downtrend.”

Will Ether Catch a Break—or Just Catch Its Breath?

Right now, ETH trades at $1,834—a head hung low, down 1% in a day. Pry open the old RSI book, and you’ll spot an indicator at 57.68, which sounds like the odds of finding gold in your neighbor’s flower bed. Some see that as bullish; others just see numbers.

The chart wranglers say if buyers pile in, ETH could break above $2,027. If not, it might drift down to $1,733, where it’ll sit a spell and wait for some action. It’s a tale as old as time—at least, as old as blockchain time.

For now, Ethereum is playing the waiting game. Let’s hope it packed snacks. ⚡🥪

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Gods & Demons codes (January 2025)

2025-05-03 04:22