As a researcher with a background in cryptocurrency markets, I find the recent Ethereum (ETH) price surge intriguing. After a week of downward momentum, ETH is up by 5% in the past 24 hours, trading at $3,065 with a market cap of $368 billion. This is a significant turnaround from the asset’s 10.7% plunge over the past seven days.

As a crypto investor, I’ve noticed an uptick in Ethereum (ETH) price, following a week-long downtrend. This surge has ignited heightened whale activity in the market.

I’ve noticed an impressive 5% increase in ETH‘s value within the last 24 hours, with its current price sitting at $3,065. At this moment, Ethereum boasts a substantial market capitalization of $368 billion. This upward trend comes after a noteworthy 10.7% decrease over the previous week.

Additionally, Ethereum’s daily trading volume experienced a significant surge of 46%, amounting to $21 billion. However, Ethereum currently remains 37% below its record high of $4,891, which was reached in November 2021.

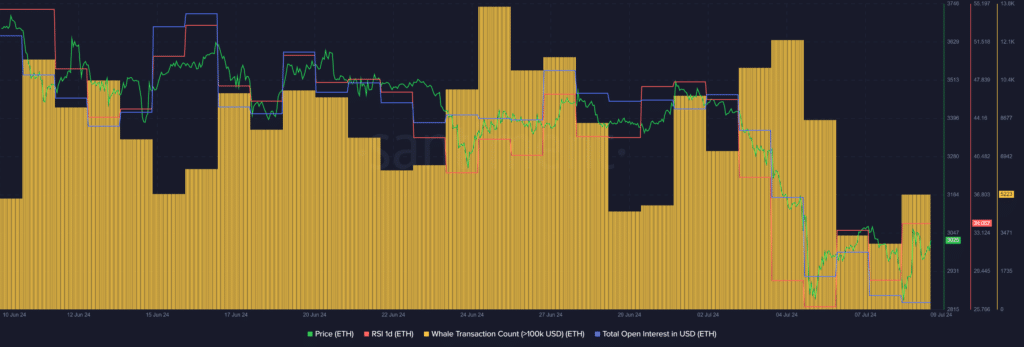

Based on Santiment’s data, there was a significant surge in the number of Ethereum transactions valued at $100,000 or more. The figure jumped by 74.5% within the last 24 hours, from 2,995 to 5,223 distinct transactions.

As Ethereum sees increased whale activity, the total open interest for the asset has been steadily decreasing over the last week. According to Santiment, Ethereum’s open interest dropped from $7.76 billion on July 2 to $6.01 billion at the current reporting time. This decline can be attributed to a large number of liquidations that occurred in the past seven days.

As a crypto investor observing the Ethereum market, I’ve noticed an increase in whale transactions and trading volume. However, it’s important to note that Ethereum’s open interest has been on the decline recently. This decrease in open interest could suggest that there will be less price volatility moving forward due to fewer liquidations taking place at current price levels.

Based on data from our market intelligence platform, the Ethereum Relative Strength Index (RSI) presently stands at 34. This implies that Ethereum is experiencing overselling within the current market scenario, according to the RSI indicator.

As a crypto investor, I’ve noticed that one significant factor fueling the current market-wide bullish trend is the substantial $295 million inflow into Bitcoin (BTC) exchange-traded funds (ETFs). This influx has been crucial in keeping the BTC price afloat above the key resistance level of $57,000.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-07-09 11:39