- Ah, the ETH L1 network, a slumbering giant, while L2 dances a merry jig, leaping 50% post-Pectra upgrade. 🎉

- In the grand theater of crypto, ETH’s mid-term positioning is bullish, despite the short-term drama of profit-taking. 🎭

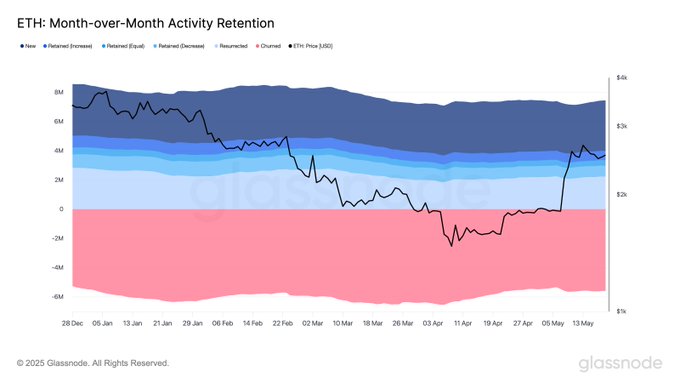

Ethereum [ETH], that elusive creature, has not quite sprung back to life, even after the much-lauded Pectra upgrade. Glassnode, the oracle of blockchain, whispers that new or returning users are still playing hard to get.

Curiously, the existing users seem to have taken a liking to their digital abode, as evidenced by a lower churn rate (-8.5%). Who knew loyalty could be so fashionable?

“Since the upgrade, the average new and resurrected addresses have taken a nosedive compared to YTD values (–1.8% and –8.4% respectively) – but churn is notably lower as well (–8.5%).”

Meanwhile, L2 activity across Base, Arbitrum One, and OP Mainnet has bounced back like a rubber ball, soaring nearly 50% in May, from 8.7 million users to a staggering 13 million active addresses. Who knew they had it in them?

ETH’s Capital Inflows: A Tale of Surges and Sighs

Despite the lethargic L1 network, ETH capital inflows have surged by a whopping $3.8 billion post-upgrade, as the realized cap growth reveals. It seems investors are still interested in this altcoin, even if the users are playing coy.

Glassnode further elucidates that the Realized Cap (the total capital stored in the asset) has broken its Q1 downtrend, signaling a renaissance of investor interest in Q2. A true phoenix rising from the ashes!

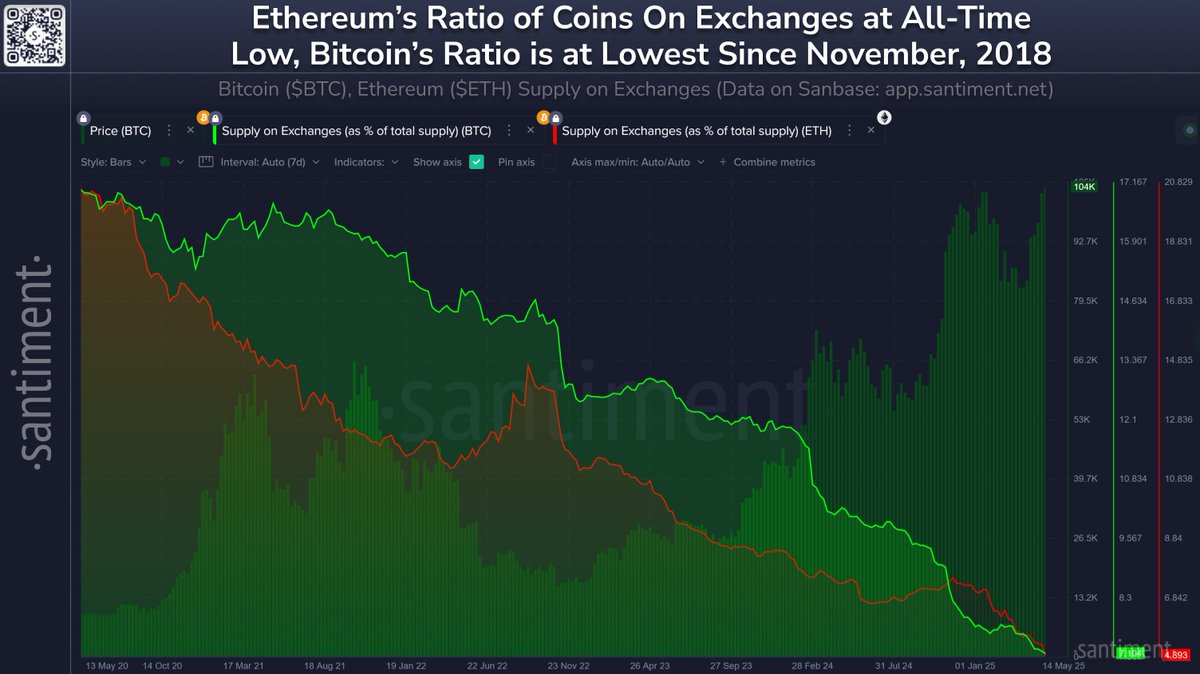

If this trend continues, the ETH price could be gearing up for a delightful uptrend. This bullish outlook is also buoyed by an impending supply shock on exchanges. Oh, the suspense!

Notably, ETH supply on exchanges has plummeted to a 10-year low below 5%, as Santiment data reveals. A rare sight indeed!

“Ethereum has under 4.9% of its supply on exchanges for the first time in its 10+ year history.”

With 15.3 million fewer ETH on exchanges, we witness a strong accumulation trend. This means reduced sell pressure and a potential supply crunch, a perfect setup for an explosive run-up if demand decides to join the party. 🎈

However, the specter of profit-taking from the Q2 recovery gains looms large, threatening a brief cool-off in the rally. Ah, the bittersweet nature of markets!

Yet, market positioning remains bullish since late April and into the mid-term. A tale as old as time!

According to Options data, the 25 Delta Skew is negative for the 1-week (-3.5%) and 1-month period (-4%), suggesting a higher demand for calls (bullish bets) than puts (bearish bets). A classic case of optimism!

In simpler terms, the market is pricing in a higher chance of a likely upward rally for ETH. At press time, ETH traded at $2.5K, about 60% from its current cycle high of $4K. A rollercoaster ride, indeed!

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2025-05-21 16:11