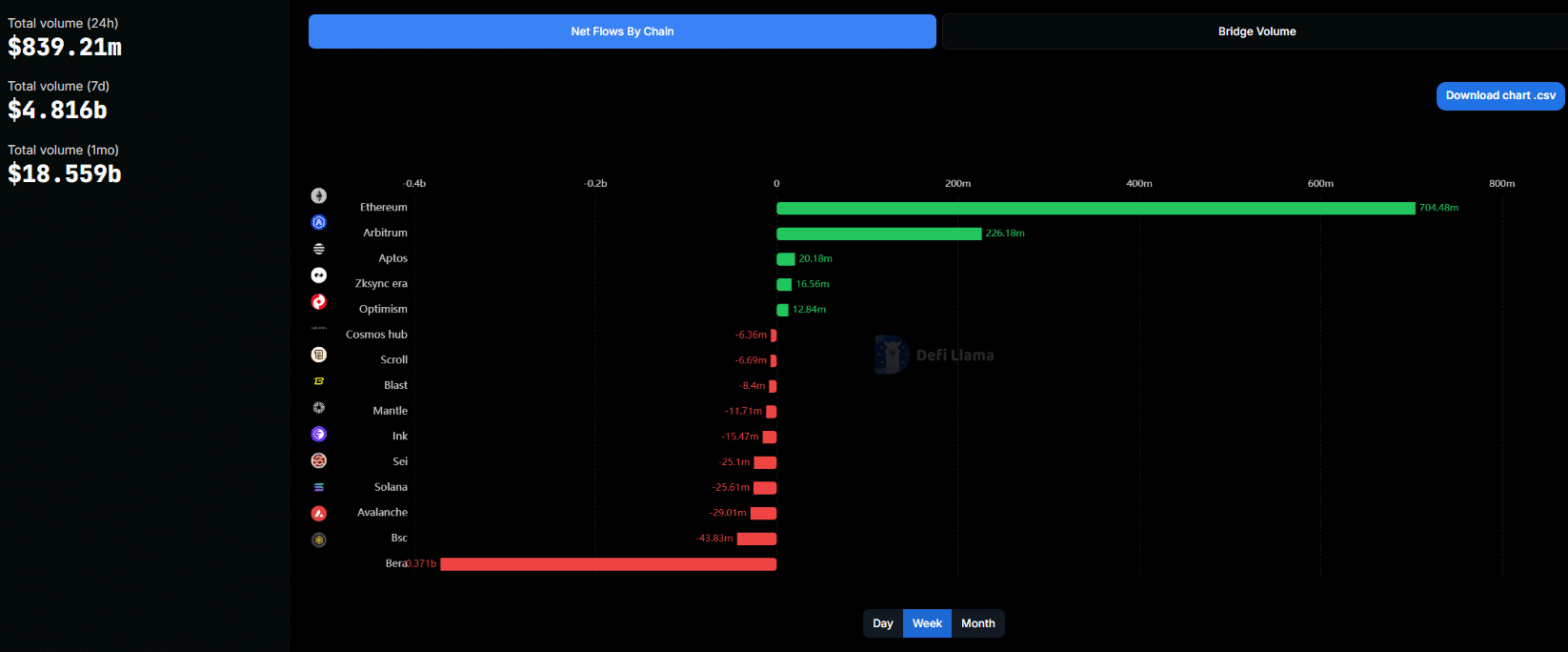

- Oh, dash it all, Ethereum scooped up a whopping85% of the weekly cash splash, reinforcing its top-dog status in DeFi liquidity, don’t you know!

- And yet, the bridge volume data reveals a steady stream of the ready making a break for it, exceeding deposits across Ethereum. Quite the caper, what?

It appears Ethereum [ETH] has pulled off another corker, asserting itself as the undisputed champ in blockchain capital inflows—by a country mile, no less.

At the time of penning this little missive, DeFiLlama’s latest figures paint a picture clearer than a summer’s day in Mayfair.

Ethereum has managed to charm a cool $704.48 million in net inflows this week, leaving all other networks looking rather like also-rans and signaling that the big cheeses with the big bucks have a clear preference.

And let’s not stop there, shall we? Arbitrum [ARB] trails behind with a mere $226.18 million—a distant second, capturing just a smidgen over a quarter of Ethereum’s haul.

Meanwhile, smaller inflows trickled into Aptos [APT] ($20.18M), zkSync Era [ZK] ($16.56M), and Optimism [OP] ($12.84M)—all combined barely making a dent, scraping together just8% of Ethereum’s total. 😅

When the Tide Turns, Some Are Left High and Dry

Now, onto the flip side of this jolly coin—the losses were just as pronounced, if not more.

Binance Smart Chain (BSC) led the outflow chart with a -$43.83 million, followed by Avalanche [AVAX] (-$29M) and Solana [SOL] (-$25M). Quite the exodus, one might say.

//ambcrypto.com/wp-content/uploads/2025/04/Screenshot-2025-04-04-202544.png”/>

For instance, back on the19th of January, Ethereum logged nearly $2.96 billion in weekly withdrawals, the highest in the current dataset. A record, but not one for the trophy cabinet, eh?

However, even amidst this exodus, Ethereum’s allure for fresh capital remains unrivaled. This seeming contradiction might just reflect a merry-go-round of capital within the ecosystem. 🎠

The Flow Knows Best, Before the Price Does Its Dance

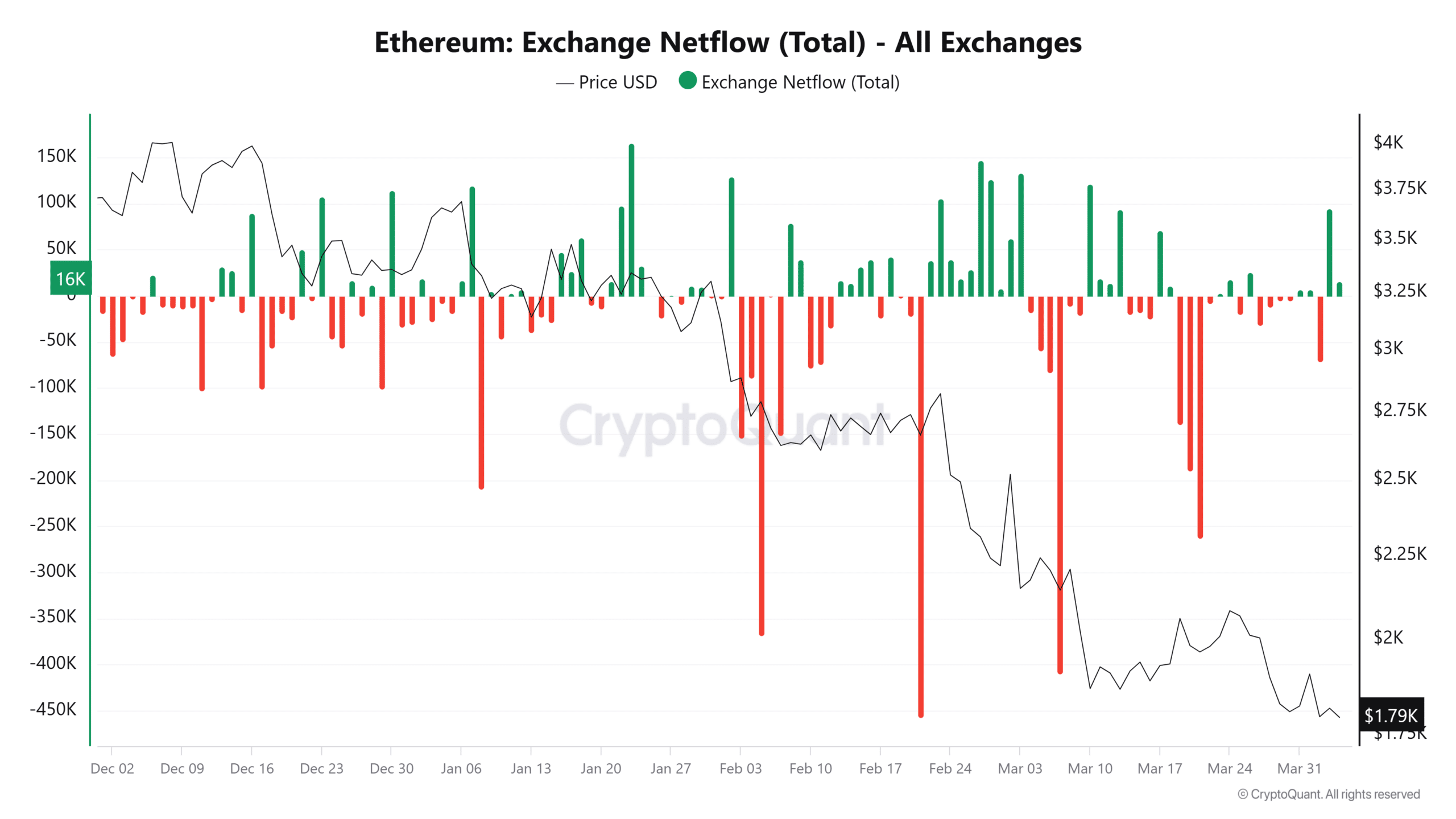

Indeed, daily netflow behavior offers a deeper dive into this intriguing saga.

Between December2024 and April2025, Ethereum’s price slid by50.6%, tumbling from $3,630 to $1,794. A bit of a rollercoaster, that.

On the8th of January, ETH plunged to $3,326 as208K ETH exited exchanges—a sign of panic, perhaps. By contrast, the23rd of February saw a rebound to $2,819 alongside a105K ETH inflow, hinting at strategic accumulation. The market, it seems, has its own peculiar rhythm.

Seemingly, it reinforces a familiar tune: inflows and outflows don’t just follow price; they often precede it, like a well-timed overture.

Additionally, in late March, Vitalik Buterin unveiled a rather forward-looking “multi-proof” Layer-2 model, fusing optimistic, zero-knowledge, and TEE-based verification. Whether this evolution can stem the outflow tide remains to be seen. Nonetheless, such architectural upgrades often take time to sway sentiment. Markets, after all, tend to reward proven stability over speculative improvements.

Ethereum remains DeFi’s liquidity backbone—commanding net flows, transaction volume, and developer activity with a widening dominance. While BSC, Solana, and Avalanche bleed capital, Ethereum and Arbitrum now absorb over90% of positive inflows, signaling a flight to trusted chains. 🛫

Outflows or Not, ETH Stands Firm

Despite the ongoing outflows, Ethereum’s simultaneous inflow surge reflects a complex but resilient ecosystem. In a market where trust drives capital, Ethereum still wears the crown—and with Layer-2s maturing fast, that grip looks firmer than ever. For now. 👑

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Hero Tale best builds – One for melee, one for ranged characters

2025-04-05 10:21