Ah, Ethereum, that once-mighty titan of the crypto realm, has plummeted—yes, plummeted—by a staggering 52% from its lofty December heights. Technical indicators and on-chain metrics, those fickle harbingers of doom, whisper ominously of further declines lurking just around the corner. 🕵️♂️

In the halcyon days of December, Ethereum (ETH) basked in the glow of $4,105, only to find itself languishing at a mere $1,970 on this fateful March 20. Such a catastrophic descent renders it one of the most lamentable blue-chip coins in the entire market. Bravo! 👏

But wait! The specter of uncertainty looms large. Just this week, the esteemed analysts at Standard Chartered, with their crystal balls, have slashed their price forecast by a staggering 60%—from a fanciful $10,000 to a more pedestrian $4,000. Their reasoning? The relentless rise of layer-1 and layer-2 networks, those pesky competitors nibbling away at Ethereum’s revenue growth. 🍽️

Layer-2 networks, such as Coinbase’s Base, Arbitrum, and Optimism, have seduced users with their tantalizingly low fees. DeFi Llama’s data reveals that Ethereum’s DEX protocols have managed a mere $9.8 billion in volume over the past week. How quaint! 🥴

Arbitrum, in a fit of competitive spirit, handled $2.87 billion, while Base followed closely with $2.8 billion. Once upon a time, such volumes would have graced Ethereum’s mainnet. Alas, how the mighty have fallen! 📉

And let us not forget the fierce competition from layer-1 networks like Solana (SOL) and BNB Chain, which have been busy raking in DEX volumes exceeding $13 billion in the last week. Ethereum, dear Ethereum, is not expected to bask in the glow of emerging technologies like Real World Asset tokenization, thanks to its higher fees and sluggish speed. Developers, those crafty architects of the digital future, may very well choose to build on more scalable and economical networks like Mantra (OM) and BNB Chain. 🏗️

Ethereum has weak on-chain metrics

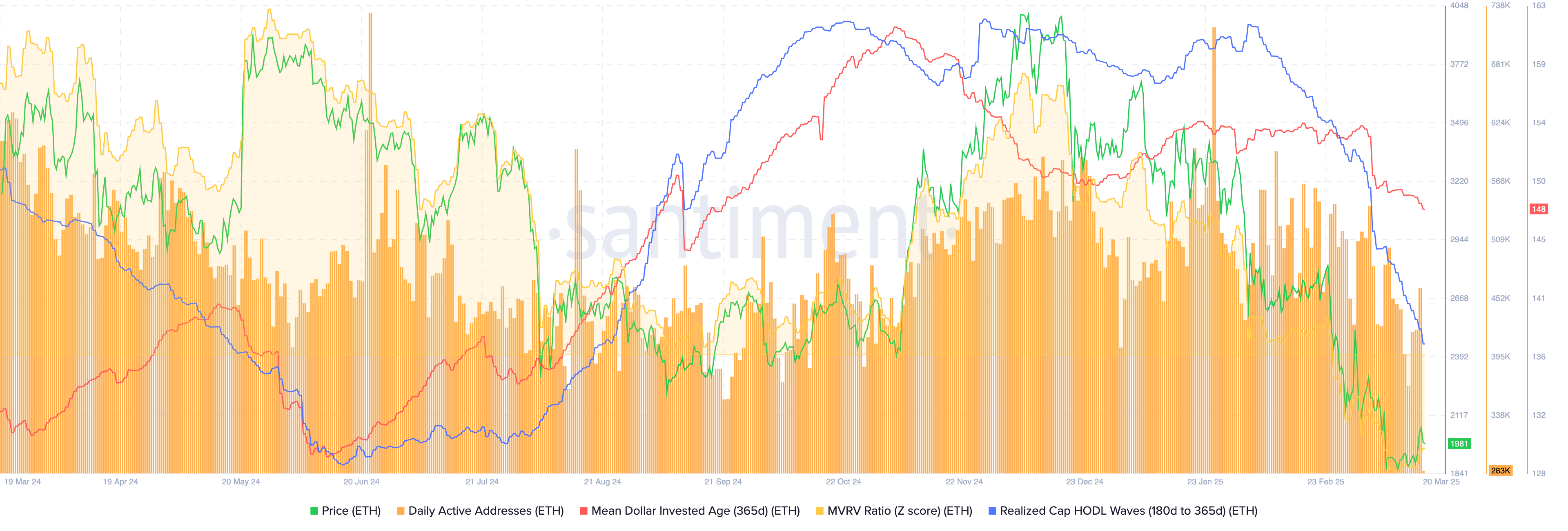

Alas, the data reveals a disheartening trend: the number of active addresses on Ethereum has dwindled in recent months. The chart below from Santiment illustrates this decline, showing a drop from 717,000 active addresses earlier this year to a mere 461,000 on Wednesday. How tragic! 😢

Another point of interest is Ethereum’s realized cap HODL wave, depicted in blue, which has plummeted to its lowest point since last August—a clear indication that long-term holders are beginning to part with their precious coins. 💔

The 365-day mean dollar invested age (MDIA), which measures how long each coin has lingered in an address, has also sunk to its September lows. A veritable tragedy of epic proportions! 📉

Ethereum price technical analysis

The daily chart, that cruel mistress, reveals that the ETH price has been ensnared in a relentless downward spiral for months. This descent commenced after it formed a triple-top pattern at $4,000, with the neckline at $2,120—how poetic! 🎭

Ether then succumbed to a death cross pattern as the 50-day and 200-day moving averages crossed paths, a harbinger of further misfortune. Popular oscillators, like the Relative Strength Index and Percentage Price Oscillator, have also taken a nosedive. 📉

Thus, it seems the coin is destined to continue its descent, as sellers eye the psychological threshold of $1,500, a full 25% below its current level. What a delightful spectacle! 🎢

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2025-03-20 21:03