In the course of the past 24 hours, ETH has found itself in quite the fray, dancing like a drunk at a ball – briefly touching $2,575 before staggering back down, as the latest CoinMarketCap intraday chart so delicately illustrates.

The illustrious technical analyst, Ted Pillows, points out a rather elegant “inverse head and shoulders” pattern taking shape on ETH’s long-term chart. Ah, the mysteries of the market – a bit like a Russian novel, but with fewer tears and more volatility.

According to Pillows’ sage analysis, should ETH manage to break cleanly above $2,700, it could very well catapult itself towards the coveted $3,000 mark, transforming into a classic bullish reversal setup. One might say, “How delightful!”

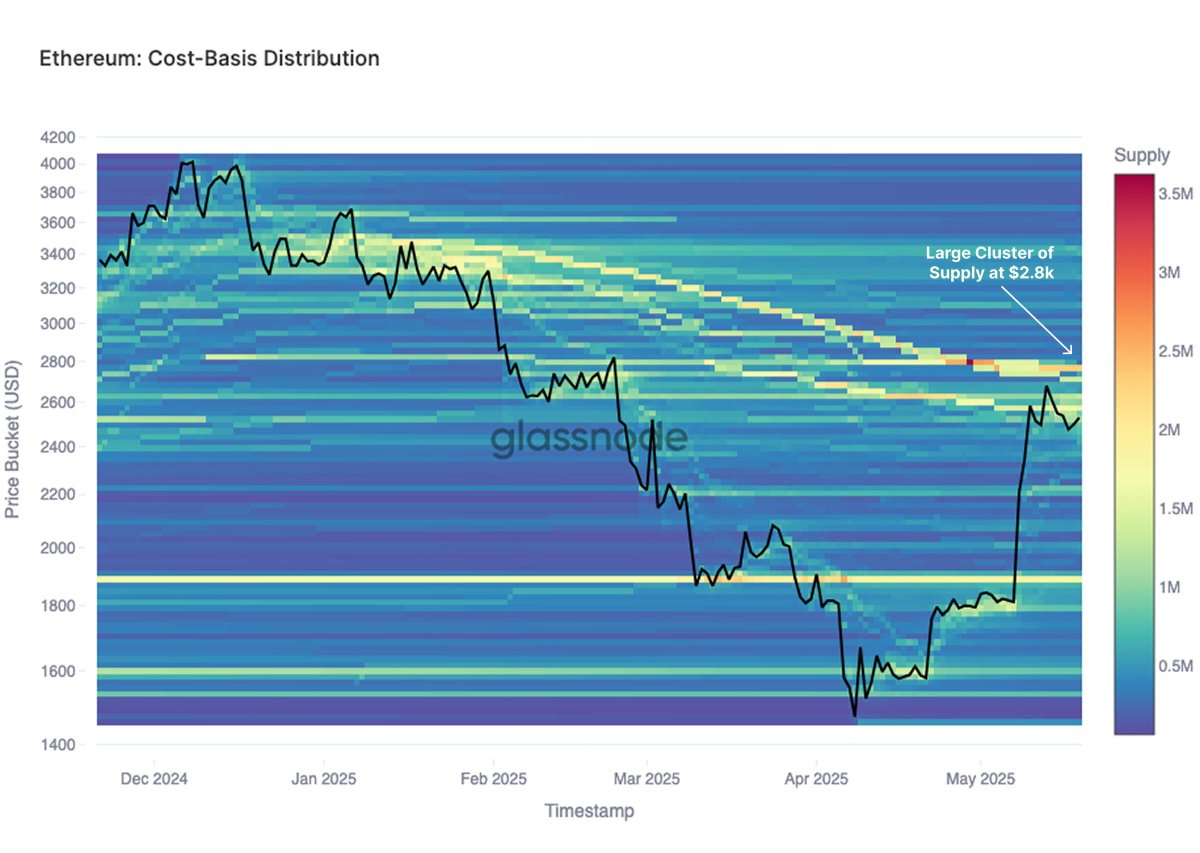

But, alas, not so fast. On-chain data from Glassnode suggests that ETH may meet a most unwelcome foe at the $2,800 level: a “large cluster of supply” – a phrase as ominous as a storm cloud in the distance. You see, many wallets have accumulated ETH around that price, and when such holders begin to see breakeven, they may flock to sell, adding a delightful layer of sell pressure to the whole affair.

The coming days, my dear reader, will be crucial. If ETH can, with a hint of grace and no small measure of determination, break above $2,700 and absorb the looming supply wall at $2,800, we may once again see bullish momentum reigniting. Until then, both bulls and bears remain perched like expectant spectators, watching for any sign of a catalyst.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-05-24 23:24