Ethereum, that digital enfant terrible of the cryptocurrency ball, has recently made a somewhat embarrassed attempt to pull itself together after a frightful tumble late last March. The altcoin, smugly paraded as the reigning monarch of smart contracts, now waltzes at a modest $1,774. 🕺

One might hope this signals a return to grace, yet lurking short-term holders—those fleeting profiteers—stand ready to skedaddle the moment pockets jingle, like debutantes eager to leave the party before the punch sours.

Ethereum Investors: A Curious Breed of Jellyfish

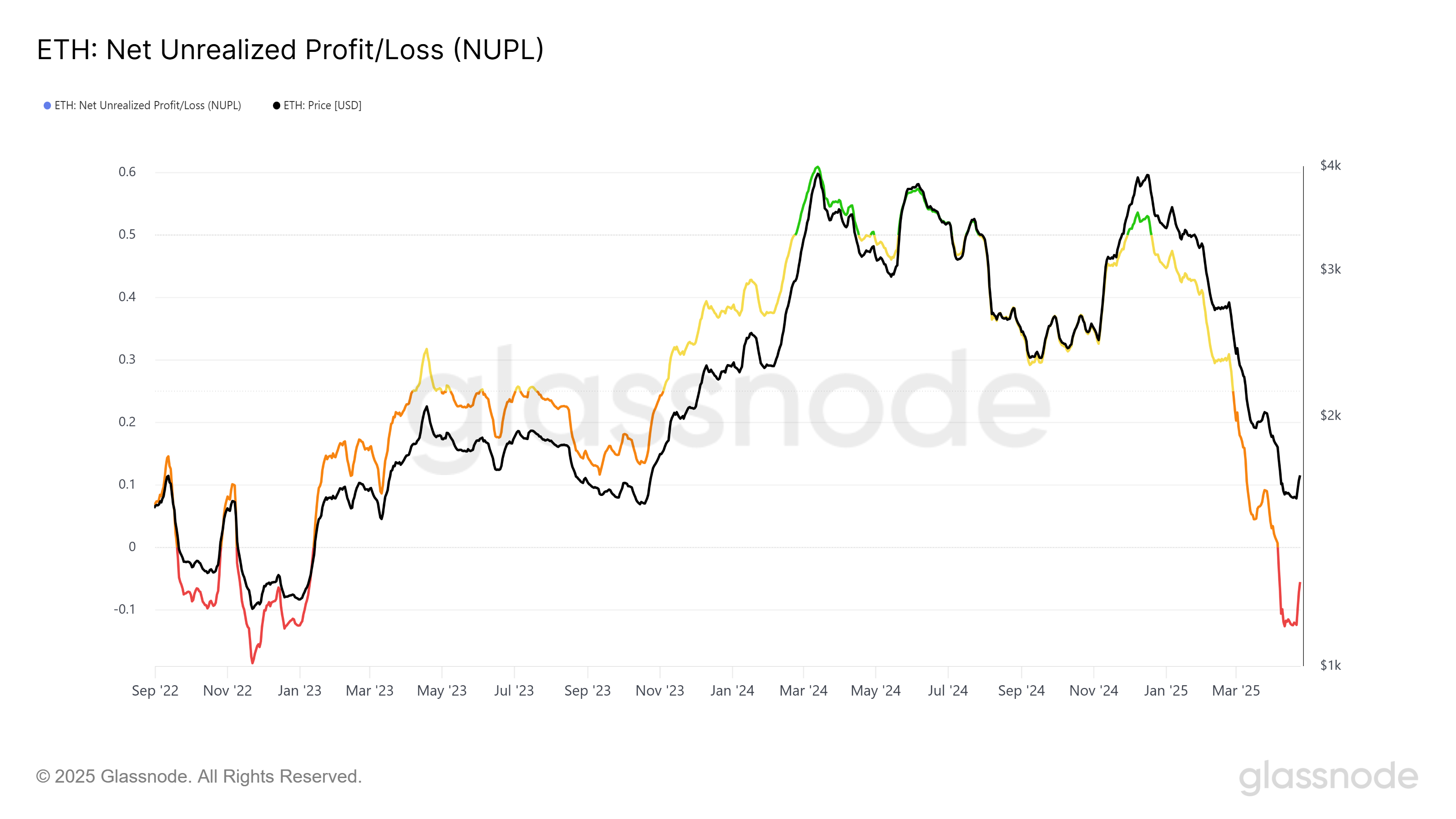

There are tentative signs resembling recovery: network value and user ballyhoo refuse to vanish altogether. Meanwhile, the Net Unrealized Profit/Loss (NUPL) indicator, that cold mechanistic barometer of fortune’s favor, sadly signals capitulation—not unlike customers abandoning a sinking ship, tote bags and all.

Though Ethereum’s price pirouettes upwards, the mood remains as gloomy as a D-list aristocrat’s country estate at dusk. Should these STHs decide to cash in with all the rapidity of a champagne cork popping, the price may pirouette just as swiftly back down.

The onus rests squarely on the stalwart few who retain hands steadier than a butler’s during a parade to hold fast, lest the altcoin be thrust headlong into yet another sell-off interval. HODLing—long seen as a quaint eccentricity—might just be Ethereum’s salvation against its own mercurial admirers.

From a broader vantage, Ethereum’s macro complexion fusses between faint optimism and grim resignation. The Market Value to Realized Value (MVRV) Long/Short Difference indicator languishes at a dismal -30%, suggesting a recovery as likely as a teetotaler at a gin-joint listening contest. 🍸🚫

This indicator reveals a schism: long-term holders nursing their portfolios like vintage port, while short-term holders, emboldened by paper profits at a two-year summit, threaten to pounce. The last soirée of such optimism ended in sell-offs reminiscent of a scandalous ball ejecting its lessened guests.

Given that these STHs hold positions ripe for liquidation at the faintest sniff of gains, Ethereum might soon find itself pirouetting inexorably downward once more. A lofty price hanging by a thread—like a debutante’s reputation—cannot withstand such vicissitudes.

ETH Price: The Eternal Test of Resilience

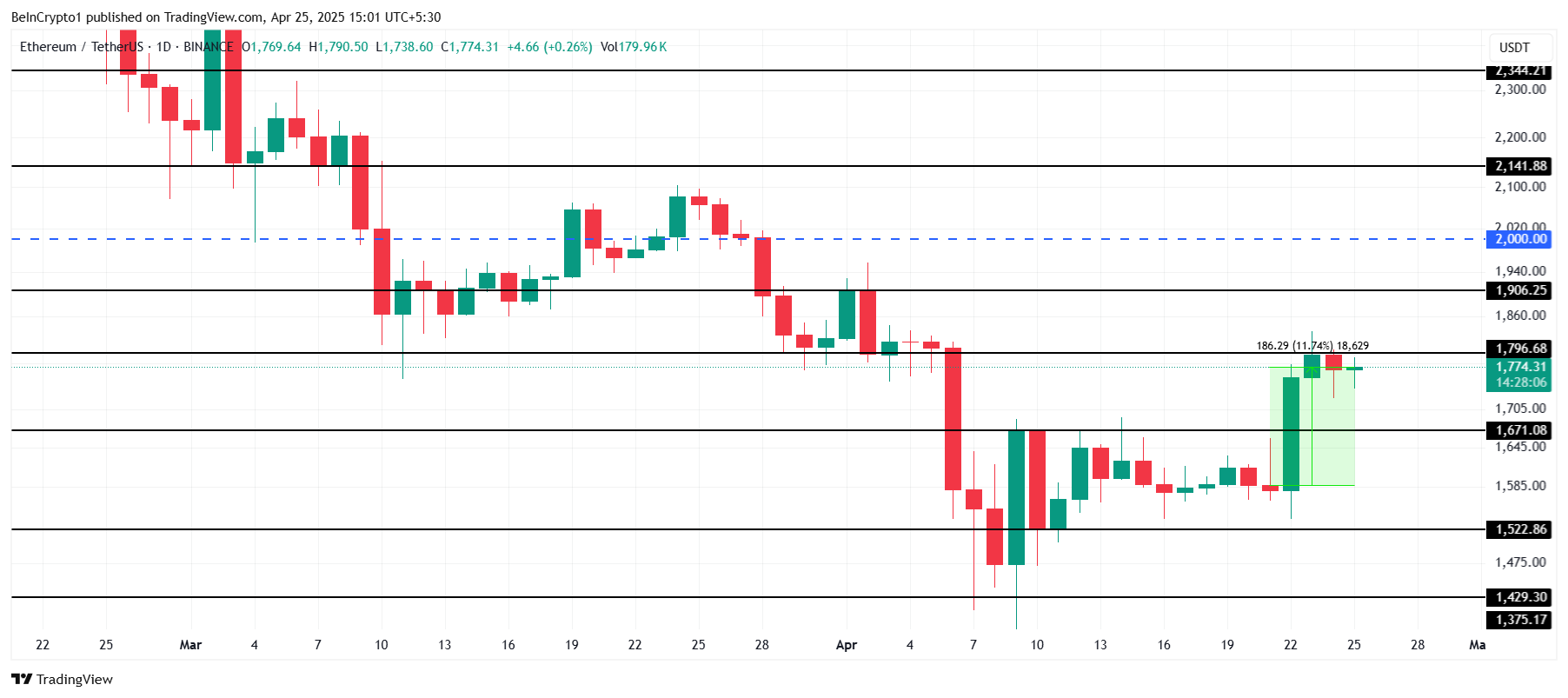

The privileged price of Ethereum has nudged upward by 11% in a week, standing at a tentative $1,774. It now eyes the resistance at $1,796, a veritable etiquette lesson in market dynamics: breach this threshold, and perhaps it may dare to approach the glamorous $2,000 ballroom.

Yet the sobering whispers among the crowd suggest that this target remains a mirage, shimmering mockingly at the distance. A tumble beneath $1,671 support could thrust Ethereum into a downward spiral, much like a socialite’s fall from grace, with $1,522 looming as the inevitable nadir.

Should fortune smile and the broader market muster some semblance of optimism, Ethereum might yet outfox the resistance and waltz past $1,906. Such a triumph would send the naysayers scurrying back to their murky parlors, validating a sustained recovery and restoring some semblance of dignity to this digital debacle.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-04-25 16:05