- The Ethereum market is front-running harder than a toddler at a birthday party. 🏃♂️🎉

- Will Pectra pump ETH, or will we all just be holding hands for a group cry? Stay tuned.

Ethereum’s [ETH] Pectra upgrade is almost here, and the market’s acting like it’s Batman and just got the bat-signal. Whale wallets are hoarding more ETH than your aunt collects Beanie Babies, underwater holders refuse to let go (they’re basically that one friend who swears this is the year they get in shape), and leverage is rising like my cholesterol at Thanksgiving. Risk-on behavior? Oh yeah, baby. We’re back in Vegas, and this time, the drinks aren’t even free.

But—plot twist—is this the actual accumulation phase or just another round of “crypto musical chairs”? If steadfast HODLers do a sudden Usain Bolt as soon as prices cross their cost basis, get ready for a liquidity squeeze more dramatic than my last breakup.

Either way, Pectra could be the plot device that finally gets us off this plateau. Cue suspenseful music.

Conviction Capital: Or How I Learned to Stop Worrying and Love Whale Bags

Ethereum whale address count (we’re talking 1,000–10,000 ETH, aka major league players) has somehow managed to ignore price action altogether since ETH pole-vaulted $4,000 on December 7th.

Back then—4,643 whales in the game. Fast forward to ETH gasping at $1,843, and suddenly, 4,953 whales. It’s like they multiplied after a buffet.

What, is there a group fitness challenge for Ethereum whales this spring?

These whales? Not even blinking. HODLing like they’re trying to win a staring contest with destiny. CryptoQuant data basically says: “ETH holders are accumulating more ETH because logic doesn’t live here anymore.”

On March 10th: 15.5 million ETH in whale hands. By May 3rd: 19 million. A jump so big, it’s basically doing CrossFit. That’s a 22.5% gain—take that, gym memberships everywhere. This is what you call structural conviction (or maybe just deep denial). If Pectra delivers, those “strong hands” are going to look pretty smug cashing in.

Ethereum: Bullish, but With a Side of Emotional Baggage

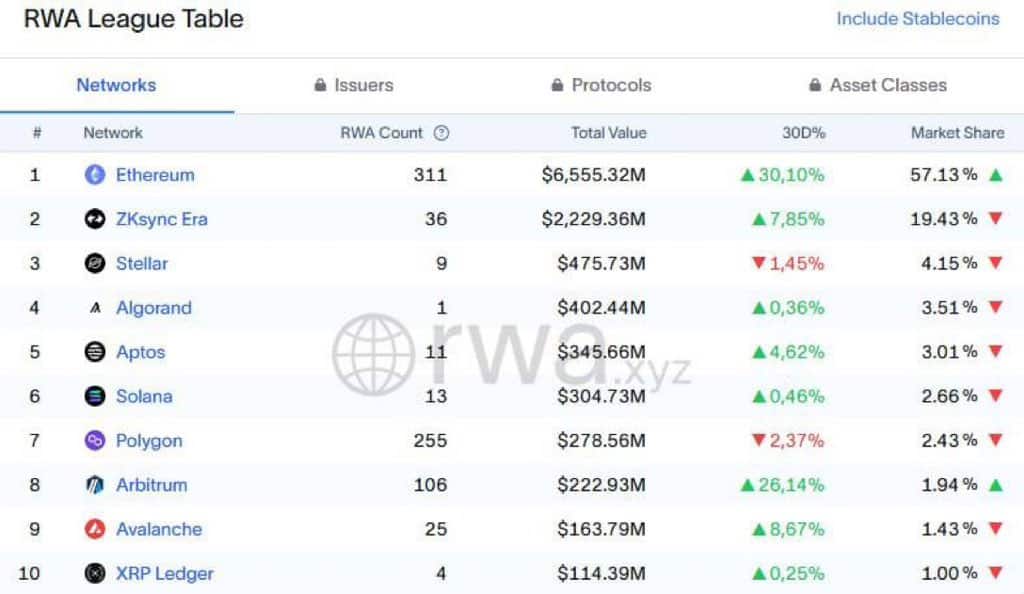

Ethereum is flexing its on-chain dominance with $6.5 billion in real-world asset TVL. The rest of Layer 1s? Eating Ethereum’s blockchain dust. ZKsync Era—barely in frame at $2.2 billion locked.

As far as real-world asset adoption goes, Ethereum is basically the prom queen holding her crown with one hand and a pizza with the other. The fundamentals? Solid. The price? Still eating lunch alone below $2,000. It’s like the universe gave ETH all the talent, but forgot to put it on stage.

Enter Pectra: This could be the glitz, the glam, the final scene in our rom-com. Or maybe…another montage of false hope set to an emotional Taylor Swift track. Depends how you feel about blockchain upgrades.

Tick, Tock: Can the Hype Outlive the Hangover?

But wait, there’s more: volatility! Ethereum’s Exchange Reserves spiked from 19.1 million to 19.8 million ETH in April—aka the crypto equivalent of “we should talk.” Is the market nervous, or just binge-watching old episodes of Shark Tank?

For a real rally, ETH needs to bust through $2,000 with reserves dropping like my followers after a dad-joke tweet. Until then, it’s all wishful thinking and awkward silences.

Meanwhile, futures traders are flexing, cranking up that Estimated Leverage Ratio like they’re at the gym with something to prove.

If there’s a sudden pump, expect liquidity squeezes to follow—like paparazzi after a new Marvel couple. In summary, this is all classic hype-cycle choreography. Either whales wait longer for payday, or Pectra finally brings the after-party. Who knows? In crypto, sometimes you just HODL onto your popcorn and watch the show. 🍿

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Every Upcoming Zac Efron Movie And TV Show

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

2025-05-06 13:55