It was a bright, sunshiny day in the world of cryptocurrencies, until Donald Trump decided to bless us all with his “Liberation Day” tariffs. In the grand tradition of making things interesting, Bitcoin and its trusty altcoin pals managed to outperform the stock market. Oh, the joy. 🥳

Bitcoin (BTC), ever the trendsetter, remained comfortably nestled between $80,000 and $90,000. Meanwhile, Ethereum (ETH) found itself awkwardly hovering just below $2,000, as if it was waiting for the cool kids to invite it to the party. Meanwhile, the entire cryptocurrency market cap took a slight nap, dropping from $2.7 trillion to $2.6 trillion. Not great, Bob. 😬

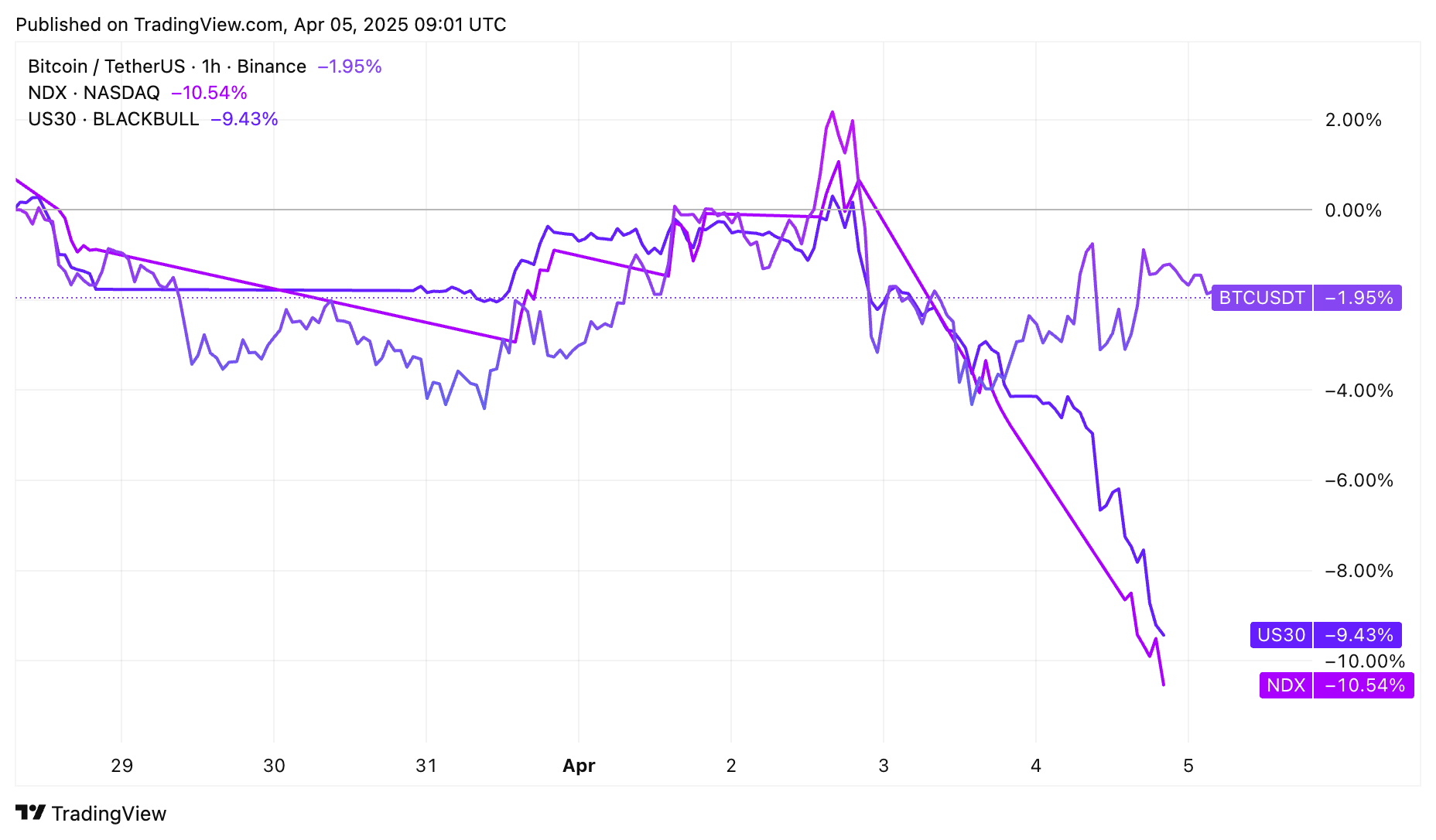

But in a twist that’s either poetic or just plain cruel, the stock market had its worst week since 2020. Stocks like Nasdaq 100, S&P 500, and Dow Jones all found themselves slumping into a correction, as if they’d just heard the world’s worst dad joke.

Fed’s Stagflation Warning: Oh, Joy

Then came the Federal Reserve Chairman Jerome Powell with his shocking warning. It seems that Trump’s tariffs could be the cherry on top of an already chaotic economic sundae, pushing inflation higher and slowing growth. Well, that’s reassuring. Powell’s only mission? To keep long-term inflation expectations “well anchored.” Apparently, that’s a thing. 🙄

Powell, sounding like a man who’s just about ready to retire to a cabin in the woods, mentioned the ever-popular concept of stagflation: high inflation paired with high unemployment. Apparently, it’s like trying to juggle flaming swords while riding a unicycle – anything you do to fix one problem makes the other worse. Fun times!

Powell wasn’t in any hurry to cut interest rates, even though inflation was still doing its best impression of a runaway freight train. Some of his colleagues, like Raphael Bostic and Adriana Kugler, also seem to be on Team “Keep Rates High For Now.” However, Trump – the man of the hour – decided that cutting rates was exactly what the world needed. Naturally, he accused Powell of “playing politics.” Politics? Surely not. 👀

Now, people in the know are wondering how this will affect Bitcoin and its band of merry altcoins. Historically, cryptocurrencies (and stocks) do well when the Fed is slashing interest rates. But with Powell holding firm like the economic equivalent of a brick wall, the future’s looking a bit… rocky.

At last check (Saturday, because nothing says ‘fun’ like crypto checking on a Saturday), Bitcoin was trading at around $83,435. Oh, to live in such an exciting time. 🤑

Bond Market and Crude Oil to the Rescue (Maybe)

But wait, it’s not all doom and gloom! The bond market and crude oil prices are here to offer some… hope? Crude oil prices have recently fallen off a cliff, with Brent dipping to $64 on Friday, and West Texas Intermediate (WTI) following suit to $62. Copper, a reliable indicator of the world’s economy, also had a rough week. But, hey, at least these things are hinting at a potential recession. So that’s comforting. 😅

The bond market is also flashing red, with the 10-year and 2-year yields dropping like a stone, falling to 3.95% and 3.5%, respectively. These signals seem to suggest that the Fed might become… dare we say it… dovish and start cutting interest rates sooner rather than later. Oh, how the mighty have fallen.

Here is my nomination for the most interesting chart of the week.

* Arguably, the stock market crashed this week

* JP Morgan is saying 60% probability of a recession

* Record uncertainty

* Unprecedented Government policy on tariffs.So, given the list above, what is 10-year…

— Jim Bianco (@biancoresearch) April 5, 2025

Now, just to spice things up, Goldman Sachs has raised the U.S. recession odds, predicting the Fed will make at least three rate cuts later this year. If that happens, expect risky assets (stocks, Bitcoin, altcoins) to get a nice little boost. Historically, these assets thrive when the Fed takes a hatchet to interest rates. Remember 2020? It was practically a crypto and stock market party when the Fed cut rates at the onset of the pandemic. 🥳

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

- Grimguard Tactics tier list – Ranking the main classes

2025-04-05 15:04