Digital asset investment funds have just clocked their fourth week in a row of lovely, succulent inflows, sucking up a colossal $882 million last week, according to CoinShares. If this were a piggy bank, we’d be talking Michelin Man-sized cheeks at this point: total inflows for the year now stand at a thunderous $6.7 billion. Even a squirrel would have trouble hiding that many nuts.

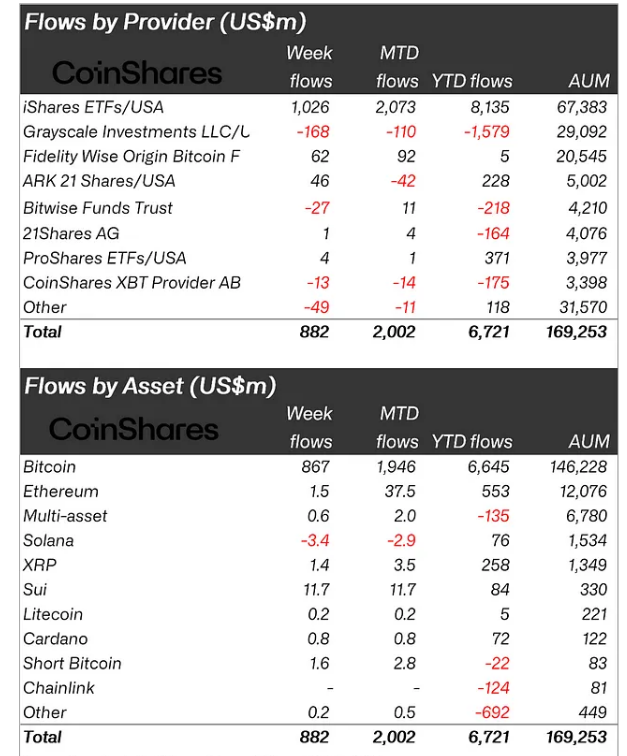

Now, BlackRock’s iShares ETFs swaggered in and dumped $1.02 billion on the table like a high roller who doesn’t know where his wallet ends and the casino begins. But before anyone could begin engraving the “Biggest Crypto Crew” trophy, a handful of other products—Grayscale, Bitwise, CoinShares XBT and friends—decided it was time for a classic financial Irish exit, hoisting $257 million out the door when nobody was watching.

James Butterfill, the firm’s head of research and certified expert in economics and, presumably, polite small talk, said this cash surge is down to a mix of an expanding M2 money supply and the U.S.’s trained ability to ignore inflation risk, much like how you might ignore a bill under your door labelled “Immediate Payment Due.”

There is good news if you like your state legislatures dabbling in crypto: Butterfill noticed more U.S. states are now approving bills to hold Bitcoin as a strategic reserve asset. Apparently, gold coins in the vault are out, digital currencies are in, and just maybe, the next governor’s portrait will be pixelated.

If you’re mapping all the action, the U.S. put in a performance worthy of a reality TV finalist, bringing in $840 million. Germany showed up with $44.5 million (undoubtedly precision-engineered), while Australia, perhaps distracted by kangaroos or the existential horror of drop bears, managed $10.2 million in inflows.

Meanwhile, Sweden had a bit of a meltdown, leaking $12 million in outflows—possibly upset they couldn’t goose-step alongside the U.S. Hong Kong and Canada also edged toward the exit with $8 million and $4.3 million outflows, albeit with the kind of quiet politeness that makes Canadian departures almost apologetic.

Bitcoin, ever the jealous headliner, hogged the spotlight with $867 million in inflows last week, bringing U.S.-listed ETF net inflows to $62.9 billion since January. Take a bow, BTC—you’re officially the homecoming king, having busted through your previous all-time high like Kool-Aid through a brick wall.

Ethereum, by contrast, seemed to have taken the week off, with just $1.5 million of inflows. But if you thought this was a “top two only” party, meet Sui (SUI)—which quietly slipped past Solana and Ethereum with $11.7 million. Sui now has $84 million YTD inflows, leaving Solana’s $76 million in the dust, and probably feeling a bit like someone who showed up late to a free buffet.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-05-12 16:33