In a move that could only be described as a dash for the gold, Franklin Templeton has decided to throw its hat into the ring, filing to launch an exchange-traded fund based on Ripple’s XRP. They are now in the company of Bitwise, Canary Capital, and a motley crew of others in this rather thrilling XRP ETF race. 🏁

Now, let’s not beat about the bush. Franklin Templeton is all set to launch Ripple (XRP) ETFs, which will track its spot price minus the pesky little fees. The ETF shares will be traded on the Cboe BZX exchange, while Coinbase will play the role of the custodian. However, dear reader, do not expect any benefits from XRP-related forks or airdrops. It seems the ETF holders will be left high and dry on that front! 😅

By filing for these Ripple ETFs, CBOE has joined the ranks of Bitwise, 21Shares, WisdomTree, CoinShares, Canary Capital, and Grayscale Investments in this exhilarating race to launch XRP-based investment products. The U.S. Securities and Exchange Commission (SEC), bless their hearts, has already acknowledged the proposals from these firms and is currently in the process of making approval decisions. However, it’s worth noting that the S.E.C. has delayed its decision on Grayscale’s XRP ETFs until May. Talk about keeping everyone on the edge of their seats! 🎢

According to the ever-reliable Bloomberg analysts, XRP ETFs have a 65% chance of approval, which, if we’re being honest, is a tad less likely than Litecoin (LTC), Solana (SOL), and even the beloved Dogecoin (DOGE). Who would have thought? 🐶

Our official alt coin ETF approval odds are out. Litecoin leads with a 90% chance, then Doge, followed by Solana and XRP. We are only doing for 33 Act $IBIT-esque filings. But def poss to see futures or Cayman-subsidiary type 40 Act stuff get through as well.

— Eric Balchunas (@EricBalchunas) February 10, 2025

However, let’s not forget that these odds were released back in February, meaning they didn’t account for the recent developments. Specifically, the legal tussle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) might be wrapping up, according to the ever-astute FOX Business journalist Eleanor Terrett. 🕵️♀️

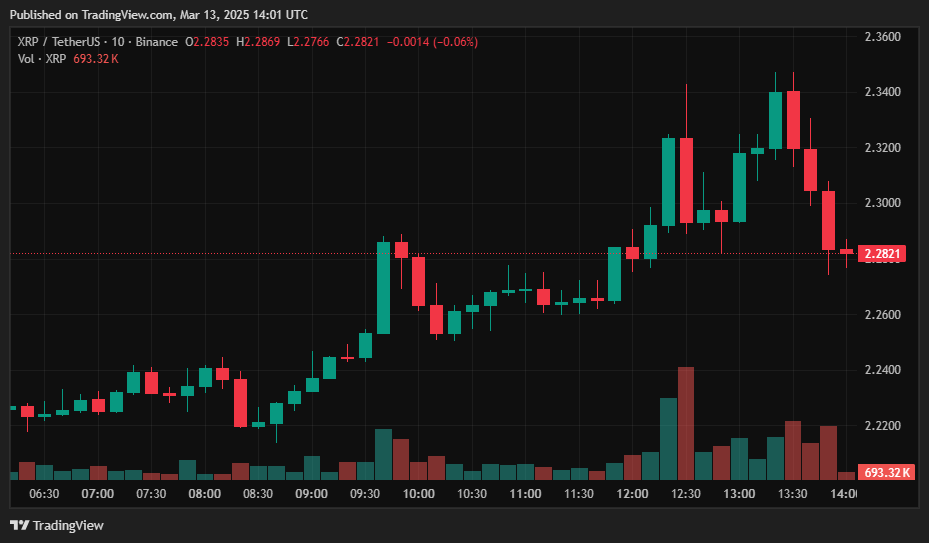

The market’s reaction to this juicy tidbit reflected a classic case of buy the rumor, sell the news. On the initial reports of the XRP case potentially nearing conclusion, XRP price rose by a sprightly 4% over the past 24 hours. But alas, after the hype cooled and no more news followed, a wave of selling pressure kicked in, as evident from the four consecutive bearish candles on the shorter timeframe chart. Quite the rollercoaster, wouldn’t you say? 🎢

With the prolonged Ripple lawsuit potentially nearing resolution, especially given the SEC’s recent dismissal of lawsuits against other crypto firms, the approval of XRP ETFs feels increasingly likely. The case was likely the main impediment to Ripple-based ETFs, as it created regulatory uncertainty around the status of XRP as a security. If this regulatory hurdle is finally removed, the arrival of XRP ETF could shift from mere speculation to a delightful reality, potentially setting the stage for a more sustained XRP price movement. Plus, the entry of Franklin Templeton into the XRP ETF race is another good sign, suggesting that they see a decent chance of approval. Fingers crossed! 🤞

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-03-13 18:19