As a seasoned crypto investor with a knack for spotting trends and reading charts like a book, I find myself captivated by Fantom’s (FTM) recent surge. With a 17% increase in value on Aug. 22, this blockchain platform optimized for DeFi applications has caught my attention.

In simple terms, the value of Fantom surged by 17%, making it the top performer among all cryptocurrencies currently on the market.

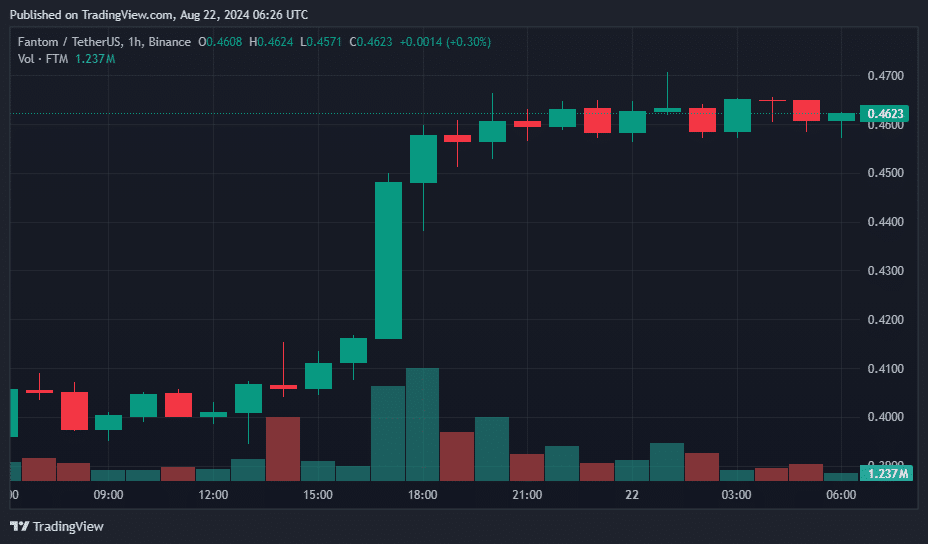

On August 22nd’s morning, Fantom (FTM), a blockchain designed for decentralized finance apps, experienced an increase of 17% in value, trading at approximately $0.461 according to crypto.news data. The day’s trading volume for this cryptocurrency surged over twice the previous day’s figure, reaching around $284 million. Its market capitalization stood at $1.29 billion, placing it 62nd among the largest cryptocurrencies in terms of market cap.

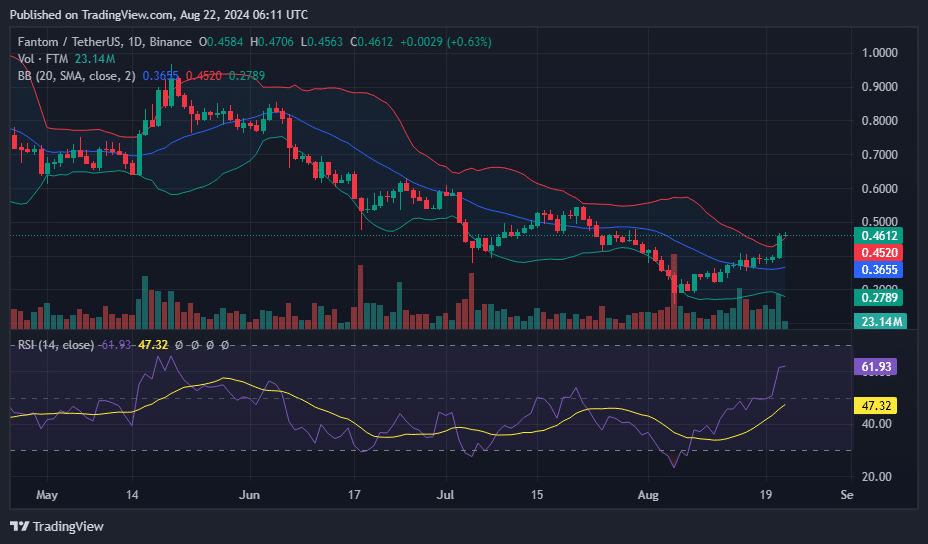

The token’s price has soared by approximately 67% since it hit $0.276 on August 5, a day when both the crypto and stock markets suffered a collapse that resulted in over $1 billion worth of liquidations. However, even with this recent increase in price, FTM remains significantly lower, having dropped 86.6% from its peak all-time high of $3.46, which it reached in October 2021.

At present, Fantom’s price sitting at $0.4621 exceeds the upper Bollinger Band ($0.4520), hinting at a possible breakout from usual volatility ranges. Being above not only the upper band but also the middle band at $0.3655 indicates an unusual surge in market momentum, which is typically associated with a robust bullish trend or optimistic investor sentiment.

If the price of FTM goes beyond its upper Bollinger Band, it might raise some worries about the asset being excessively bought (overbought). However, with an RSI value of 61.93, although it’s higher than usual, it hasn’t yet reached the level that typically signals overbought conditions (an RSI above 70). This means that while the buying momentum is significant, there could be further potential for price increases before the asset enters potentially overbought territory.

The current situation suggests that the market may be responding positively to certain triggers, causing prices to surge beyond typical resistance points. However, it hasn’t yet reached a point of reversal due to excessive buying. This could draw more traders who want to cash in on the momentum, possibly driving the price even higher in the near future.

Yet, traders need to stay vigilant for sudden shifts that might cause a swift correction if the price swings back towards the usual band range of the Bollinger Bands.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Silver Rate Forecast

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Pi Network (PI) Price Prediction for 2025

2024-08-22 09:50