The number of investors withdrawing their funds from the Grayscale Bitcoin Trust (GBTC) exchange-traded fund has decreased dramatically, hitting a new record low which is around 90% less compared to the previous day.

At the same time Bitcoin‘s price bounced back following the unveiling of the recent US inflation figures, market volatility ensued.

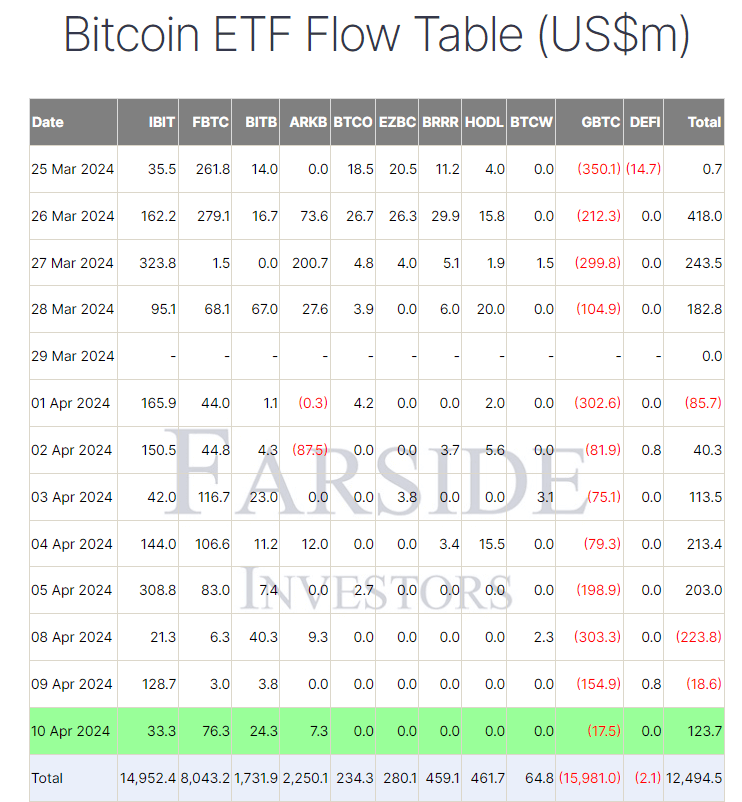

On April 10, there were withdrawals of approximately $17.5 million from GBTC, significantly less than the $154.9 million invested on April 9, according to Farside’s data.

On April 10, 2024, the total net Bitcoin ETF flow amounted to $123.7 million. (This is preliminary data.)

— Farside Investors (@FarsideUK) April 11, 2024

Bitcoin’s price climbed by 2.08% within the past 24 hours, reaching a value of $70,542 based on CoinMarketCap data. This surge transpired after Bitcoin dipped to a recent low of $67,482 following the release of the March U.S. Consumer Price Index (CPI) report revealing a larger-than-expected 3.5% yearly increase. The unexpected CPI figure instilled fears that the Federal Reserve could delay potential interest rate reductions.

Some analysts in the cryptocurrency world are hopeful that the decrease in outflows from Grayscale Bitcoin Trust (GBTC), amounting to $16 billion since its transformation into a spot Bitcoin ETF in January, could be a sign of improvement.

Thomas Fahrer, the CEO of crypto-centric review platform Apollo, asked his 41,500 followers on April 11 if the selling of GBTC (Grayscale Bitcoin Trust) had ended. He mentioned that the outflows from the trust on April 10 amounted to approximately 250 Bitcoins, which represented a staggering 95% decrease from the start of the week.

On April 8, just days prior, Grayscale saw outflows of 4,288 Bitcoin, totaling $303 million.

The smallest preceding disbursement occurred on February 26th, totaling $22.4 million. Over a four-month period, the daily average outflow amounted to approximately $257.8 million.

According to Farside’s data, only BlackRock IBIT, Fidelity FBTC, ARK’s ARKB, and Bitwise BITB saw investments on April 10 out of all the Bitcoin ETFs.)

FBTC received a substantial inflow of $76.3 million, marking its largest intake since April 5, adding up to a grand total of $8,043.2 billion in inflows. Meanwhile, the combined net inflows into Bitcoin ETFs amount to an impressive $12,494.5 billion.

In simple terms, the approaching Bitcoin halving, roughly scheduled for April 20th, represents an important milestone for investors. This significant occurrence reduces the number of new Bitcoins created per block from 6.25 to approximately 3.125.

Every four years, Bitcoin experiences a decrease in new supply being added to circulation, called halvings. Historically, this has resulted in an increase in Bitcoin’s value due to the reduced inflation rate.

In simple terms, the current excitement about possible Bitcoin ETF approvals is leading markets to believe there will be more demand, which could make the price rise even faster.

In an interview with Bloomberg on April 9, Marathon Digital’s CEO, Fred Thiel, shared his perspective. He believed that the recent approval of Bitcoin spot ETFs had led to a significant influx of investment capital into the market. Consequently, the value of Bitcoin was increasing at a faster rate than expected following the halving event.

The cost of Bitcoins has risen by over 60% during the past few months prior to the halving event. Experts believe that this upward trend in the market is primarily due to heightened demand, rather than the reduction in supply that comes with the halving.

Previously, Bitcoin supply reductions have led to significant surprises. However, this year’s occurrence is expected to be unique due to the simultaneous presence of both a supply reduction and a demand decrease. The primary cause of this shift is believed to be ETFs; in just one day, investments into these BTC spot ETFs have surpassed $1 billion, as stated by Andras Kristof, CEO and co-founder of Galaxis during an interview with Crypto.news.

If the demand for the new ETFs remains high, it may lead to increased purchasing every day. Considering the current decrease in supply, this situation could cause a notable increase in bitcoin’s price and instability.

Over the last 12 months, Bitcoin’s cost has nearly tripled. Yet, this impressive surge may not be over just yet. Institutional investors, who have been cautiously observing from the sidelines, could soon jump in due to the halving effect and the fear of missing out on further potential gains.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Grimguard Tactics tier list – Ranking the main classes

- Every Upcoming Zac Efron Movie And TV Show

2024-04-11 15:12