As a seasoned crypto investor with a decade of experience under my belt, I find the latest Gemini report both encouraging and insightful. Despite the rollercoaster ride that the market has been over the past few years, it’s heartening to see that the number of crypto owners remains consistent in key regions like the U.S., U.K., France, and Singapore.

The report titled “Global State of Crypto 2024” by Gemini, published on September 10, highlights that even amidst recent market difficulties, significant numbers of people continue to own cryptocurrencies in key countries such as the United States, United Kingdom, France, and Singapore.

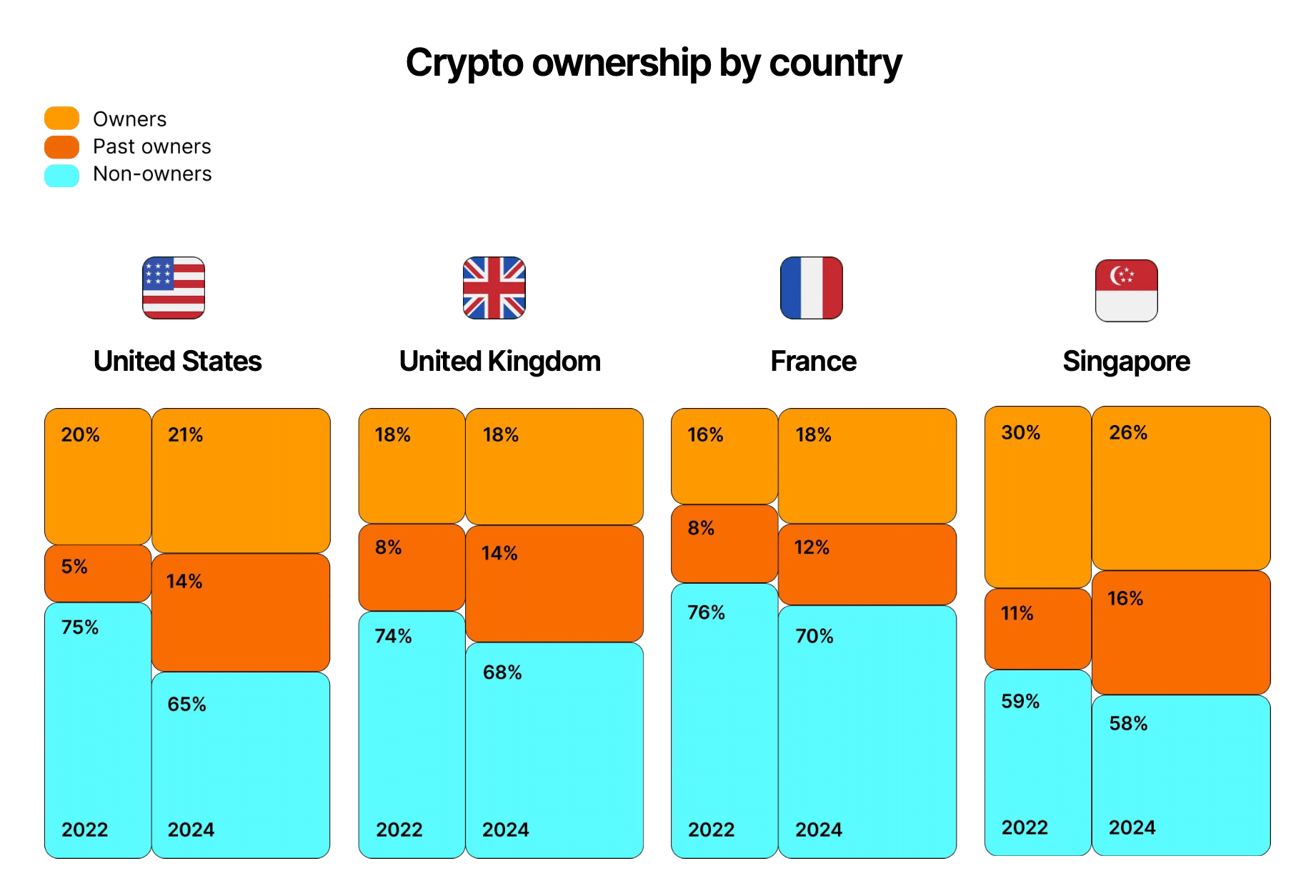

According to a report sent to crypto.news, Gemini researchers pointed out that the number of people worldwide who own cryptocurrencies has remained relatively stable, even amidst the upheavals experienced by the industry between 2022 and 2024.

Over the specified period, both the United States and the United Kingdom consistently held ownership rates of approximately 21% and 18%. Meanwhile, France observed a minimal increase in cryptocurrency ownership, moving from 16% up to 18%. Conversely, Singapore witnessed a small decrease in ownership, dropping from 30% to 26%, as per the report.

The durability of cryptocurrencies can be largely traced back to the long-term investing approach of their owners, as approximately 65% of them in these areas admitted to purchasing and holding digital currencies for their prospective growth potential.

As a researcher, I’ve discovered that approximately one-third (38%) of these investors consider cryptocurrency as a protective measure against inflation. This perspective underscores the strategic importance of digital assets within investment portfolios.

Crypto selling has slowed in recent months

Over the last six months, the report shows a substantial decrease in crypto trading among investors. Despite an uptick in new crypto holders recently, about three-quarters of them sold their investments over half a year ago, mostly because of unpredictable market fluctuations.

Contrarily, with the market demonstrating indications of revival over the past six months, it’s been noticed that fewer investors have offloaded their investments in comparison to those who did so over a year prior. Interestingly, just 29% of the investors who sold their cryptocurrency did so following incurred losses.

Spot crypto ETFs are bringing new owners to crypto in the United States

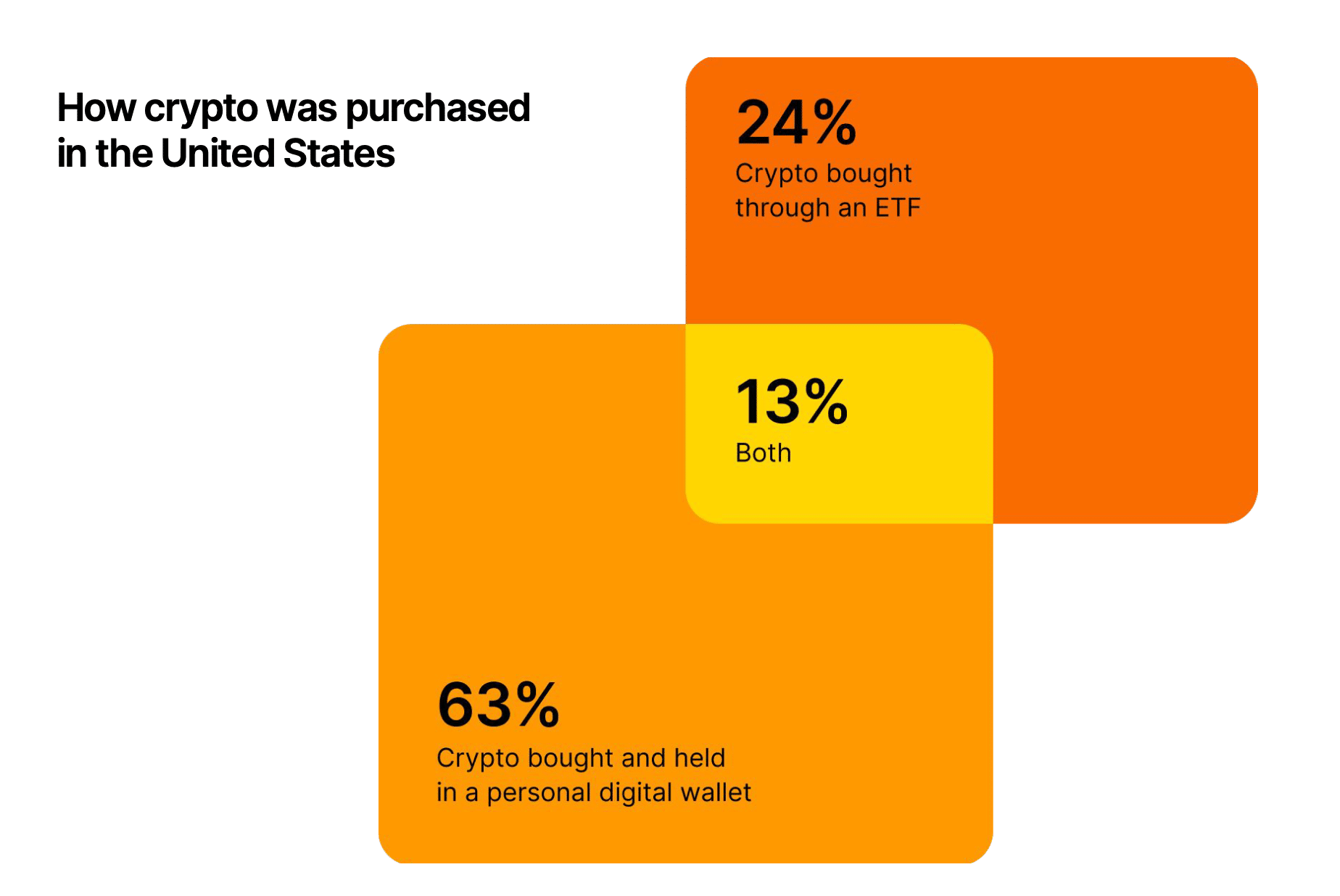

According to a recent study by Gemini, approximately 37% of American cryptocurrency owners currently have some investments in crypto via ETFs. Additionally, around 13% of new entrants into the crypto market chose to join solely through these exchange-traded funds.

At the start of July, ETFs for Ethereum (ETH) became available for trading. This marked a significant step towards mainstream recognition and acceptance of cryptocurrencies other than Bitcoin (BTC).

Regulatory concerns and gender disparities

Approximately 38% of people in the United States and the United Kingdom who do not own cryptocurrency mentioned regulatory issues as a factor preventing them from investing in it. This concern was particularly pronounced in Singapore, with 49% of those surveyed voicing similar apprehensions about regulatory matters.

The report further revealed an ongoing disparity in cryptocurrency ownership between genders. Men make up the majority, accounting for 69%, while only 31% identify as female investors. Interestingly, women who do invest in crypto show similar tendencies to hold onto their assets for a long term, just like men do.

The data indicates that when women start investing, their strategies tend to follow the general pattern of long-term investment.

Past crypto owners are likely to return to crypto

Once they left the cryptocurrency market during its downturn, those who previously owned cryptocurrencies continue to be hopeful about digital assets and are signaling a willingness to return to the market.

Approximately 3 out of every 4 past crypto owners in the U.S. have shown a strong interest in acquiring more cryptocurrency within the next twelve months, as suggested by recent findings. To be more precise, a whopping 77% of these American crypto holders indicated they are at least somewhat inclined to invest in digital currencies again over the coming year.

Crypto is booming in Turkey

2024’s Crypto State Study featured Turkey as a new participant for the first time this year. Over half of the participants from Turkey (approximately 58%) indicated that they currently own cryptocurrency, and an impressive 65% expressed their intention to buy crypto within the next twelve months, according to the study findings.

Moreover, it was found that Turkish cryptocurrency holders were substantially more prone to frequently engage in trading crypto (representing 62%), contrasting with those from the other surveyed nations (who traded at a rate of 43%).

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Gods & Demons codes (January 2025)

2024-09-10 15:36