As someone who has navigated through various market cycles over the past few decades, I find myself intrigued by this analysis. The interconnectedness of economic growth, investor sentiment, and the crypto space is a fascinating study in the dynamics of global finance.

How might you adjust your investment portfolio to capitalize on the potential growth spurred by global central banks lowering interest rates and boosting liquidity? Let’s delve deeper into this topic.

Table of Contents

Macroeconomic triggers deepen

Worldwide funds are experiencing a significant boost due to central banking institutions worldwide, notably China and the United States, implementing strategies to inject capital into their respective economies.

China has unveiled a $143 billion economic boost plan, fueling robust growth across the nation. Additionally, the People’s Bank of China has directed commercial banks to decrease mortgage rates for existing home loans by at least 0.3 percentage points below their prime lending rate, with the goal of bolstering its flagging real estate sector by October 31.

Consequently, Chinese stocks are experiencing an unprecedented upward trend. Over the last five days, the Shanghai Composite Index has skyrocketed by 20%, and it even increased by 8% in just one day, on September 30th.

remarkable surge: China’s stock market has experienced an extraordinary rise this week

— Radar🚨 (@RadarHits) September 30, 2024

But it’s not just China. On Sep. 18, the U.S. Federal Reserve implemented an aggressive 50-basis-point rate cut, and according to the CME FedWatch Tool, the market now anticipates another 25 to 50 bps cut in November. If this occurs, the federal funds rate could drop to a range of 4.25-4.50% or 4.50-4.75%.

Furthermore, following the Federal Open Market Committee meeting on September 18, cryptocurrencies have generally performed better than conventional assets. Given the rising liquidity levels, particularly in the United States and China, it’s plausible that investor interest in riskier ventures such as cryptocurrencies will increase significantly in the coming days.

Let’s delve further into these occurrences and investigate their potential impact on the crypto market, with a particular focus on Bitcoin, as we move forward.

Global liquidity on the rise

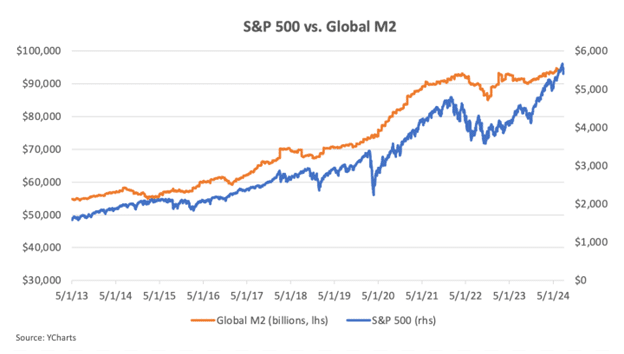

Among various factors influencing Bitcoin’s price fluctuations, global liquidity emerges as a significant predictor.

In simpler terms, the term ‘Global liquidity’ or ‘M2 supply’ represents the easily accessible funds like cash and savings in banks. When central banks ease their restrictions, for instance by lowering interest rates or providing economic stimulus, they effectively boost the circulation of money within the financial system.

Over time, it’s been noticed that Bitcoin’s value generally increases as the global money supply expands, while it typically struggles during periods of shrinking liquidity.

Based on research conducted by Lyn Alden Investment Strategy, the relationship between Bitcoin and global liquidity from May 2013 to July 2024 was remarkably strong, with a correlation coefficient of 0.94. A correlation of 1.0 would signify a perfect match, so this is very close.

Looking at smaller time periods reveals a more intricate pattern. Specifically, when considering a 12-month rolling window, the association between Bitcoin and liquidity weakens slightly to 0.51. And if we narrow our focus even more to a 6-month period, the correlation becomes even less pronounced, dropping to 0.36.

What causes these variations in Bitcoin’s price? Although long-term price changes are primarily driven by liquidity, short-term fluctuations are frequently influenced by events specific to Bitcoin, like regulatory changes, shifts in market sentiment, or significant crypto news. This is why Bitcoin might sometimes diverge from the general liquidity trend in the short term.

Currently, we’re witnessing a shift in the worldwide liquidity scenario. Following a phase of reduction, the M2 money supply is expanding at a fast pace once more. For much of 2022 and the beginning of 2023, it contracted due to the Federal Reserve’s tightening measures, but since then, it has experienced one of its steepest increases in recent times, exceeding $21 trillion by early September.

Worldwide, the M2 money supply reached around $108 trillion by late September, indicating a significant rise in value following several months of stagnation, suggesting an upward trajectory.

The boost in liquidity is essential because, as demonstrated by past events, Bitcoin’s value tends to escalate with an increase in liquidity. This pattern was evident during the COVID-19 pandemic in 2020, when central banks, notably the Fed, pumped vast amounts of money into the economy. Consequently, the M2 supply surged, and Bitcoin’s price mirrored this growth.

However, as the Federal Reserve commenced increasing interest rates and reducing liquidity supply in 2022, the growth of M2 declined, and the value of Bitcoin plummeted dramatically.

Essentially, it’s crucial to understand that Bitcoin tends to react strongly to changes in liquidity levels. When the worldwide M2 money supply grows, Bitcoin usually gains value. Given the current rise in liquidity, notably in the U.S. and China, there’s a good chance we might see another increase in Bitcoin prices soon.

While history demonstrates that short-term price movements can stray from the long-term trend, it’s essential to keep a close watch on both market liquidity and Bitcoin-related aspects to predict potential future price directions.

The trickle down effect

With central banks globally increasing liquidity, the resulting flood of capital progressively impacts the economy at large. Ultimately, these effects extend to the cryptocurrency market.

The procedure commences as there’s an influx of cash in conventional industries, allowing both businesses and consumers to hold more funds. This surge in funds encourages increased spending and investment opportunities across multiple types of assets.

To begin with, funds tend to move towards secure investments like bonds, precious metals (gold), or property. Such assets often experience growth early on because investors look for reliable and established markets to safeguard their money.

As liquidity accumulates and faith in the economy grows, a new phase emerges where investors look for greater yields. This shift in focus leads them towards riskier investments.

Over the last twenty years, China has experienced five significant stock market surges, with nearly half of them being fueled by substantial financial stimuli. With a new wave of economic stimulus currently underway in China, certain experts predict that this could initiate a fourth such rally.

For the past twenty years, China has experienced four significant stock market surges, with three being primarily driven by economic stimuli. It seems we might be starting another stimulus-driven surge now, which increases anticipation for potential returns ranging from 50% to 100%.

— Gavekal (@Gavekal) September 30, 2024

As investors grow increasingly daring and adventurous, they start exploring investment opportunities beyond traditional stock markets, seeking higher yields. It’s here that cryptocurrencies often come into play.

Investments such as Bitcoin are often considered high-stakes, high-yield opportunities. With increased funds circulating within the financial market due to central bank policies, a portion of this liquidity tends to seep into the cryptocurrency sector over time.

Over time, this situation evolves steadily, influenced by factors such as economic expansion, investor opinions, and the continuous quest for profitable returns in a market flooded with liquidity.

In essence, this series of events—from the economy to bonds, then stocks, and finally cryptocurrency—highlights the impact that central bank policies can have on the attractiveness of the cryptocurrency market as an investment option, particularly during times when there is increased money supply.

What do experts think?

Several analysts are of the opinion that the coordinated efforts of monetary injections, fiscal boosts, and reduced interest rates might create a favorable environment for high-risk investments such as Bitcoin to gain prominence.

Quinten Francois, one of the founders of WeRate, shares an encouraging perspective on history, pointing out that a significant majority, approximately 80%, of Octobers have seen positive performances in both stock and cryptocurrency markets, suggesting they often thrive during the last three months of the year.

80% of Octobers were colorful with a green hue.

— Quinten | 048.eth (@QuintenFrancois) September 30, 2024

It’s quite fascinating to note that each election year consistently experiences a “green” period from October through December. The fact that a favorable September often predicts a successful fourth quarter adds to its appeal.

Not all people see the influx of money as a rosy situation. Instead, Daniel Lacalle, an economist and educator, adopts a more prudent stance on this matter.

Unprecedented growth in global liquidity, as seen on Bloomberg, indicates a rapid decrease in money supply, which could lead to prolonged economic sluggishness and an increase in riskier investments.

— Daniel Lacalle (@dlacalle_IA) September 29, 2024

He warns that while liquidity is indeed ‘exploding,’ this isn’t necessarily all good news. Lacalle cautions that this massive influx of cash could lead to ‘unprecedented monetary destruction.’

As Lacalle suggests, a rise in liquidity might potentially lead to inflation, economic sluggishness, and the formation of financial bubbles – risks that could negatively impact robust markets such as cryptocurrency over a prolonged period.

Simultaneously, Max Sultakov, the head of Yona Network, offered unique perspectives on cryptocurrency news platforms about how liquidity impacts Bitcoin’s value.

Historically, Bitcoin tends to increase in value during times when the world’s money supply expands. This is according to Sultakov’s assertion. He also anticipates that institutional investors may start moving larger amounts of funds into Bitcoin and cryptocurrencies as a way to protect their assets from potential instability in traditional fiat currencies.

A significant aspect to consider, as suggested by Sultakov, is the influence of non-centrally managed assets in areas where stringent capital restrictions are enforced, especially in China.

In China, cryptocurrency serves not only as an investment opportunity but also as a vital means for individuals to transfer their assets beyond the control of the government.

With the growing abundance of funds in these marketplaces, it’s plausible that individuals might opt for decentralized assets such as Bitcoin as a means to safeguard their wealth, bypassing the regulatory control of governments.

As a crypto investor, I’ve been keeping an eye on the latest updates from the Federal Reserve, and it seems that Chair Jerome Powell has hinted at further interest rate reductions in the near future. However, these cuts are likely to be smaller than the recent 0.5% reduction we’ve seen.

With U.S. interest rates currently at approximately 4.8% and a goal of lowering them to around 3%, Powell clarified that this implies “two additional reductions, but not multiple 0.5 percentage point cuts.” This statement suggests that the Federal Reserve is being cautious to prevent the economy from overheating.

In simpler terms, as the amount of cryptocurrency available for trading (liquidity) expands, it might lead to an uptick in funds moving towards high-risk investments. Yet, maintaining a delicate equilibrium between inflation and economic stability is still crucial to keep an eye on.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-10-02 17:59