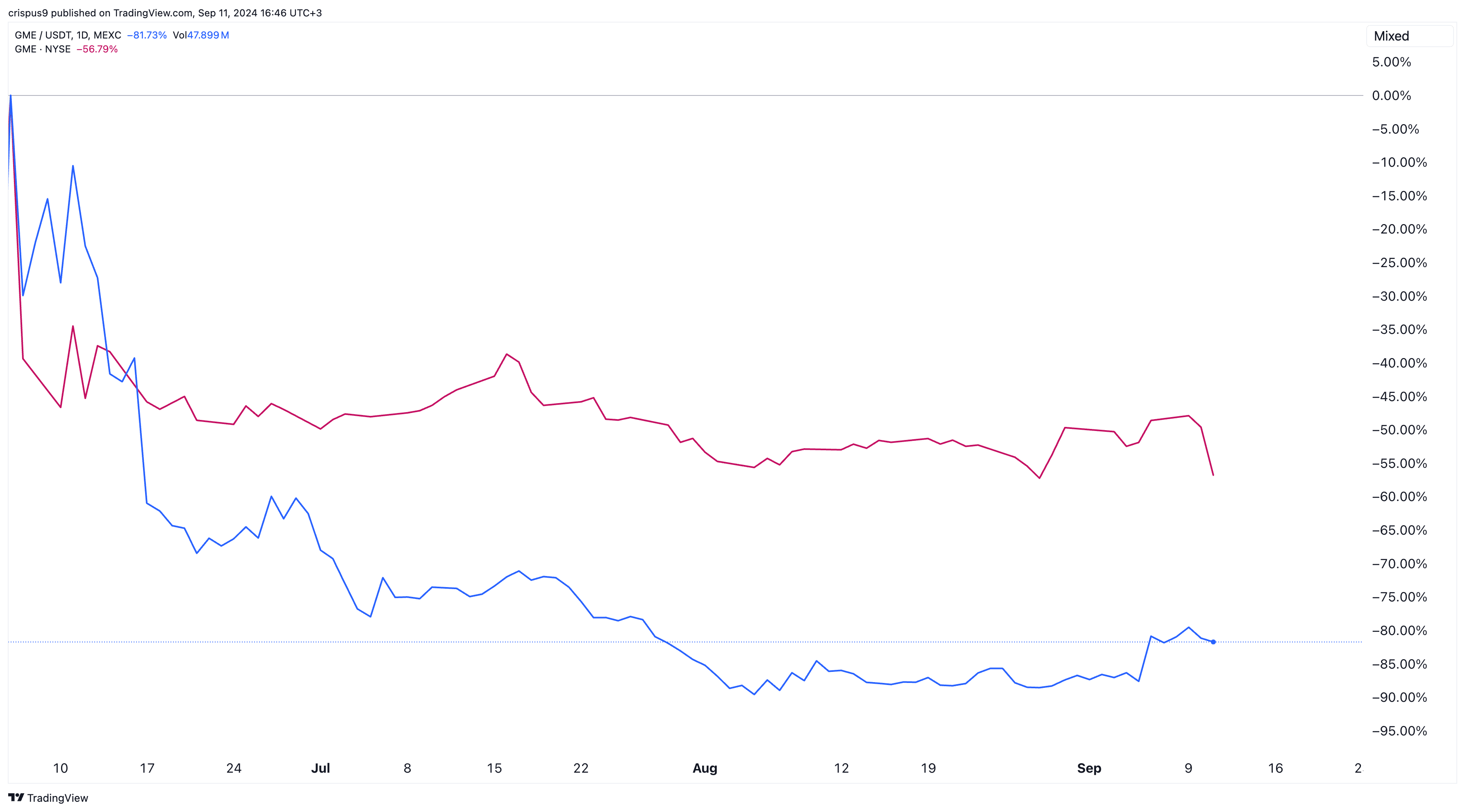

As a seasoned researcher with a knack for deciphering market trends and a keen interest in the intersection of traditional finance and cryptocurrency, I find myself once again at the crossroads of intrigue and caution as I observe the GME token’s downward spiral. The correlation between the token’s performance and GameStop’s stock is undeniably evident, and the recent selling pressure on GameStop shares due to weaker-than-expected quarterly results has undoubtedly cast a shadow over the GME token.

After GameStop’s shares faced intense selling due to disappointing quarterly earnings, the price trend for the GME token continued to decline.

As a crypto investor, I’ve noticed that the value of my GME holdings has taken a hit, dropping by 11.4% to approximately $0.0041. This decline in price has resulted in a total market capitalization of over $28 million, which is significantly lower than its peak of $157 million back in May.

Following a decline, the token was traded after GameStop experienced a drop, having peaked on Friday due to Roaring Kitty’s re-emergence at X. The stock then dropped more than 15%, trading below $20.

In Q2 of 2023, GameStop announced a decrease in their quarterly earnings, which dropped to approximately $798.3 million – this is a decline from the $1.16 billion they earned during the same period the previous year. This drop can be attributed to an increasing number of customers preferring to buy video games online instead of at GameStop’s physical stores.

As a researcher, I noticed that the stock experienced a decline following the company’s suggestion of boosting their cash reserves by offering shares for sale. Given that GameStop currently holds an impressive $4.1 billion in cash and carries no debt, this move might be aimed at strengthening their financial structure and potentially funding future acquisitions.

It’s common to see a strong link between the GME token and GameStop shares. Last Friday, the token surged to $0.0055, marking an increase of more than 110% compared to its lowest point earlier in the week. This upward trend came after Roaring Kitty, a well-known trader on Wall Street Bets, posted something new on X for the first time in months, which may have positively influenced GameStop’s performance and caused it to reach a two-month high.

Previously, the GME coin reached an all-time peak of $0.03230 in May, coinciding with GameStop shares hitting their 2021 maximum of $64. This surge occurred following Kitty’s reemergence on social media after a prolonged absence. However, both the coin and shares experienced a significant decline by double digits as the excitement subsided.

GameStop’s decline also occurred during a downbeat period in both the stock and cryptocurrency market following the release of the most recent US inflation report. As a result, the Dow Jones and S&P 500 indices plummeted by more than 0.50%, while Bitcoin (BTC) dipped to $56,400.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gods & Demons codes (January 2025)

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-09-11 17:30