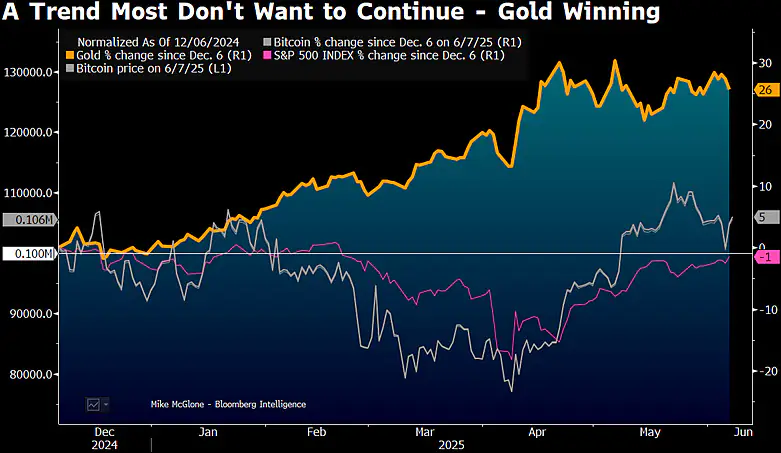

So, in a delightful little post, our friend McGlone has pointed out something that’s as shocking as finding out your favorite TV show got canceled. Since BTC decided to hit the big leagues at six figures, gold has been strutting around like it owns the place, leaving both BTC and the S&P 500 in the dust. Seriously, where’s all that cash going during these uncertain times? 🧐

The data shows:

- Gold has gained a fabulous ~26% since December 2024. 💰

- Bitcoin? Oh, it’s just hanging out, barely moving, like that friend who never leaves the couch. 🛋️

- The S&P 500? It’s as flat as a pancake, maybe even a little negative. 🥞

“A trend most don’t want to continue — gold winning,” reads the chart header from Bloomberg. Because who doesn’t love a good plot twist? 📉

Crypto Saturation Adds Pressure

Now, McGlone is waving a red flag about the sheer number of cryptocurrencies. With over 16 million tokens listed on CoinMarketCap, it’s like a never-ending buffet of digital coins. But beware! Too much of a good thing can lead to a serious case of indigestion. 🤢

While innovation is the name of the game, the lack of quality control is like letting toddlers run a candy store. Expect volatility, dilution, and a whole lot of investor fatigue. 💤

“Highly speculative, volatile cryptos face unchecked supply and competition,” he warns. And honestly, who needs that kind of stress? 😩

What This Means for Investors

McGlone’s message is as clear as mud: If Bitcoin can’t get its act together and reclaim that $100K glory while gold keeps strutting its stuff, risk assets might just face some serious headwinds from:

- Interest in safer inflation hedges (because who doesn’t love a cozy blanket of safety?)

- Oversaturation of crypto markets (like too many cooks in the kitchen)

- Broader macroeconomic uncertainty (cue the dramatic music) 🎶

Although Bitcoin and crypto are still the darlings of the long-term game, this data suggests that the near-term upside might be as elusive as a good hair day—unless something big happens to reignite that demand. 💥

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Every Upcoming Zac Efron Movie And TV Show

- PUBG Mobile heads back to Riyadh for EWC 2025

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Gods & Demons codes (January 2025)

- USD CNY PREDICTION

2025-06-09 02:18