As a seasoned researcher with over two decades of experience observing and analyzing financial markets, I have seen my fair share of economic cycles and market fluctuations. The current surge in both gold and Bitcoin is a phenomenon that has piqued my interest, as it mirrors similar patterns observed during periods of uncertainty and instability.

As gold and Bitcoin reach or approach all-time price peaks, discussions about which represents a superior form of ‘solid currency’ are intensifying among investors searching for protection from economic instability, rising prices, and global political shifts.

Table of Contents

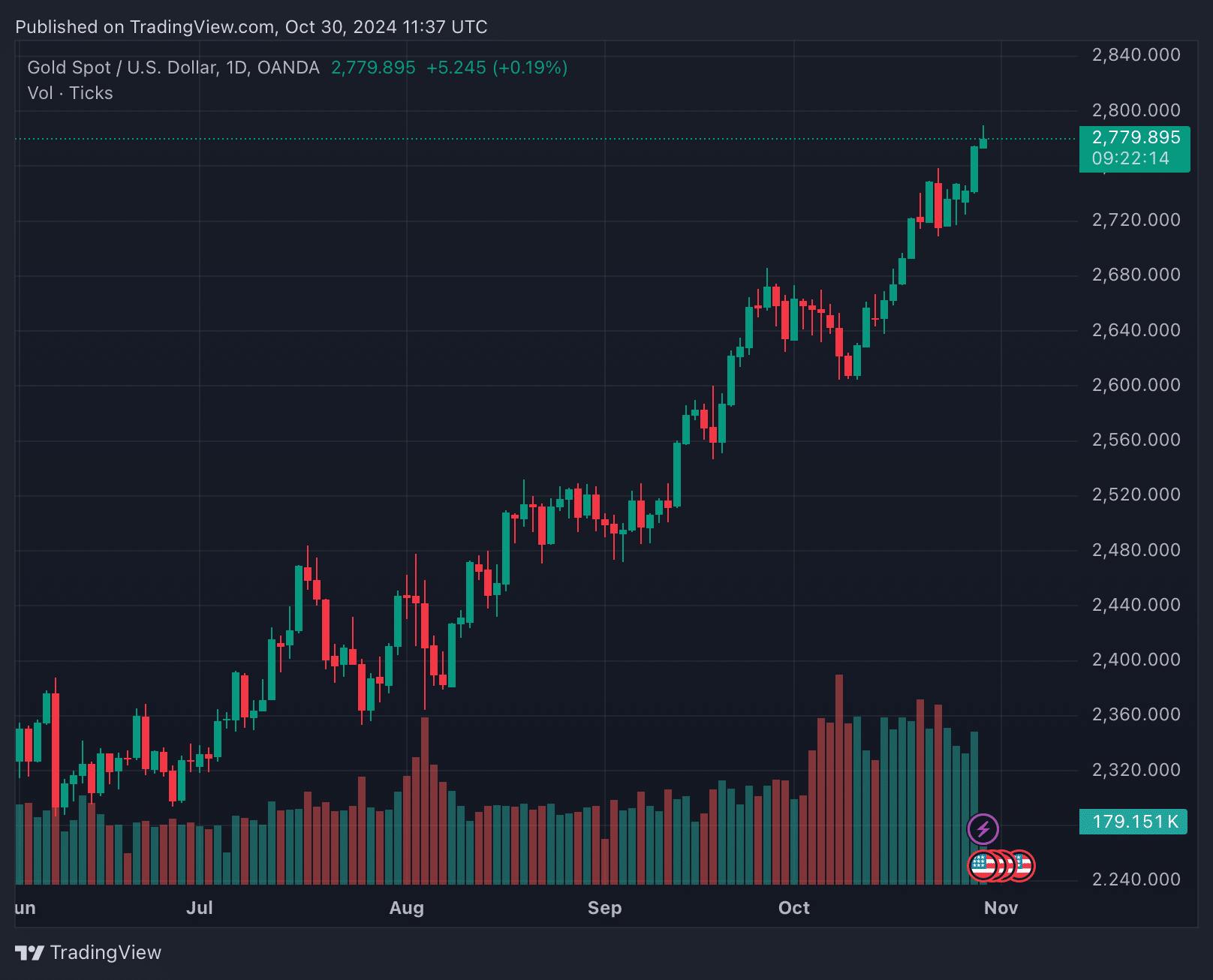

Amid growing financial strains, two assets that were once seen as adversaries – gold and Bitcoin – are experiencing significant growth, nearing their maximum recorded values. This has sparked discussions about their function as a form of “solid currency.” Gold is currently soaring above $2,770, while Bitcoin (BTC) fluctuates close to its peak value of $73,800. The coinciding increases suggest underlying market concerns. Investors are increasingly viewing both assets as protective measures against economic instability, fueling a debate over which one retains its worth more effectively.

It’s crucial to grasp the arguments surrounding the hard money concept, particularly during periods of uncertainty, such as the tight US election race we find ourselves in; this debate becomes even more relevant as people question which investment might provide protection against potential economic volatility, inflation, and geopolitical changes that could disrupt traditional market dynamics.

Surge in precious metals vs. Bitcoin

Over the past year, gold has risen by over 38%, while at the same time, Bitcoin has risen a shade by over 115%. These peaks have drawn commentary from various investors on both sides of the hard money debate, including Chamath Palihapitiya, Larry Fink, and Peter Schiff.

As stated by Palihapitiya, “Bitcoin will likely serve as an exceptional long-term inflation protection asset over the next fifty to hundred years,” he commented during a recent podcast discussion.

“You’re seeing the last vestiges of people using gold as a rational economic insurance policy.”

Gold’s recent all-time high has also garnered attention from prominent figures like Peter Schiff, a well-known proponent of precious metals as currency. He recently tweeted: “Gold closed at an unprecedented high over $2,755, on track for its strongest year since 1979.

Back in 1979, inflation had reached its maximum level and the gold market was about to decline, while currently we’re seeing inflation at its lowest point and the gold market seems poised for a fresh surge.

Bullish sentiments on precious metals, others are more nuanced in their views of what hard money looks like in the 21st century.

“The role of crypto is digitalizing gold,” said Larry Fink, CEO of BlackRock on a recent Fox Business segment. “We hope regulators look at the Spot ETF filings as a way to democratize crypto,” the world’s leading asset manager stated.

Bitcoin: ‘digital gold,’ store of value or medium of exchange?

Unlike traditional gold, Bitcoin doesn’t have a history spanning centuries and has experienced significant fluctuations in value, making it less appealing for those seeking stability. However, as Bitcoin approaches its maximum value, there is increasing curiosity about its role as a digital equivalent to gold, particularly among younger and tech-oriented investors who appreciate its mobility and ease of transfer.

The phrase “digital code” is frequently linked to computer science and digital data theory, yet no one individual is universally recognized as its inventor. However, Claude Shannon, an influential figure from the early days, played a significant role in shaping digital information theory. In his pathbreaking 1948 paper titled “A Mathematical Theory of Communication,” Shannon established the principles for digital encoding and information theory. These foundations have greatly influenced the development of digital code, Bitcoin, as well as the idea that traditional money could be encoded using blockchain technology, encryption, and a set limit on supply.

Are these rallies an early warning sign?

The increase in gold and Bitcoin values might not just mirror specific market trends, but rather indicate an escalating concern about the overall economic situation.

Historically, large, sudden increases in these assets have typically been followed by economic recessions, as investors tend to shift towards safer investments due to anticipated market instability. This pattern, evident during the 1970s and the 2008 financial crisis, implies that today’s price spikes might be a reflection of dwindling trust in traditional financial markets.

The findings from scholarly studies back up this argument. Specifically, Bouri et al. (2017) suggest that Bitcoin functions much like gold, offering protection during currency devaluation and economic uncertainty. This sentiment is also expressed by Ratner and Chiu (2013), who noted that investors tend to favor secure assets such as precious metals and digital currencies like Bitcoin when financial crises arise. Reboredo (2013) further strengthens this argument by emphasizing the stability of gold, suggesting that economic events and financial crises lead investors to seek safety in gold, thus reinforcing its status as a safe haven.

Gold’s value remains stable over time due to its limited supply increase through mining, which is subject to physical constraints. In contrast, Bitcoin’s supply is fixed at 21 million coins and is expected to reach this cap by 2140. This built-in scarcity, along with Bitcoin’s halving events that decrease the miner reward every four years, fosters a deflationary perspective on the asset.

The hard money debate into 2025

As both gold and Bitcoin continue to rally, investors are left with a critical choice: a traditional asset that has long served as a safe haven or a newer, digital alternative with distinct advantages in portability and scarcity. The debate over which is the better “hard money” has yet to be settled, but one thing is clear—both assets are resonating with a growing audience that values stability in uncertain times. Whether the economy’s direction will validate this defensive positioning remains to be seen, but if history is any guide, gold, and Bitcoin may once again serve as early indicators of shifts on the horizon. Just don’t mention Ethereum.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-30 15:52