As an analyst with over two decades of experience in the financial markets, I have witnessed countless bull runs and bear markets, and I must admit that Grass crypto’s performance has caught my attention. The token’s meteoric rise to become one of the best-performing airdrops of the year is nothing short of spectacular, especially considering its sharp contrast with other newly minted altcoins that have plummeted from their post-listing highs.

The Grass cryptocurrency token maintained its robust surge, placing it among the top-performing airdrops for the current year.

The price of GRASS soared to reach an intraday peak of $3.9587, marking a staggering 2405% jump from its all-time low following the airdrop. This dramatic rise has propelled its market capitalization beyond $893 million and its fully diluted valuation to a whopping $3.6 billion.

The growth pattern of grass has varied significantly compared to recently launched cryptocurrencies, many of which have experienced a steep drop since reaching their peak prices. For example, Wormhole (W), a widely used bridge network on Solana, has fallen by approximately 87% from its price following its listing.

Various digital assets, including Hamster Combat, Notecoin, zkSync, and Pixelverse, have plummeted more than 10% since reaching their peak values.

The robust growth of Grass might be linked to the strategy used during its initial launch, particularly when it distributed its airdrop. Around 10% of the total token supply was reserved for Airdrop One, where around 100,000 users each received 100 GRASS tokens as an incentive for downloading and installing the extension.

Simultaneously, the developers incorporated a staking feature, leading approximately 35% of all circulating tokens to be staked. This staking process offers an annual percentage yield (APY) of roughly 50%, which is significantly higher than many popular tokens such as Ethereum (ETH) and Solana (SOL), whose yields are generally under 6%.

Experts estimate that Grass Network’s monthly income might reach around $300,000 if they manage to handle 300 Terabytes of data each month. As the system expands, it’s anticipated that the earnings distributed to investors will also grow accordingly.

The cost of grass is additionally being influenced by a sense of urgency among individual investors, demonstrated by an increase in trading activity. This sense of wanting to avoid missing out (FOMO) has grown stronger as investors remain hopeful that cryptocurrencies will keep growing following Donald Trump’s victory in the U.S. election, leading them to believe prices might further escalate.

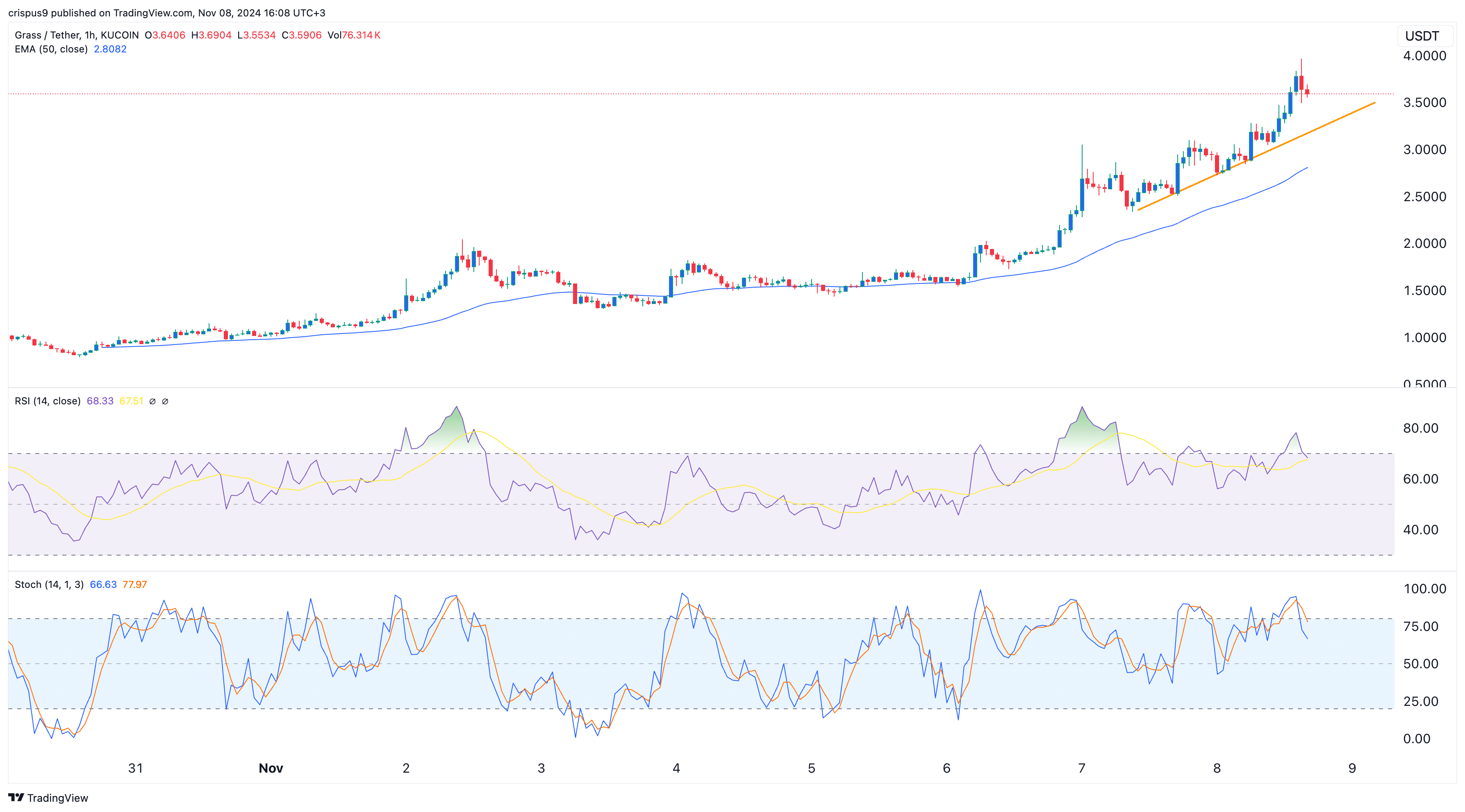

Grass crypto price gets overbought

As a crypto investor, I’ve noticed an impressive surge in the value of the GRASS token over the past few days. It started around the $0.1 mark and has soared nearly up to $4 on the hourly chart.

Grass remains significantly above the 50-period moving average, which is a positive indicator.

It’s possible that we might witness a price decrease due to certain indicators. The token has shown a bearish engulfing pattern, where a large bearish candle completely envelops a previous bullish one. Furthermore, it appears to be forming a rising wedge shape, and both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) have reached high levels, suggesting overbought conditions, and are currently trending downward.

Consequently, it’s possible that the GRASS cryptocurrency’s price might retreat to re-evaluate around $3, then possibly recover. Looking further ahead, robust staking incentives could drive the price beyond $5.

Read More

- Silver Rate Forecast

- Gods & Demons codes (January 2025)

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-08 17:08