Approximately half of the Bitcoins overseen by Grayscale Bitcoin Trust have been reduced since its transformation into a regular exchange-traded fund (ETF).

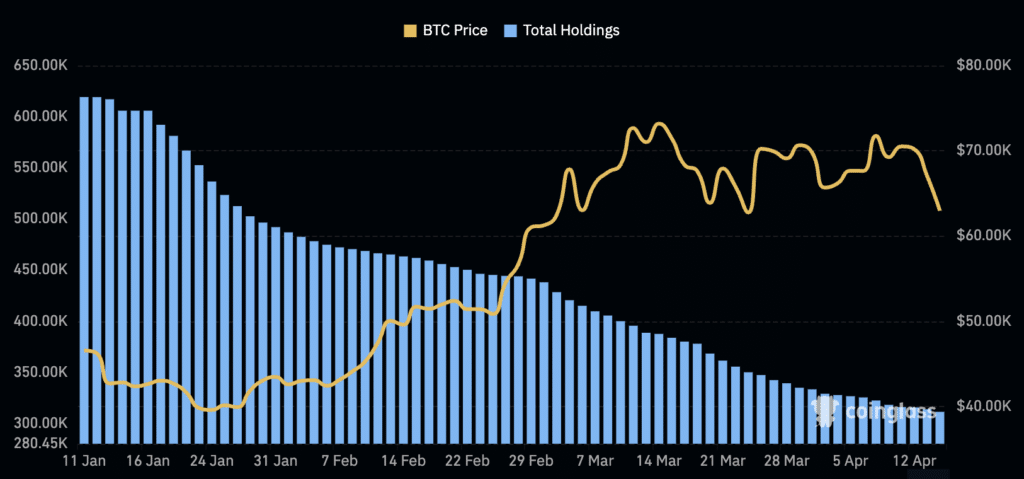

Grayscale’s Bitcoin Trust (GBTC), which is different from offerings by companies like BlackRock and Fidelity, started trading on the New York Stock Exchange with around 619,220 Bitcoins in January. However, as of April 16, according to Coinglass data, GBTC held approximately 311,621 Bitcoins.

Starting from January, our assets under management (AUM) dropped by nearly a third, down to $19.6 billion from the initial $28.7 billion. This decrease can primarily be attributed to Bitcoin’s impressive surge of around 38% in price since its launch on January 11th.

The BlackRock Bitcoin ETF from Spot saw significant competition with approximately $17.2 billion in assets. Meanwhile, there was a substantial withdrawal of funds totaling $16.38 billion since the launch of the GBTC convertible product.

On April 15, SoSoValue reported that BlackRock and Grayscale were the only Bitcoin ETFs in the US with any inflows or outflows, totaling at $36.67 million in net outflows for spot Bitcoin ETFs.

Although Michael Sonnenshein, the CEO of Grayscale, has mentioned attempts to steady the outflow of funds from GBTC, there have still been ongoing withdrawals.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-04-16 20:01