The cryptocurrency market’s surge in 2024 is one of Bitcoin‘s most robust rallies ever. Here’s why that’s true.

After reaching an all-time high of $73,750 on March 14th, Bitcoin (BTC) has since settled into a period of price stability. In recent trading periods, its value has fluctuated between $68,000 and $72,000. This price surge has led to debates about whether the ongoing crypto market boom has officially begun.

Bitcoins value has been rapidly increasing in recent times, with a significant factor being the upcoming halving of rewards for Bitcoin miners. This event is set to take place around April 19-20. During this occurrence, the compensation given to miners for adding new blocks to the Bitcoin blockchain will be reduced from 6.5 Bitcoins to 3.25 Bitcoins. Previous trends indicate that such an adjustment in supply has resulted in increased demand and, consequently, higher Bitcoin prices.

Based on James Check’s analysis at Glassnode, the cryptocurrency market is moving from an excited bull phase into a possibly frenzied one. This transition started in October 2023 and picked up speed as Bitcoin reached its peak price around the beginning of this year.

The ongoing Bitcoin bull market is particularly robust, as indicated by a scarcity of significant price dips during its upward trend.

Additionally, the rise in cryptocurrency values isn’t just affecting trading but also creating opportunities in the industry labor market. Contrary to the sluggish trends seen in past years, job openings in crypto reached a record high in March.

In a comparable manner, the data from CryptoJobsList indicates a significant surge in job listings and job applications, hitting an all-time high of 5,843 applicants in March.

What really is happening? Has the crypto bull run of 2024 officially started? Let’s find out.

What is crypto bull run?

An uptrend in cryptocurrencies, specifically Bitcoin and significant digital coins, signifies a crypto bull market.

In a bull market, there’s a boost in investor belief and purchasing actions, pushing up crypto prices. This upward trend frequently results in record-breaking highs for different cryptocurrencies and draws significant interest from both individual and institutional investors.

The ongoing stock market surge is driven by optimistic investor attitudes, including the U.S. Securities and Exchange Commission’s green light for Bitcoin spot ETFs and excitement surrounding the approaching Bitcoin halving event.

Yet, keep in mind that bull markets don’t last forever, and they typically lead to times of price adjustment or stabilization afterward.

Crypto bull run history

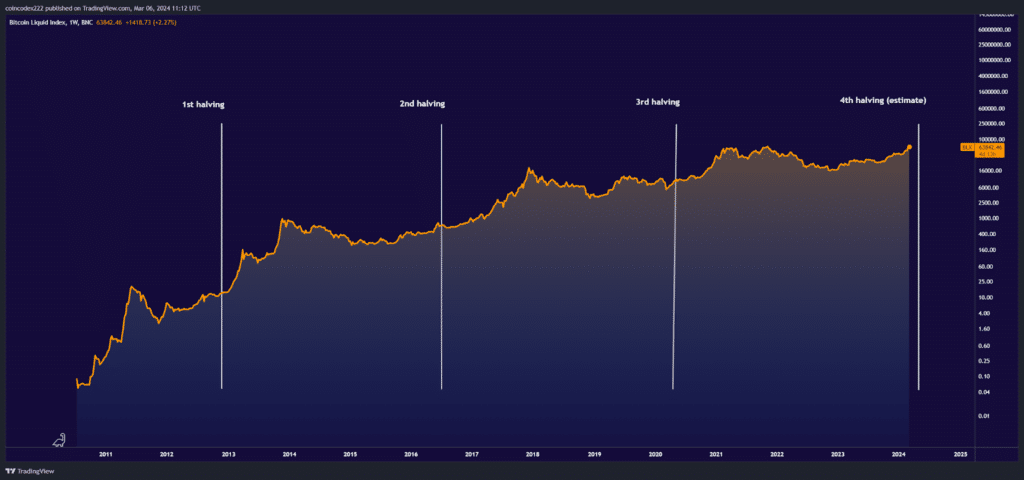

After Bitcoin’s initial reduction of rewards from 50 to 25 coins per block in 2012 – its first-ever halving event – the number of new Bitcoins entering the market slowed down, leading to an increase in demand and price, resulting in the first significant bull run for the cryptocurrency.

In the early stages, Bitcoin’s value remained under the radar, but it experienced a significant increase in price, jumping from less than $100 to over $1,000 in 2013. This unexpected surge drew widespread interest and signaled Bitcoin’s emergence into the limelight of the financial world.

Yet, the price surge did not last long; it was met by a sharp decline, bringing the prices back down to approximately $200 by 2015.

During the second bull run in Bitcoin’s history, which occurred in 2016, the digital currency experienced its second halving event. In this event, the reward given to miners for each block mined was reduced from 25 to 12.5 Bitcoins. Consequently, Bitcoin’s price surged, rising from approximately $430 to above $750 by early June 2016.

In December 2017, Bitcoin experienced a significant increase in value despite earlier price fluctuations that reached volatile levels beforehand. The digital currency eventually broke through the $19,000 mark.

After the 2020 reduction in the supply of Bitcoin (halving event), the third significant price surge took place amidst the ongoing COVID-19 pandemic.

In spite of economic instability on a global scale, Bitcoin’s value surged forward with optimism after the halving event, climbing up to approximately $15,000 by November 2020 and later peaking at nearly $69,000 in November 2021.

Over the past few years, Bitcoin’s price trends have generally followed a pattern typical of cryptocurrency bull markets. This pattern includes periods of significant price increases leading up to the halving event, which is followed by price declines and stabilization before hitting new record highs.

Cues that we are in next crypto bull run

In 2024, we can expect the signs of a cryptocurrency market upturn. Let’s examine these indicators closely and understand their potential consequences.

Inflows into spot BTC ETFs

Starting from January 2024, the value of spot Bitcoin ETFs has expanded significantly, amassing an impressive total market capitalization of $81 billion by April 10th.

The two major players, Grayscale Bitcoin Trust (GBTC) and BlackRock iShares Bitcoin Trust (IBIT), control more than two-thirds of the total assets in their care.

The substantial investments into Bitcoin ETFs suggest that more and more investors are becoming interested and confident in Bitcoin, reflecting a positive outlook on its price trend.

In addition, the continual growth of investments in Bitcoin, along with modest price fluctuations, indicates a robust demand for Bitcoin investment and supports the idea that a bull market is underway.

Price stability

One clear sign of an upcoming bull market for Bitcoin is when its price remains relatively stable.

In spite of the volatile market conditions, Bitcoin (BTC) has managed to keep its price within a narrow band, remaining above $65,000 since hitting its record peak.

In recent weeks, Bitcoin (BTC) has frequently encountered resistance at around $69,000 to $70,000, only to rebound due to robust underlying bases that could fuel additional gains.

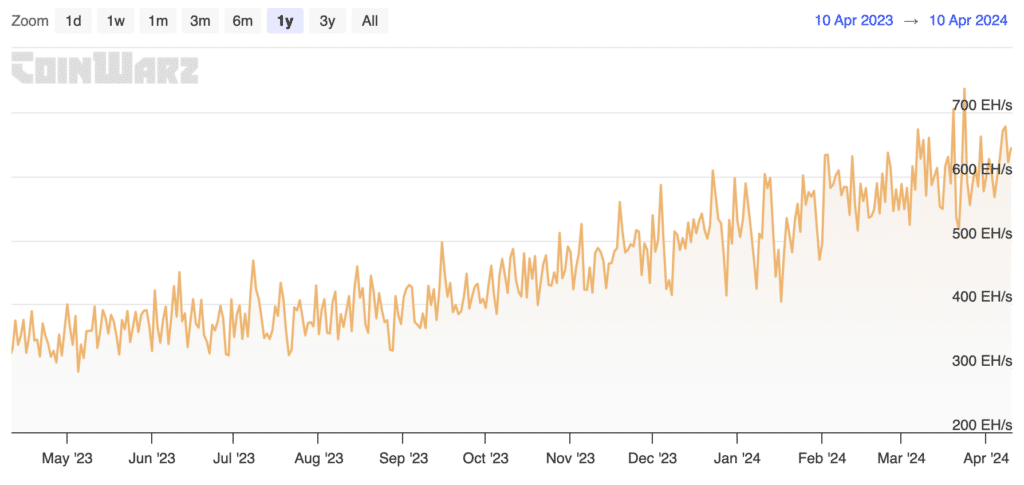

BTC hash rate

The upcoming BTC halving is causing even more excitement among investors, supporting the belief that Bitcoin’s price will continue to rise.

The Bitcoin hash rate has been gradually increasing, reaching a new high of 653 exahashes per second by April 10. This heightens the importance of the upcoming halving event.

The increasing hash rate and the upcoming bitcoin halving make investors more optimistic about the price of BTC going up.

Fear and greed index

The BTC fear and greed index often surpassing 75, with readings reaching as high as 90 at Bitcoin’s record peak in March, is yet another strong sign reflecting the widespread optimism among investors.

When the investor sentiment is highly optimistic, as indicated by the fear and greed index, it usually goes hand in hand with increasing market prices.

Rise in crypto stock prices

The rising costs of shares connected to cryptocurrencies, including Coinbase (COIN), Marathon Holdings (MARA), and Microstrategy (MSTR), adds strength to the optimistic perspective towards the crypto sector.

In the past six months, MSTR and COIN stocks have experienced significant growth, with MSTR rising more than threefold (300%) and COIN increasing by over 200%. This upward trend underscores the positive market sentiment currently present.

Crypto bull run prediction: what do experts think?

Based on Michaël van de Poppe’s perspective, Bitcoin reaching new peak prices prior to the halving event is a favorable indication. This could be a sign that the four-year cycle is continuing, suggesting potential growth for the cryptocurrency market.

The price of Bitcoin reaching new highs before its next halving event is a promising sign. This pattern, which occurs approximately every four years, indicates that the market’s upward momentum remains strong. If Bitcoin continues on this trend, it could lead to significant gains for alternative cryptocurrencies as well.

— Michaël van de Poppe (@CryptoMichNL) April 8, 2024

Additionally, according to Van de Poppe, Bitcoin’s continued progress might lead to significant expansion for alternative cryptocurrencies.

An alternate perspective emphasizes the persisting power of BlackRock’s Bitcoin ETF, fueled by increasing investment from longer-term stakeholders.

Approximately 500,000 Bitcoins are now held by new investors, while IBIT manages around 250,000. This trend indicates a growing preference for long-term investment, potentially lasting for several decades. The speaker proposes that we’re witnessing the early stages of an extended bull market for Bitcoin.

Although these forecasts are optimistic, it’s crucial to exercise caution. The crypto market is subject to changes and unexpected incidents that could alter the course of digital assets.

It’s important to thoroughly research your investments and consult with financial experts before making any decisions. Remember the essential guideline for investing: don’t put in more money than you’re prepared to part with.

FAQs

How long does a crypto bull run last?

A crypto bull market may persist anywhere from a few months to several years. Determining its precise length can be challenging due to the impact of variables like investor enthusiasm, market mood, and unexpected occurrences.

Why is the crypto bull run every four years?

Every four years or so, during a Bitcoin bull run, the creation of new Bitcoins gets slower due to a process called halving. This happens approximately every 210,000 blocks in the Bitcoin network. As a result, the supply of new Bitcoins decreases, making them more scarce. Historically, this scarcity has caused increased demand and higher prices for Bitcoin, fueling bull markets.

What causes a crypto bull run?

A crypto bull market can be triggered by various elements. These include favorable investor attitudes, fueled by factors such as regulatory certainty, corporate endorsements, innovative developments, and economic trends. However, it’s important to keep in mind that bull markets don’t last forever and usually lead to price downturns or stabilization periods.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-04-10 18:28