As a seasoned researcher with a keen eye for detail and a heart for justice, I find myself intrigued by the recent turn of events surrounding Hailey Welch, the “Hawk Tuah Girl.” The class-action lawsuit against her, while not directly naming her, raises some eyebrows given her prominence in the $HAWK token’s launch.

After being involved in a class-action lawsuit due to the crash of the $HAWK token, Hailey Welch, or “Hawk Tuah Girl” as she’s known, has broken her silence. Investors claim that they suffered significant financial losses when the coin’s value plummeted drastically following its launch. The lawsuit, filed on December 19, targets the creators and promoters of the project, alleging a “rug pull” and deceitful practices.

On December 4, the $HAWK token was introduced and immediately gained significant backing from Welch’s supporters, propelling it to a maximum market capitalization of $490 million. However, just 20 minutes after its launch, the coin experienced a sharp decline in value, dropping to a market cap of $41 million. This sudden plunge led token holders to accuse the project creators of flooding the market with large quantities of the coin, thereby causing its price to tumble.

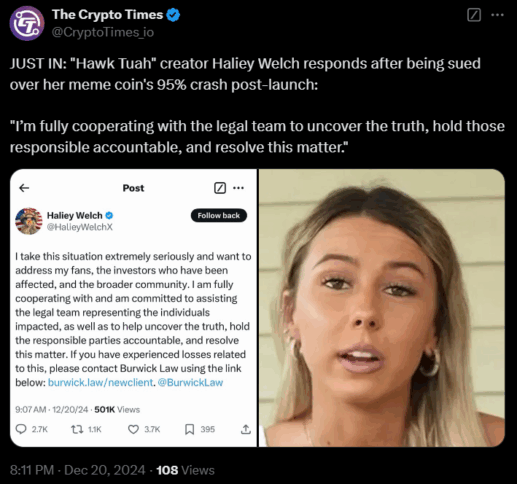

In regards to the lawsuit, Welch expressed through a tweeted statement: “I regard this matter gravely, and I wish to speak to my fans, the investors impacted, and the wider community.

She reassured her supporters that she’s collaborating with her legal advisors to clarify the circumstances and find a solution for the issue at hand. Additionally, Welch invited those directly impacted by this situation to contact the lawyers handling the court case.

The lawsuit does not mention Welch’s name, though it targets the Tuah The Moon Foundation, OverHere Ltd., and Alex Larson Schultz, one of the key promoters of $HAWK. According to the lawsuit, $HAWK token was sold to the public without proper registration, which violated U.S. securities laws. It also accuses the promoters of using Welch’s celebrity status to sell the coin, thus leading to investors being duped.

In legal documents, it’s stated that the pre-sale of the HAWK cryptocurrency raised approximately $2.8 million. Once launched, the initial market value of the token was around $16.69 million. However, as a large portion of the token supply was quickly sold, the price of the coin dropped significantly.

A representative for Welch stated that he did not manage the project. Furthermore, the representative noted that Welch was given an initial sponsorship amount but had no influence on how the coin functioned. In other words, she had no power to decide the project’s direction.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- The 15 Highest-Grossing Movies Of 2024

2024-12-20 20:52