Hedera Price has suddenly become the talk of the town, or at least the corner of the internet where crypto enthusiasts gather. After a spectacular breakout, bullish analysts are once again dusting off their crystal balls, eyeing an exciting price range of $0.30 to $0.42. There’s hope in the air, folks!

These financial fortune tellers suggest that this breakout isn’t just a fluke but rather a grand shift in the cosmic balance of structure. They’ve circled $0.28 and $0.42 as the next hotspots for all anti-gravity HBAR action. As HBAR Price valiantly attempts to inch higher through resistance zones, traders are glued to their screens, eagerly watching for signs of whether this newfound momentum is more than just a brief caffeine buzz.

The Pursuit of $0.42: A Journey Worth Taking

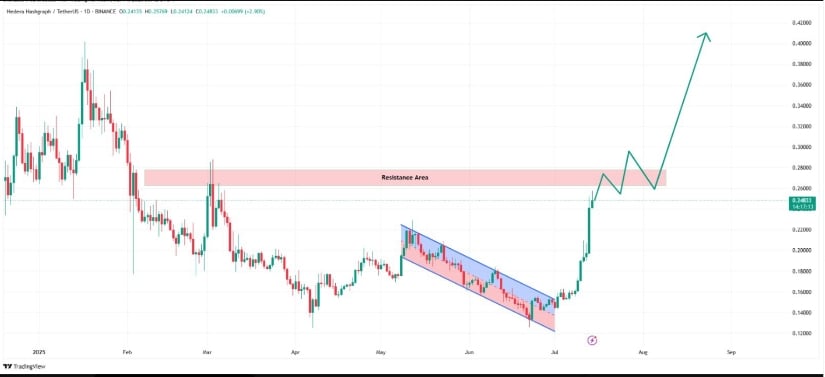

Seemingly with the determination of a hiker pressing onward through a foggy woods, Hedera (HBAR) Price has confidently breached a descending parallel channel on the daily chart—thanks to those industry wizards at Token Talk. After a few weeks of shuffling between June and July, reminiscent of a cat trapped in a cardboard box, the token sprang back from depths around $0.16 and is now humorously flirting with approximately $0.24833. That’s quite the ascent, akin to watching a toddler on a sugar high!

Source: X

A barrier between $0.26 and $0.28 now stands like a bouncer outside an exclusive club. If HBAR manages to sustain its elevated position above this channel resistance, we might just find ourselves en route to that coveted $0.42 zone, as sketched out in the analyst’s grand vision of what could be.

So far, the emerging structure suggests a potential continuation pattern. Picture it: consolidation near resistance, followed by another hopeful leg upward. The current price is hanging out near critical resistance like a teen waiting for their crush to text back, with short-term consolidation determining the next step in this awkward dance.

HBAR Weekly Structure: A Surprising Trend Shift

Analyst WSB Trader Rocko—who surely carries a delightful nickname—has confirmed that a breakout has occurred, sparking revelry among trend enthusiasts everywhere. Recently, the weekly candle toasted to a trendline closure above the waterline, signaling a structural reversal after an age of sideways meandering. During this breakout, the token peaked at a modest $0.239, and early July activity revealed that buyers were suddenly more interested than a kid in a candy shop.

Looking further into the crystal ball, the long-term chart whispers sweet nothings about $0.576 as a potential new all-time high. Rocko highlights ecosystem developments like DeFi expansion, USDC integration, and the tokenization of real-world assets on Hedera as sweet “hooks” drawing in the investor crowd—turning once-tired resistance zones into cozy little support havens.

Crypto Patel’s Vision: Rally Towards the $0.42 Horizon

Then enters Crypto Patel, who’s jumped on the proverbial bullish bandwagon armed with confirmation of a breakout from a descending trendline, coupled with several glowing technical indicators. Patel’s keen eye spotted a MACD crossover and a sturdy support base hanging out above the $0.10 mark. With rising interest swirling around like confetti at a parade, this seems to be an undeniable shift in both trend structure and sentiment. Patel has proclaimed the breakout to be “real,” which we can only assume means the markets are getting their groove back!

The chart shared by Patel illustrates some short-term resistance hot spots along the route towards a broad range between $0.30 and $0.42. Patel suggests that waiting for a retest of the broken trendline before making new positions might be prudent—an approach that echoes traditional technical setups. If that retest holds up, there’s a delightful chance we’ll see the rally unfold as anticipated!

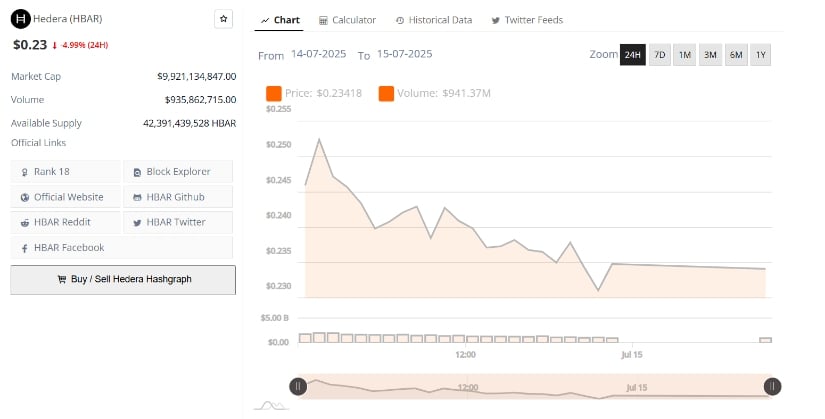

Short-Term Price Shenanigans: A Correction & Support Retest

In an unexpected plot twist, HBAR Price took a cheeky dip of 4.99% in the last 24 hours, falling from a session high that made traders grin from ear to ear above $0.25, stabilizing near $0.234. This descent followed a sharp rally earlier in the week, and it’s just a small correction—a necessary nap after running marathons. While we didn’t quite manage to keep the $0.240 support, all is not lost, as the price is managing to linger above $0.230. Take a breath, everyone!

Even with this dip, trading volume remains impressive, exceeding $935 million—like a party that just won’t end. This level of interest, alongside the recent consolidation, might just set the stage for another push upwards if buyers keep coming back like loyal fans at a concert. Analysts have their eyes trained on the $0.23 zone as a short-term support level, ready to pounce back into action should the price cooperate!

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2025-07-15 20:26