As a seasoned crypto investor with a decade-long journey through this wild and unpredictable market, I must admit that witnessing Ethereum’s resurgence is truly exhilarating. After months of bearish consolidations, the second-largest cryptocurrency has shown signs of life, much like a long-hibernating bear awakening from its slumber.

Over the past week, Ethereum, the foremost alternative cryptocurrency, has displayed encouraging trends, following several months of tightening bear market patterns.

Right now, Ethereum (ETH) is experiencing a 4% increase over the past day and is being exchanged at approximately $3,840. In recent events, this leading alternative coin reached its highest point in six months ($3,900) due to Bitcoin‘s (BTC) surge beyond the $100,000 mark earlier today.

At this point, Ethereum is 21% away from its all-time high of $4,891 in November 2021.

On a notable rise, the second-biggest digital currency surpassed a market value of $463 billion, with its daily trading volume swelling by an impressive 46%, reaching approximately $63 billion.

What’s driving the ETH rally?

There are many factors driving Ethereum upwards, creating strong buying pressure.

Notably, U.S.-based Ethereum exchange-traded funds have consistently received investments for eight days straight, according to Farside Investors’ data. This inflow totals approximately $882.3 million, with the majority being invested in BlackRock’s ETHA fund.

Despite a significant outflow of $3.4 billion from the Grayscale ETHE fund, the overall accumulation into these investment items still reached a total of $901.3 million.

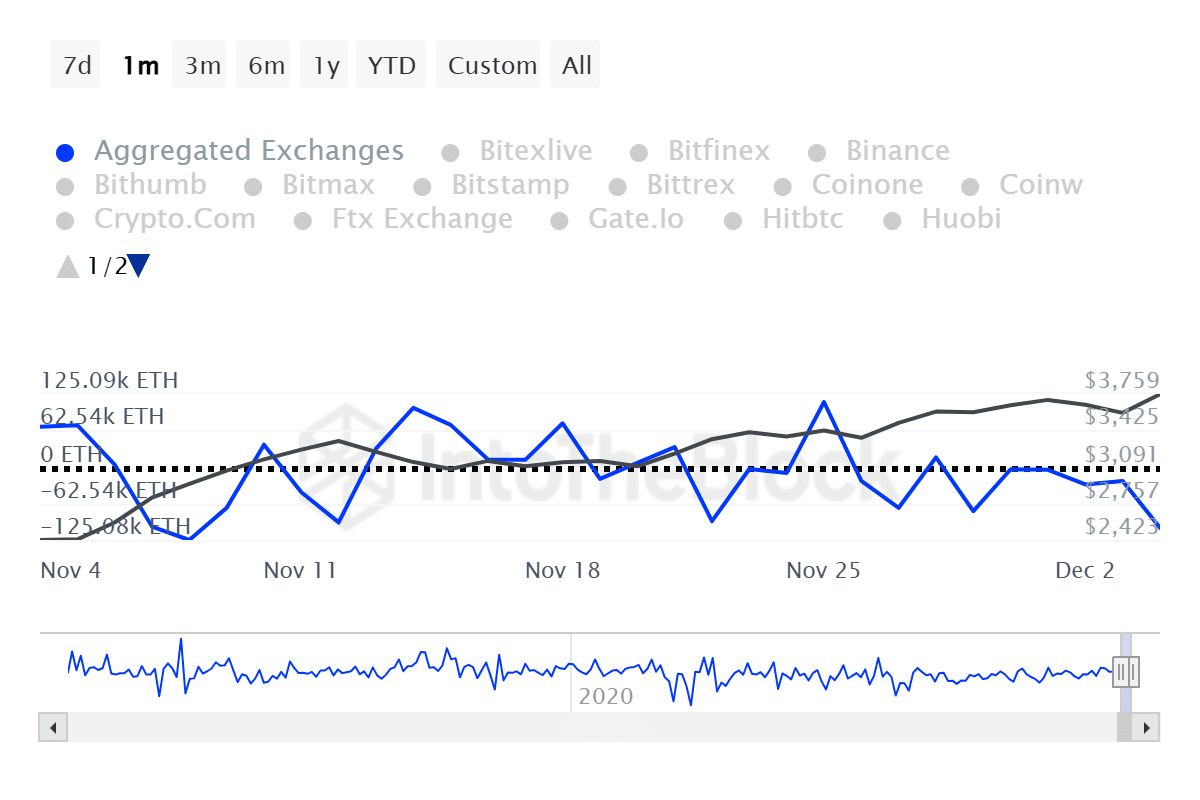

To add to that, Ethereum saw a net outflow of approximately $820 million over the past week, reaching a one-month peak of $385 million on December 4th, as per data from the analytics provider IntoTheBlock.

Based on recent transactions recorded on the blockchain, it appears that investors are steadily building up their positions in this asset. Given that about three-quarters of Ethereum owners have held onto their coins for more than a year according to ITB’s data, there might be less urgency among these long-term holders to sell, potentially resulting in reduced selling pressure for the leading altcoin.

As a researcher delving into blockchain data, I’ve discovered an intriguing fact: Whale transactions involving at least 100,000 dollars’ worth of Ethereum (ETH) collectively accounted for approximately 73 billion dollars over the past week, according to data sourced from ITB.

Increased whale behavior often stirs up feelings of wanting to be part of the action among individual investors, leading to a surge in purchasing demand as the desire for potential profits escalates under competitive market circumstances.

Additionally, it’s worth noting that the decentralized finance sector on Ethereum has been expanding rapidly. As reported by crypto.news on Wednesday, the total value locked in Ethereum’s DeFi reached an impressive $72.9 billion, marking a 31-month high of $134.7 billion for the total TVL (Total Value Locked).

Even though Ethereum’s price has climbed up to its June peaks, its Relative Strength Index remains in the neutral range, standing at 63. This indicates that Ethereum may be going through a period of steady accumulation, much like the gathering phase for the leading digital currency often compared to digital gold.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Gold Rate Forecast

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

2024-12-05 10:33