As a researcher with years of experience tracking financial markets, I’ve witnessed many instances where events in traditional finance can significantly impact the crypto market. The recent Fed rate cut is one such example that has sent shockwaves through both worlds.

Following a 0.25% reduction in interest rates by the Federal Reserve, the cryptocurrency market experienced a significant sell-off worth over $239 million within minutes. For a brief moment, Bitcoin dropped below $100,000, and other leading digital tokens followed suit.

On December 19th, the Federal Reserve decreased its main interest rate by 0.25% and indicated potential reductions in the coming years. The Fed suggested that it might reduce rates just two more times during the upcoming year.

According to Fed Chair Jerome Powell, with the U.S. government adopting a more lenient approach, the agency now has the flexibility to proceed with “a more measured pace” when contemplating additional modifications to its interest rate policy.

He stated that both the economy and its current policies are thriving exceptionally well.

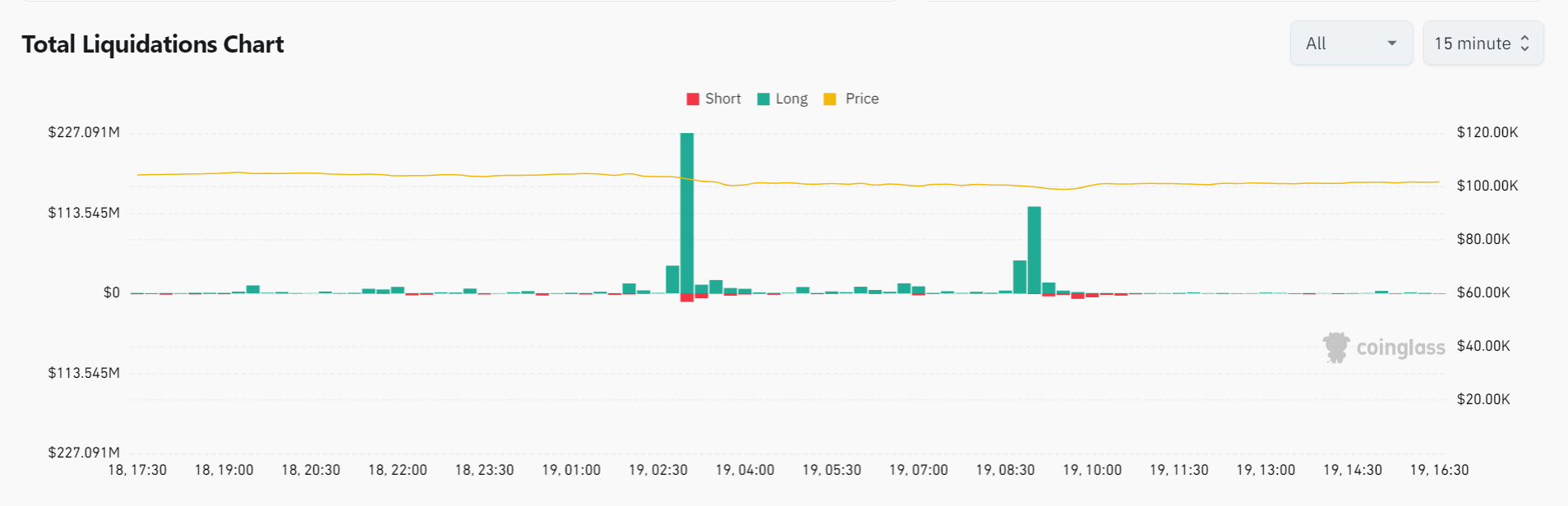

After the Federal Reserve’s interest rate reduction, the overall long liquidation in the cryptocurrency market skyrocketed to an astounding $239.2 million within half an hour of the announcement, according to data from Coinglass. This surge came from a mere $39.73 million just prior to the news. In the past day, a total of $853 million in cryptocurrency assets have been liquidated, with Ethereum (ETH) accounting for the largest portion at $134.9 million.

Based on information from crypto.news, Bitcoin (BTC) dipped below the $100,000 mark due to a 5% decrease, but it quickly rebounded. At the moment, Bitcoin is being exchanged at approximately $101,705, representing a 2.35% decline over the past 24 hours of trading.

Apart from Bitcoin, other significant digital currencies such as Ethereum, Solana (SOL), and XRP (XRP) mirrored its downward trend. Furthermore, popular altcoins like Dogecoin (DOGE) and PEPE (PEPE) also experienced difficulties following the Fed’s recent cut.

After the Fed’s interest rate decrease, Ethereum dropped by approximately 0.68%, resulting in a current value of around $3,674. Over the past 24 hours, Ethereum has experienced a decline of about 4.5%. On the other hand, XRP also saw its price decrease by nearly 3%, with a current trading price of approximately $2.36. In the previous 24-hour period, XRP has fallen almost 7%.

Just like many other assets, Solana was also influenced by the Fed’s cut decision. Over the past 24 hours, its popular meme coin variant experienced a drop of 1.15%, and this decline intensified further to reach 3.58%. Currently, the token is being exchanged at $208.98.

The market for alternative cryptocurrencies (altcoins) also took a hit, resulting in a decrease of almost 8% in the total market value of meme coins to approximately $105.2 billion, as reported by CoinMarketCap. The top-ranked meme coin, Dogecoin, saw a drop exceeding 7% immediately following the Fed’s decision and has yet to rebound since then. Currently, one Dogecoin is being traded at around $0.36.

Currently, PEPE experienced a drop of almost 4% right following the Fed’s decision, and it has fallen over 11% within the last 24 hours, as per data reported by crypto.news.

The Fed’s cautious approach toward future rate cuts suggests a continued focus on controlling inflation, which could lead to a strengthening of the dollar. This could indicate a potential decrease in the public’s investment in alternative assets like cryptocurrencies.

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2024-12-19 14:02