As a seasoned researcher with a decade of market analysis under my belt, I’ve seen my fair share of market turbulence. This latest crypto crash in South Korea, triggered by the political crisis, is yet another reminder of how interconnected global events can be.

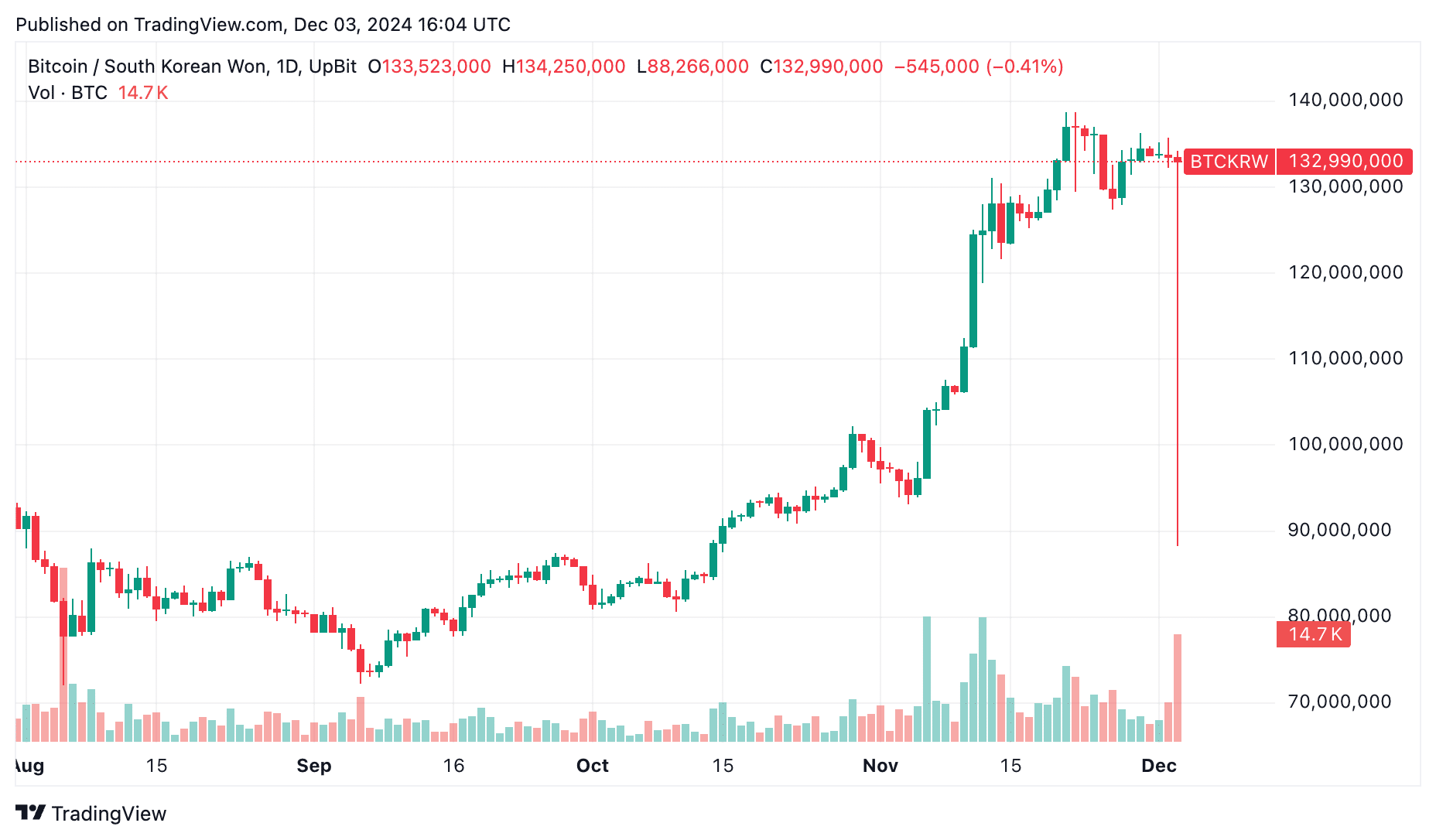

Crypto prices crashed hard in South Korea as the local currency plunged to a record low.

On October 5th’s price level, the value of Bitcoin (BTC) dipped to approximately 88,197,000 Korean Won, then bounced back to around 132,000,000 Korean Won. This cryptocurrency had fallen nearly 40% from its peak this year.

In a similar pattern, other cryptocurrencies also experienced a price drop. For instance, Ethereum (ETH) hit a record low of 4,210,630 KRW since November 9th. Similarly, Ripple (XRP), Stellar Lumens, and Solana (SOL) all saw declines of more than ten percent.

A crash ensued after a significant political turmoil in South Korea, causing the South Korean currency, the won, to reach an all-time low. Unfortunately, the won is now among the poorest performing Asian currencies, plummeting more than 13% during the current year.

As a researcher, I find myself delving into events that were set in motion by President Yoon Suk Yeol’s decree to implement emergency martial law. He justified this action by pointing towards the opposition party, alleging connections to North Korea. In his own words, President Yoon stated:

I’m imposing military rule to safeguard the democratic Republic of Korea from the menace of North Korean communist armies. This action aims to suppress and eliminate the abhorrent pro-North Korean elements that are undermining our freedom and joy, and to uphold the democratic constitution.

Consequently, the value of Bitcoin and other alternative coins dropped significantly due to a mass sell-off by investors who were spooked by the intensifying political crisis, as such events typically trigger fear among investors.

For example, just like during the start of the war in Ukraine and the COVID-19 pandemic, there were similar market drops, but afterwards, as investors adapted to the changing situations, there was a rebound. This pattern may be what led to the recovery we’ve seen in Bitcoin and other cryptocurrencies after their initial decline.

Moreover, cryptocurrencies have robust foundations, and it’s anticipated that regulatory advancements will enhance in the U.S.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-12-03 19:20