As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-evolving digital asset market, I find myself closely monitoring the latest developments surrounding Jupiter DEX. The recent surge in transaction failures has raised red flags for many users, including myself.

Title DEX on Jupiter is under growing examination due to a reported 50% transaction failure, sparking worries and curiosity about the system’s efficiency. Users seek clarification and want to know how the issue is being addressed. This article delves into the causes behind the high failure rate and discusses the steps taken to enhance the platform’s performance and user experience.

Table of Contents

High failure rate: causes and concerns

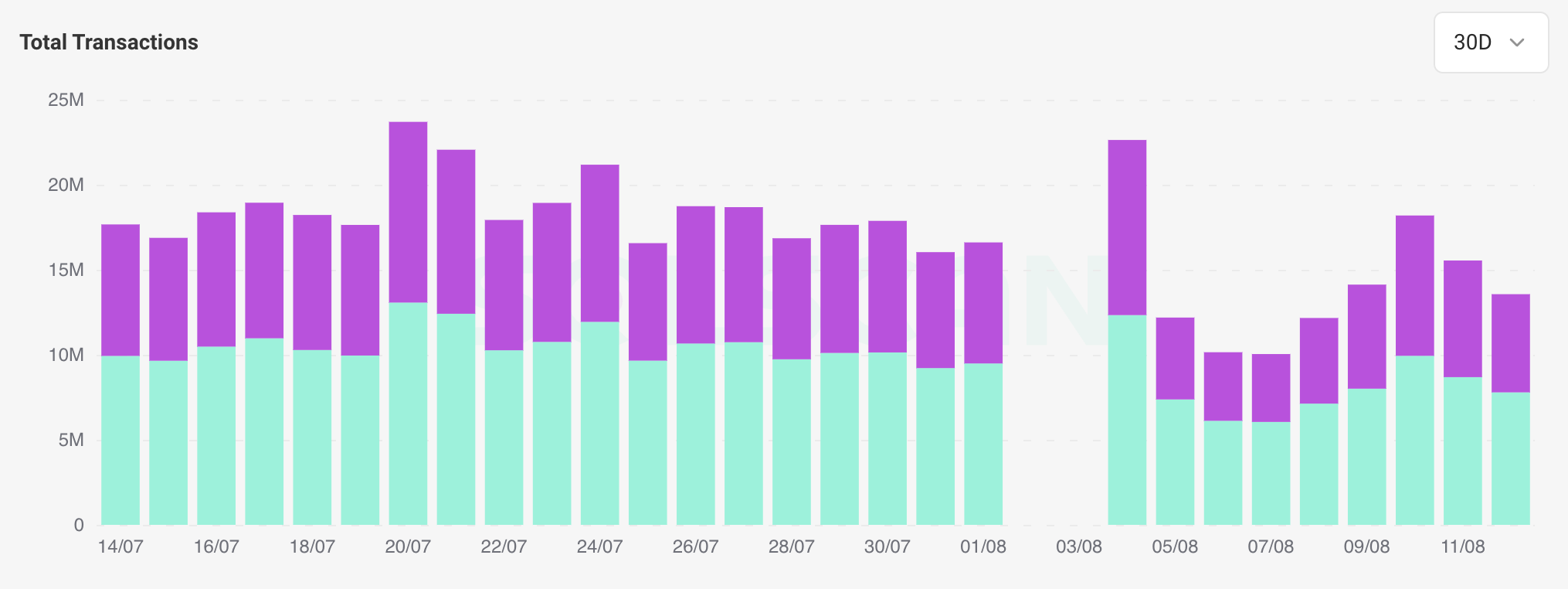

Over the past month, except for the data gaps on August 2nd and 3rd, I’ve observed a consistent failure rate of approximately 42.89% on Jupiter. This persistent issue has sparked curiosity among users, who are eagerly inquiring about the root causes and wanting to understand what steps we’re taking to enhance our platform’s performance.

One common complaint among users is that they’re still billed for transactions that don’t go through. Although this might appear unjust initially, it’s a fundamental characteristic of blockchain technology. Every transaction, whether successful or not, consumes network resources such as computational power and storage space within the block. Even when a transaction doesn’t complete, validators will still process it until an error occurs. Because the network is being used to handle the request, the fee serves to reimburse these computing resources.

Increased slippage tolerance is a risky solution

Users frequently raise their tolerance for slippage in order to prevent multiple fees and facilitate successful transactions. This adjustment allows the network to execute the trade, even if the price fluctuates slightly from the initial estimate.

While raising slippage may seem like a solution, it introduces another potential issue: bots exploiting this through front-running. These automated systems can identify transactions with high slippage and execute trades prior to yours, buying assets at a lower price (due to your increased slippage) and selling them back at the higher price you’ve set. This unfair practice leads to less favorable exchange rates for users, effectively increasing their costs beyond just the transaction fees.

How front-running works on smart contract blockchain networks

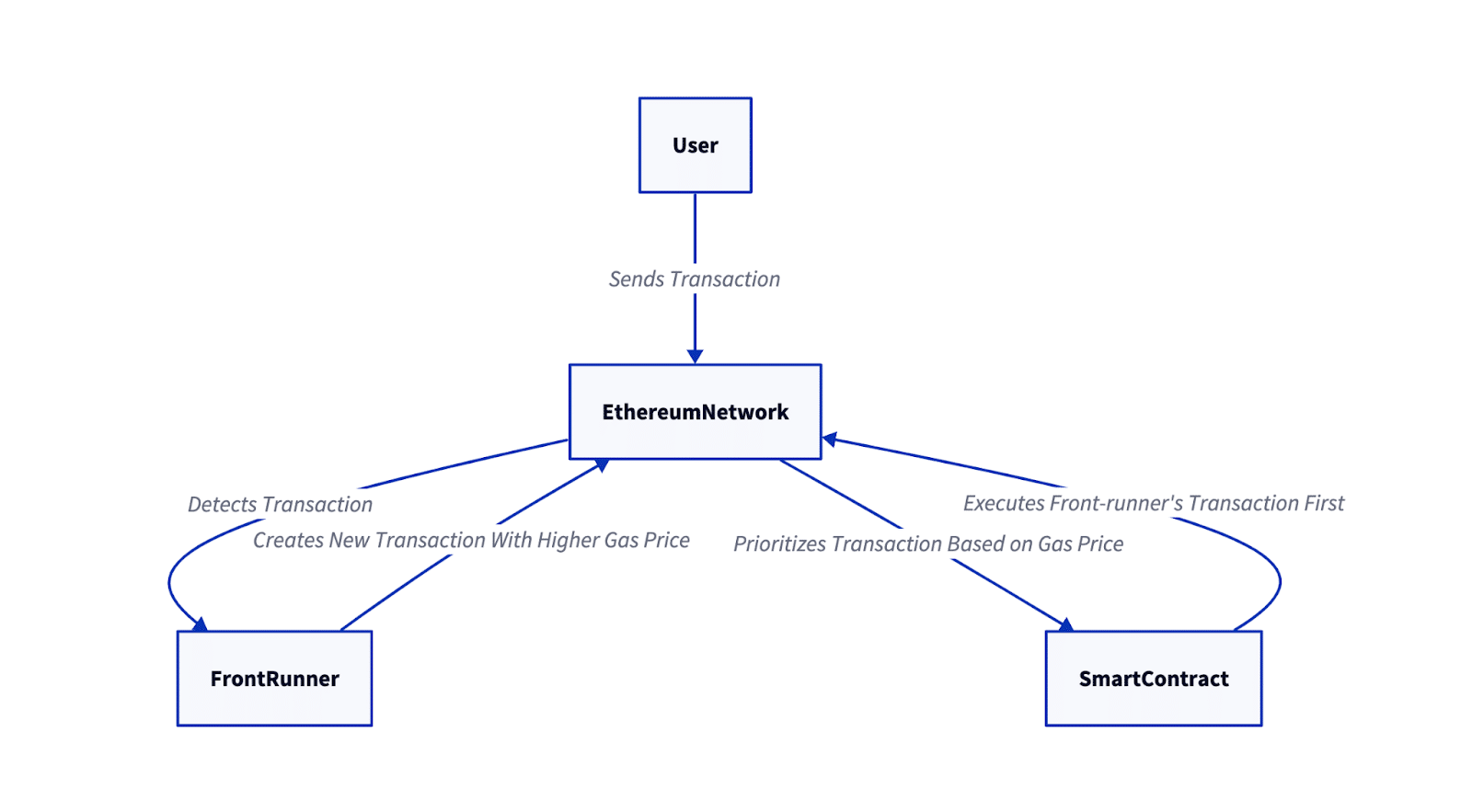

The diagram from Hacken shows how front-running works on Ethereum, but the concept also applies to Solana and other smart contract blockchains.

- Step 1: The user initiates a transaction on the network, intending to interact with a smart contract.

- Step 2: A front-runner (usually a bot) monitors the network and detects the user’s transaction.

- Step 3: The front-runner creates a new transaction with a higher gas price. The higher gas price incentivizes validators to prioritize processing the front-runner’s transaction over the user’s original transaction.

- Step 4: The blockchain network prioritizes transactions based on the gas price. Since the front-runner’s transaction offers a higher gas price than the user’s, it gets processed first.

- Step 5: The user’s transaction gets less favorable terms or even fails, which leads to financial losses or missed opportunities.

In Jupiter’s own words:

The vast majority of unsuccessful transactions originate from automated trading bots known as arbitrage bots. These bots operate by executing trades when an arbitrage opportunity is detected, aiming to complete a trade once the opportunity arises. This high frequency of activity can result in a higher failure rate. However, it’s important to note that for our users on the Jupiter UI, the success rate of transactions exceeds 90%!

Regardless, the practice of front-running is strongly tied to the reliability of the Remote Procedure Call (RPC) intermediaries used for network interaction. These RPC providers function as a bridge between users and the blockchain, sending transaction data to the network. If an RPC provider lacks credibility, it might unwittingly or intentionally facilitate or even engage in front-running by disclosing transaction details to bots or manipulating the sequence of submitted transactions. Trustworthy RPC providers, however, are expected to maintain ethical principles and prevent user exploitation or any such malicious activities from occurring.

One possible reason for a high number of unsuccessful transactions is the continuous boom of meme coins, which results in thousands of new tokens being generated daily. Unfortunately, many of these newly minted meme coins have insufficient market liquidity, meaning there are not enough tokens available to facilitate trades. As users try to buy or sell these illiquid tokens, transactions may fail because the trade cannot be completed due to a lack of counterparties.

Throughput limitations and delays in order processing

In a scenario where meme coins’ rise leads to more failures, it’s important to note that Jupiter’s automated slippage and gas estimation tools are also factors. These tools function effectively in stable market situations but can encounter difficulties during times of extreme volatility. Furthermore, there have been issues with the platform’s free tier quote API, which has been manipulated by users evading rate limits by creating multiple machines. This manipulation has led to higher operational expenses and potential deterioration of service quality for legitimate users.

Additionally, Jupiter’s capacity is presently inadequate, especially since it is struggling under a massive influx of requests. This overload results in its reattempt mechanism taking longer than 25 seconds.

Conclusion

The Decentralized Exchange (DEX) on Jupiter is encountering some significant hurdles such as frequent transaction failures, potential front-running threats, and infrastructure constraints. These aren’t trivial concerns; they have a direct impact on user confidence and the platform’s capacity to function effectively. The team is putting in a lot of effort to address these problems, but an important question arises: Can Jupiter not only tackle these current difficulties but also adapt to the expanding needs of the DeFi sector?

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-13 18:10