As a seasoned analyst with over two decades of experience in global markets, I’ve witnessed numerous geopolitical tensions that have traditionally sent investors scrambling for safe havens such as gold or the U.S. dollar. However, the recent resilience shown by Bitcoin during escalating tensions between Ukraine and Russia has caught my attention. This could signal a significant shift in how investors perceive the digital gold.

In the face of mounting tension between Ukraine and Russia, Bitcoin demonstrated its robustness by altering how investors view it as a form of digital gold.

On November 19, marking the 1,000th day of the continuing dispute, Ukraine launched attacks against Russian territory using American-supplied ATACMS missiles, targeting a military installation, following approval from the Biden administration.

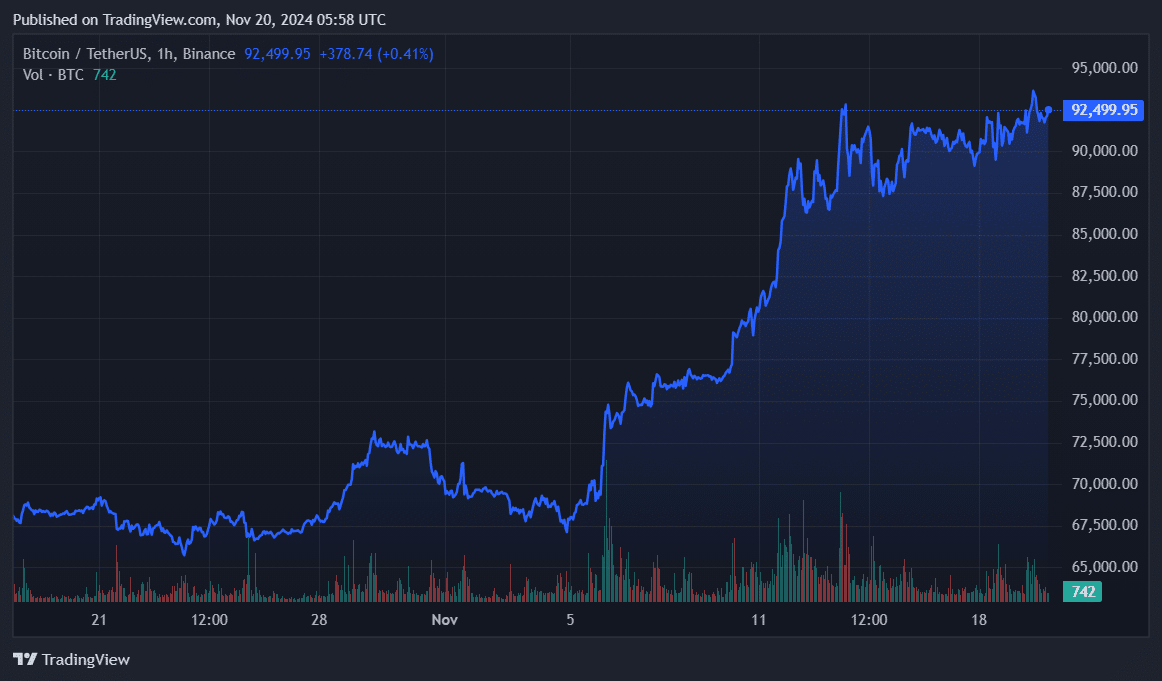

Contrary to the expected downturn during the recent economic uncertainties, Bitcoin (BTC) defied expectations and reached a new peak at $94,000, boasting a market capitalization of an impressive $1.86 trillion.

According to Cory Klippsten, CEO of Swan Bitcoin, such actions might signal an evolution in the story of Bitcoin as a reliable storehouse for value.

Historically, periods of geopolitical unrest have prompted investors to seek refuge in secure investments such as gold or the U.S. dollar. However, Bitcoin’s recent record-breaking highs suggest it is beginning to take on a new function as a protective measure against both inflation due to money printing and geopolitical turmoil.

Klippsten said.

The major shift

In February 2022, the Ukraine crisis led to an 8% drop in the value of Bitcoin down to approximately $34,000, and the overall cryptocurrency market experienced a loss of around $150 billion.

In a remarkably similar fashion, the top cryptocurrency dropped by 4%, reaching $61,000, mere hours following the intensification of the Israel-Iran conflict in October of this year.

As a crypto investor, I find solace in the fact that while traditional markets can be rocked by geopolitical turbulence, Bitcoin emerges as a beacon of stability. It serves as a secure haven for those who seek an investment that’s not tied to these external factors. In times of uncertainty, it’s like having a reliable lifeboat in the stormy sea of global politics.

Even though Bitcoin dipped slightly from its all-time high, it has managed to increase by 1% over the past 24 hours and is currently valued at approximately $92,500. According to information from CoinGecko, the total market capitalization of cryptocurrencies has dropped by 1.7%, settling around $3.203 trillion.

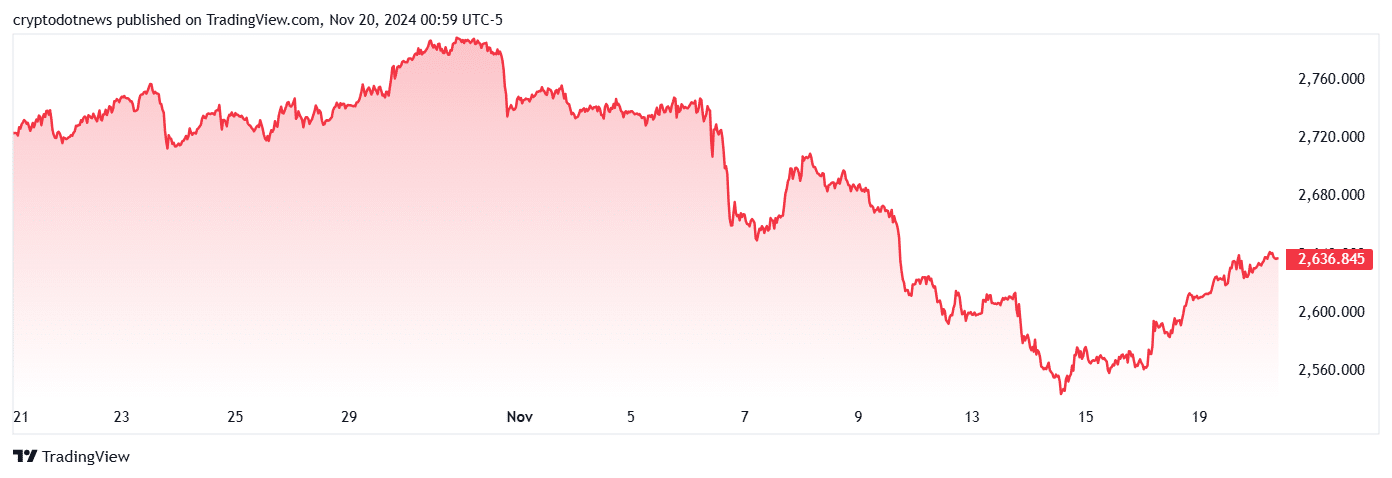

Gold experienced a slight increase of 0.1%, currently valued at approximately $2,636 per ounce. However, it’s still decreased by about 3.3% over the past month. On the flip side, crude oil WTI futures dipped 0.09% to reach a price of $69.17 per barrel for the same period.

The Swan Bitcoin CEO believes that Bitcoin’s recent ATH could potentially solidify it as the go-to asset for uncertain times. “We could be witnessing Bitcoin’s transition from a speculative asset to a macroeconomic refuge,” Klippsten concluded.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-11-20 10:39