Bitcoin is currently the most widely used cryptocurrency globally. In this piece, we’ll walk you through a simple process for buying this digital currency.

If you’re new to digital assets and curious about Bitcoin (BTC), this guide will help you get started by explaining how to open a Bitcoin account. Whether you’re drawn to the idea of decentralization, financial independence, or the workings of digital currency, we aim to clarify the process and provide you with the tools to begin your exploration into the world of Bitcoin.

In theory, setting up a Bitcoin wallet is simple, similar to downloading an app on your smartphone or computer. But don’t be misled; storing Bitcoins carelessly isn’t advisable. This guide will provide you with essential information if you’re considering opening a Bitcoin account.

Table of Contents

What is a Bitcoin wallet?

Bitcoins can be kept in digital wallets, which support various cryptocurrencies such as Ethereum (ETH) and Ripple (XRP). These wallets have the functionality to manage your virtual coins using private keys for access and transactions. They exist in different forms, including hardware gadgets, software programs, and even printed paper versions. With a Bitcoin wallet, you can easily send and receive payments and maintain your funds safely through offline cold storage.

Using your own private keys to access most Bitcoin wallets gives you the power to manage your bitcoins’ security. However, this level of control comes with its own set of responsibilities and consequences. Depending on how carefully you handle your private keys, the benefits or drawbacks can vary.

How does a Bitcoin wallet work?

A Bitcoin wallet serves the same purpose as a traditional wallet for holding cash and plastic cards, but it exists solely in the digital realm. It operates more like an email address in its function of facilitating transactions.

To carry out transactions on our platform, users are required to sign in with their personal cryptographic keys, retrieve their digital currency, and transfer the desired amounts to the designated recipients.

There are two main types of bitcoin wallets:

- Hot wallet: These store Bitcoin private keys on internet-connected devices. While they are convenient and easy to use, they can pose a significant security risk to bitcoin holders who lose their primary device. As a result they may be best used to store small amounts of crypto.

- Cold wallet: These store bitcoin private keys offline. They are highly secure and with a far smaller risk of compromise by hackers.

How to open a Bitcoin account: step-by-step

After getting a good understanding of Bitcoin’s fundamentals, let’s move on to creating a straightforward BTC account using these steps.

- Research. Take some time to thoroughly research the different kinds of exchange websites that support Bitcoin and what they offer, such as Coinbase, Kraken, or Bitstamp. This will help you determine which is the most suitable for your needs.

- Registration. Go to the cryptocurrency exchange website that you have chosen. Enter your email address and a strong password. You’ll receive a verification code in your email.

- Verification. Exchange platforms typically have Know Your Customer (KYC) and Anti-Money Laundering (AML) that require users to verify their address by submitting documents such as ID. This process can vary from minutes to days depending on the exchange’s requirements and the number of verifications they need to complete.

- Deposition. Once you verify your account, you can start depositing funds immediately. There are many ways to transfer funds, including bank transfers and credit cards. However, users should ensure they look into the processing time and fees associated with each method of deposition, as they may vary from one exchange to another.

- Buying and selling crypto. Once you’ve deposited your funds, you can buy and sell bitcoin.

Types of wallets

Just as there are various types of physical wallets, there is a wide selection of Bitcoin wallets, each offering unique benefits and drawbacks.

Mobile wallet

A mobile cryptocurrency wallet is ideal for conducting transactions in person or making purchases at traditional stores. The majority of these wallets employ near-field communication technology (NFC). This feature enables users to complete a transaction by simply tapping their phone against a compatible terminal.

Pros

- Highly portable and convenient.

- Easy to set up.

- Added security with two-factor authentication.

Cons

- May be more prone to hacking compared to cold wallets.

- May offer users reduced control over nodes and transactions.

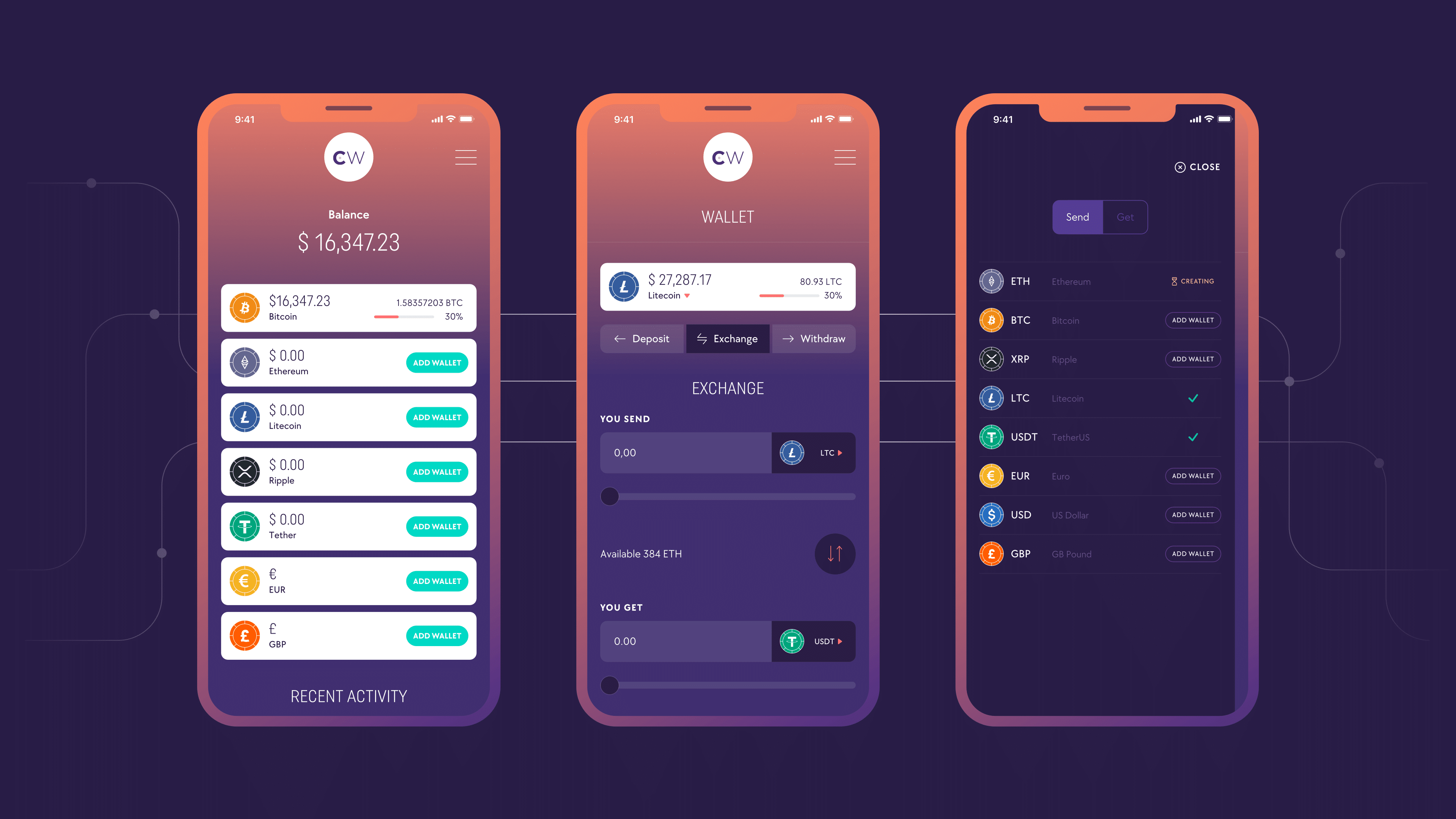

One example of a mobile wallet that includes an exchange feature is EU-approved CryptoWallet. With this app, users can set up several wallets for cryptocurrencies like bitcoin and ether. Similar to other mobile wallets, CryptoWallet enables users to make online payments and spend crypto as if it were real money. Additionally, CryptoWallet offers an affiliate program: when someone you refer registers using your unique code in the app, you’ll earn a percentage of any transaction fees they are charged.

Trust Wallet is a widely-used mobile cryptocurrency wallet that works seamlessly with exchange platform Coinbase. Similar to CryptoWallet, it enables users to manage various digital currencies and NFT tokens in a single location. Notably, Trust Wallet is linked with BinancePay, enabling transactions using cryptocurrencies as payment methods at retail outlets, such as making purchases in physical stores.

Mobile wallets are working to stay current with security standards and laws. For example, in March 2023, CryptoWallet obtained a renewed trading license in Estonia as EU cryptocurrency regulations became stricter. Nonetheless, it’s essential to keep in mind the disadvantages previously discussed and perhaps avoid keeping large quantities of crypto in hot wallets.

Software wallet

Mobile or desktop apps called software wallets enable users to conduct transactions online. These wallets function independently as they don’t require intermediaries like wallet providers to access your cryptocurrencies. Instead, you maintain full control over your digital assets.

Pros

- No cost to download, no registration fee.

- Easy to use.

Cons

- Dependence on electronic devices.

- Potential for user error.

MetaMask is widely used among individuals for managing their Ethereum and related tokens, including ERC-20 and ERC-721, through a browser extension or mobile application.

MetaMask’s advantage includes smooth integration with numerous dapps. This feature allows users to effortlessly access a range of decentralized services, such as decentralized exchanges (DEXs), lending platforms, and gaming applications.

With just a few simple steps, users have the ability to include personalized tokens in their digital wallets, providing them with the flexibility to oversee various types of assets. Nevertheless, MetaMask is restricted to ethereum tokens at present, rendering it an inferior choice for individuals requiring a versatile multi-chain wallet.

Another point to consider is that software wallets like MetaMask have their drawbacks. While they offer convenience and ease of use, they may not meet the decentralization standards preferred by some cryptocurrency advocates. Transactions made through MetaMask are traceable on the blockchain, meaning users’ wallet addresses and transaction histories can be exposed to public view.

Additionally, while MetaMask ensures a certain degree of security, it falls short when compared to hardware wallets in terms of providing maximum protection for your cryptocurrency assets.

Hardware wallet

Hardware wallets are a type of wallet that don’t connect to the internet, allowing for offline transactions. Various hardware wallet models exist, including the Ledger Nano S and Trezor Model T, which are widely used. These devices offer broad cryptocurrency compatibility and come equipped with screens for transaction confirmation prior to signing.

Pros

- Keys are more secure as they are never connected to the internet.

- Easy to back up and restore.

Cons

- Not ideal for frequent bitcoin transactions as they can be difficult to access.

- Some hardware wallet sellers are unreliable/not secure.

Centralized exchange wallet (CEX)

Third-party management is a commonality between CEXs (Centralized Exchanges) and trading accounts. In both cases, external entities handle account maintenance, exchange services, digital wallets, and transaction processing.

Pros

- Easy to set up and use

- Compatible with desktops or mobile devices

Cons

- Stored Bitcoin may be at risk of hacking or operational faiures

- Requires permission for withdrawal

- Longer withdrawal periods

- Higher transaction fees compared to non-custodial options

The Binance peer-to-peer (P2P) platform demonstrates how centralized exchange wallets operate, enabling users to swiftly exchange funds for cryptocurrencies online. Unlike other transactions on Binance, the crypto assets being traded aren’t held by the platform. Following a completed trade, the acquired crypto is moved into the trader’s individual Binance wallet.

Paper wallet

To create a paper wallet for your bitcoins, you’ll first need to download software that generates unique key pairs. Once obtained, print these keys onto paper for safekeeping. This method allows you to manage your bitcoins offline and away from digital connections. However, with advancements in technology, many crypto users now prefer the convenience of digital wallets, which are generally more user-friendly.

Pros

- Low-cost alternative to hardware wallets

- Ideal for face-to-face transactions

Cons

- Easy to lose paper keys

- Requires physical access to the printed keys

- Complex setup process compared to digital wallets

Conclusion

Creating a Bitcoin account is not a complex process, but the choice of wallet can significantly impact the security of your coins. Consider how you plan to access your Bitcoins, what you intend to use them for, and which option suits you best. In essence, here’s a simplified guide:

Hot wallets are ideal for transactions that need immediate confirmation on the blockchain, such as cryptocurrency trading, making payments, and peer-to-peer exchanges. In contrast, cold wallets are designed for securely storing digital assets over extended periods, including saving and long-term investment.

While doing your homework can make dealing with cryptocurrencies seem effortless, be mindful that investing in crypto carries the potential for losses. Consider carefully your portfolio diversity and risk tolerance prior to making any financial moves.

FAQs: how to open a bitcoin account

Can I open a Bitcoin account on my phone?

Affirmatively, opening a Bitcoin account is feasible via your mobile device or even a tablet, particularly in the case of establishing a mobile wallet.

Do I need to pay to open a Bitcoin account?

Opening a Bitcoins account doesn’t come with a fee. But certain wallets may ask for a small initial deposit instead.

What is the best Bitcoin wallet?

There are various types of Bitcoin wallets that cater to diverse requirements. For those who prioritize offline transactions, consider using a hardware or paper wallet. On the other hand, if your preference leans towards online trading, then an online wallet would likely serve you best.

How much is 1 bitcoin in US dollars?

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-04-10 16:24