As a seasoned researcher with over a decade of experience in the cryptocurrency market, I must say that the current Dogecoin (DOGE) situation presents an intriguing opportunity. The coin’s 450% YTD surge is nothing short of remarkable, and it seems to be on the cusp of yet another significant move.

Dogecoin price has moved into a consolidation phase near the year-to-date high of $0.4795.

On December 5th, Dogecoin (DOGE), the meme coin with the highest market capitalization, was being traded at the significant price point of 0.45 USD. Remarkably, it has surged by an impressive 450% from its lowest value this year, resulting in a market cap exceeding 65 billion dollars.

Experts seem hopeful that the current merging phase might signal a period of tranquility preceding a significant surge for the coin, potentially reaching $1 within the coming days. According to World of Charts, such a bullish escalation could be imminent.

A strong possibility for the increase in DOGE’s price is the continuous surge of Bitcoin (BTC) beyond the significant barrier at $100,000. With this move above that threshold, it becomes probable that numerous institutional investors and corporations will begin purchasing the coin. The rise in BTC prices frequently fuels greater interest in affordable meme coins like DOGE.

The potential increase in Dogecoin’s price could be fueled by the persistent enthusiasm within the cryptocurrency market. The Crypto Fear and Greed Index has climbed to an extreme greed level of 85, indicating heightened optimism among investors. Furthermore, the Altcoin Season Index has persistently risen, potentially driving increased interest in Dogecoin.

The rising value of Dogecoin could be boosted by the ongoing purchases made by large investors, known as “whales.” According to recent findings from ClankApp, these significant investors have been stockpiling Dogecoin, with transactions exceeding $3 million observed on December 5th alone.

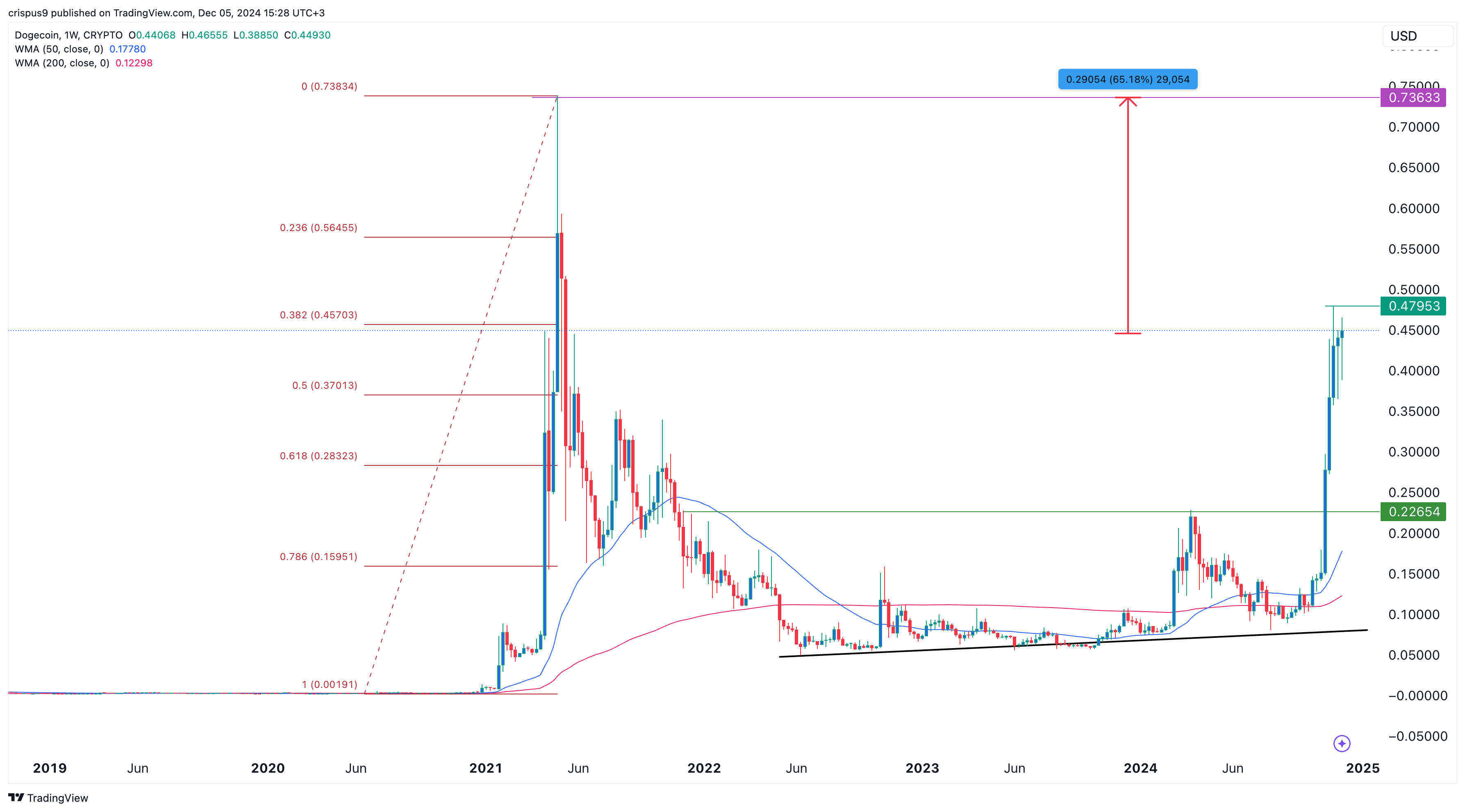

Dogecoin price chart points to more gains

The weekly graph indicates that Dogecoin (DOGE) surpassed a significant resistance point at $0.2265, which was its peak on March 25. It’s now above both its 50-week and 200-week moving averages. Moreover, Dogecoin is getting close to the 38.2% Fibonacci Retracement mark.

As I analyze the market trends, I’ve noticed the coin appears to be shaping into a modest ascending wedge chart pattern. This pattern, while common, could signal potential volatility ahead. Consequently, there’s a heightened risk that the price may dip and revisit the support level at $0.40 before resuming its bullish trajectory.

If the price of the coin surpasses its highest point so far this year ($0.4795), it could potentially reach an all-time high of $0.7363 by December 31st, representing a significant increase of approximately 65% from its current value. This potential surge might encourage investors to anticipate further growth towards the desired $1 mark during this bullish trend.

If the price drops below the crucial support level at $0.35, it would undermine the optimistic outlook and potentially cause a decline towards the peak of $0.2265 achieved in April this year.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-12-05 16:36