As a researcher with a background in economics and experience observing Bitcoin’s market behavior, I believe that while crypto-specific factors such as halvings, adoption, and psychological price points can influence Bitcoin’s price, macroeconomic and global events play a significant role. Inflation rates and central bank interest rates are two critical factors that have demonstrated an outsized impact on BTC‘s performance.

As a crypto investor, I cannot overlook the fact that Bitcoin‘s price can be significantly impacted by elements unique to the cryptocurrency market. However, it is essential to acknowledge that external macroeconomic and global occurrences play a substantial role in shaping its value as well.

Sometimes, Bitcoin’s price can suddenly leap or plunge without warning.

In numerous instances, the price fluctuations of Bitcoin (BTC) are largely influenced by larger economic trends and international occurrences beyond its direct influence, instead of being solely driven by sentiments specific to Bitcoin itself.

In this analysis, we will delve into the significant data points and advancements that can greatly impact the value of a digital asset.

Inflation

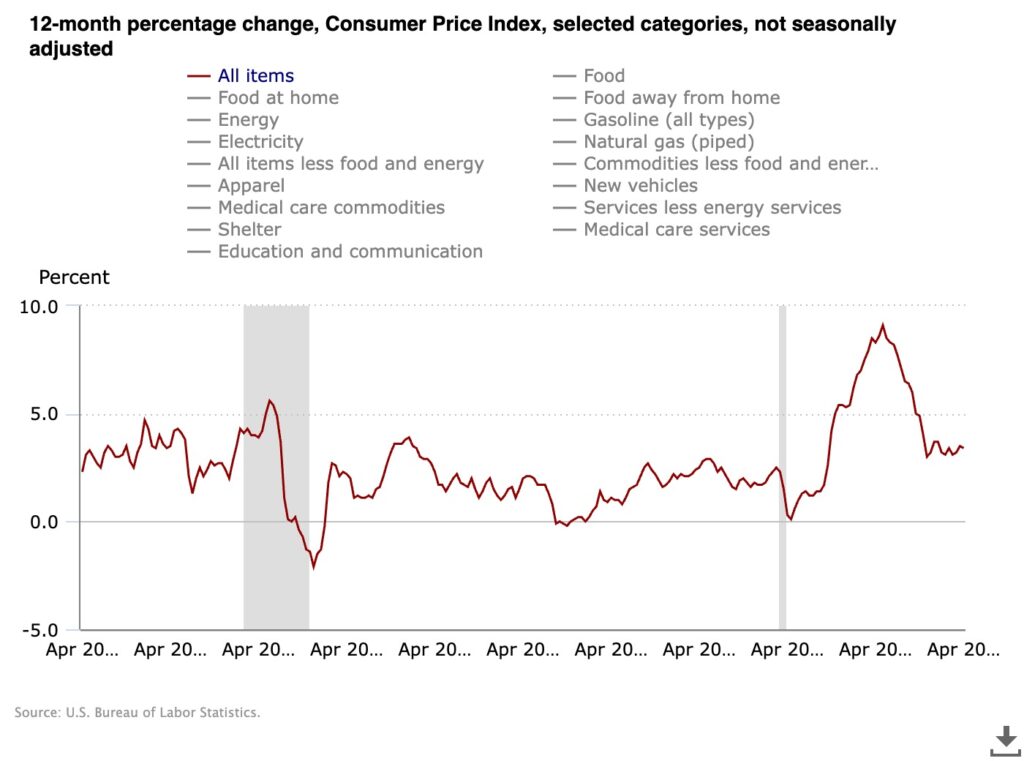

As a researcher studying economic trends, I’ve noticed that the cost of living in countries such as the United States and the United Kingdom has reached levels not seen in over four decades. Inflation has therefore emerged as a critical indicator of economic well-being in these and other major economies.

The Federal Reserve and Bank of England have traditionally aimed for an inflation rate of 2% based on the Consumer Price Index. However, this goal became obsolete with the onset of the coronavirus pandemic.

As a researcher, I’ve come across some alarming inflation figures for both the United States and the United Kingdom. In June 2022, the Consumer Price Index (CPI) in the US surged unexpectedly to a striking 9.1%. Meanwhile, across the Atlantic, the CPI in the UK reached double-digit heights of 11.1% as late as October that same year. Central bankers from both countries have publicly acknowledged the challenge they face in reining in this stubborn inflation trend.

As a Bitcoin investor, I frequently hear fellow community members describe inflation in fiat currencies like the US Dollar or British Pound as an “invisible thief.” This metaphor highlights how over time, these currencies lose value due to increasing supply through central bank printing or government borrowing. In contrast, Bitcoin is unique because it has a finite supply of only 21 million coins that can ever be mined. By holding and transacting with this digital currency, we’re protecting our wealth from the erosive effects of inflation.

Considering this, it’s possible that disappointing Consumer Price Index (CPI) reports could be perceived as beneficial for Bitcoin’s value, potentially boosting interest in this virtual currency.

But a lot of the time, the opposite has proven to be true.

In May 2024, the Consumer Price Index (CPI) surprised analysts by registering a lower-than-anticipated figure of 3.4%.

Within a span of four hours following the data’s unveiling, Bitcoin experienced a significant jump from $62,650 to $65,000 – representing a noteworthy increase of approximately 3.8%. Concurrently, Wall Street achieved new peak levels.

And that brings us neatly on to the reason for this little rally.

Interest rates

At the inception of Bitcoin in January 2009, a groundbreaking digital currency birthed as a response to the mishandling of the 2007-08 global financial crisis, the Federal Reserve’s interest rate hovered at a record-low of 0.25%, an unprecedented level in the preceding four decades.

I had invested in those assets for approximately six years, watching them stagnate during that period. However, as optimism about the economic recovery from the last recession began to surface, their value started to tick upwards gradually. But then, the unexpected onset of the coronavirus pandemic brought about another significant downturn, and their value was once again slashed down to a mere 0.25%.

Critics argue that this marked the beginning of a period of easy access to funds, primarily due to reduced borrowing costs. Consumers were encouraged to spend more, given the meager interest returns on savings accounts. However, inflation took off at an unprecedented pace, forcing central banks to act swiftly and raise interest rates sharply to their present level of 5.5%, a figure last seen in 2001.

Regrettably, high borrowing rates have a negative impact on Bitcoin. This is due to the fact that demand for riskier investments like Bitcoin decreases when investors can earn substantial yields from safer options such as savings accounts or bonds.

Anticipation has built up for several months that the Federal Reserve may eventually reduce interest rates, an event some market analysts propose could serve as a trigger for Bitcoin’s price increase. In a report published in March 2024, Deutsche Bank strategists suggested this possibility.

As Treasury yields decrease, it’s expected that more investors will be drawn to investments offering better returns. These alternative assets encompass unconventional classes such as cryptocurrencies. The influx of capital into this sector could potentially fuel a continued surge in digital currency values.

Marion Laboure and Cassidy Ainsworth-Grace

The stock market

Occasionally, Bitcoin’s price movements have shown a strong relationship with major indices like the S&P 500 and the Nasdaq 100.

As a researcher studying the cryptocurrency market, I can propose that the introduction of exchange-traded funds (ETFs) based on Bitcoin’s (BTC) spot price in U.S. markets significantly brings us nearer to the reality where institutional investors can obtain exposure to BTC’s price movements without having to own the cryptocurrency physically.

As an analyst, I’ve observed that geopolitical instability in the Middle East has significantly impacted Bitcoin’s value in the past few months.

In the heart of April, there was a notable decrease in Bitcoin’s value. This decline occurred when it was revealed that Iran had carried out a drone and missile strike against Israel. The cryptocurrency dropped from $70,000 to $62,000 almost instantaneously due to the market reacting to this news. However, Bitcoin soon regained its footing and bounced back.

As a crypto investor, I closely monitor geopolitical events that could impact the market. A few days ago, there was another price drop when Israel responded to tensions in the region. The fear among investors was that this conflict could escalate further and potentially lead to wider instability.

As a Bitcoin analyst, I can’t ignore the fact that while certain events, such as halvings, widespread adoption by nations, or breaking past psychologically significant price points, can positively impact Bitcoin, the value of this cryptocurrency is closely interconnected with the broader dollar-based economy it was intended to challenge.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-16 12:24