As someone who has closely followed the cryptocurrency industry in India for quite some time now, I can’t help but feel a sense of apprehension and excitement as we approach the Union Budget on July 23. Ajay Kashyap, a well-known crypto influencer in the country, voices similar sentiments when he talks about the hope for greater clarity on taxation frameworks and the need for more defined guidelines.

On July 23, Nirmala Sitharaman, India’s Finance Minister, will unveil the union budget for the fiscal year 2024-25. This eagerly anticipated event has traders, investors, businesses, the salaried class, and crypto enthusiasts on edge, as they look forward to noteworthy declarations. As an added significance, this budget marks the first presentation under the third term administration of Prime Minister Narendra Modi.

As a cryptocurrency market analyst, I’ve noticed India’s sector undergo significant fluctuations since the global financial crisis and subsequent implementation of strict tax and regulatory frameworks. Industry heads in India frequently advocate for reduced taxation on crypto assets to maintain a healthy ecosystem.

On Taylor’s third day of the week, Finance Minister Nirmala, carrying a red Gladstone bag, will make her entrance into the chamber to unveil significant financial and taxation plans for the upcoming years. The local crypto community, in anticipation, will intently watch for any notable announcements.

In preparation for India’s upcoming union budget, The Crypto Times had the opportunity to engage in conversations with several influential figures within the cryptocurrency sector. During these discussions, we sought to gain insight into their hopes and anticipations regarding the forthcoming financial announcement.

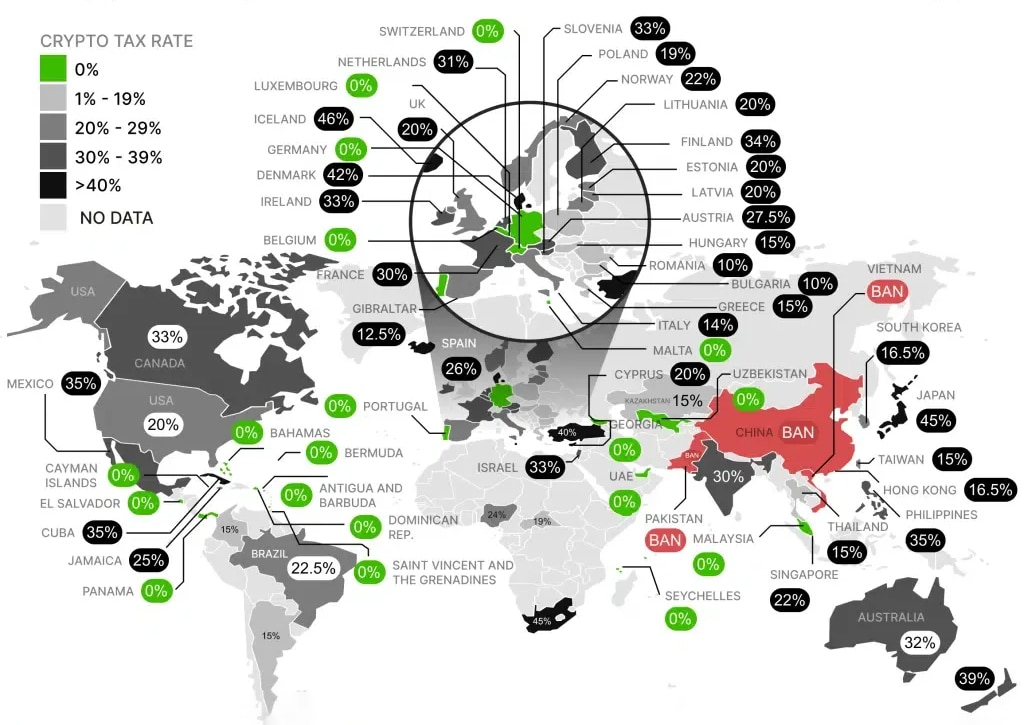

We will provide examples of cryptocurrency taxation and regulation from various countries for a comprehensive comparison with India’s approach.

What do Crypto Industry Leaders Expect from the Budget?

As the Union Budget approaches, the crypto community expresses optimism towards several key demands. These include the possibility of reduced taxes on cryptocurrencies, allowing crypto investors to set off their losses against gains, and granting equal status to crypto capital gains as compared to other financial assets.

In the year 2022, India implemented a 30% flat tax on income derived from cryptocurrencies. However, the sector is shrouded in ambiguity due to ongoing debates about a possible prohibition of private cryptocurrencies, coupled with continuous taxation regulations. At present, trades involving cryptocurrencies are subjected to a 1% Tax Deducted at Source (TDS). This high TDS rate has sparked controversy within the industry, leading to diminished trading volumes and reduced market activity.

Ashish Singhal – CoinSwitch

In simpler terms, the crypto industry desires tax relief to bring parity with other financial assets, thus enhancing the appeal and fairness of investing in cryptocurrencies. Additionally, there’s an advocacy for allowing the deduction of losses from gains accrued within the same fiscal year.

Ashish Singhal, one of the co-founders of the cryptocurrency app CoinSwitch, advocates for a reassessment of the taxation framework on cryptocurrencies in India’s upcoming budget to maximize the potential benefits of Web3 technologies within the country.

He expressed apprehension regarding the present tax rate, commenting, “The uniform 30% levy on income derived from VDA transfers should be reassessed to maintain fairness with other technology-driven industries. Moreover, reconsidering the minimum thresholds of Rs 10,000 and Rs 50,000 is worth considering. A large proportion of crypto sellers fall into the lower income groups. Raising the threshold would lessen the tax department’s workload when dealing with refund claims.”

Shivam Thakral – BuyUcoin

Shivam Thakral, the CEO of BuyUcoin, remarked that the Indian Virtual Digital Asset (VDA) market has witnessed a downturn over the last two years as a result of the 1% Tax Deduction at Source (TDS) and capital gains tax. He believes that the forthcoming budget may lessen these taxes to more acceptable figures, thereby creating a level playing field for businesses to prosper.

Sumit Gupta – CoinDCX

Furthermore, Sumit Gupta, a co-founder of CoinDCX, suggested the reduction of the tax rate from 30% to just 0.01%, along with lowering the TDS rate from 1% to an identical rate of 0.01%. He believes that implementing these changes would provide a significant boost to the cryptocurrency sector.

Additionally, CoinDCX has made applications and proposals to the Indian Government and attended pre-budget discussions as a representative of the Bharat Web3 Association (BWA) at the Finance Ministry. The exchange advocates for a balanced tax structure within the Virtual Digital Asset (VDA) sector.

In a recent announcement from CoinDCX, they have outlined four crucial requests directed towards the upcoming budgets.

CoinDCX’s key asks include:

- To ensure a level playing field for the Indian VDA Industry vis-a-vis the offshore counterparts, we urge the government to expand the scope of the TDS mandate to explicitly include offshore platforms.

- Additionally, we advocate for a reduction in the TDS rate under Section 194S(1) from 1% to 0.01%, emphasizing the necessity of a tax-friendly environment to stimulate industry development.

- In pursuit of equitable taxation, we propose an amendment to Section 115BBH to reduce the tax rate from 30%, at par with assets in other industries.

- Further, we recommend revisiting the threshold limit for tax deduction under Section 194S, suggesting an increase from INR 10,000/INR 50,000 to INR 5,00,000, in coherence with the provisions in Section 194-O of the Act,” said an official statement from CoinDCX.

Ajay Kashyap – Crypto Influencer

In the crypto sector, there’s widespread optimism regarding potential decreases in the Tax Deduction at Source (TDS) rate. Proposed reductions include lowering it to 0.01%. Additionally, adjustments to tax thresholds could enhance competition and breathe life into the dynamic crypto marketplace.

Ajay Kashyap, a well-known figure in the Indian crypto community, shares my concerns and states, “The crypto sector is mainly anticipating clearer directions regarding taxation in this budget, specifically a possible decrease in the TDS rate from the present 1%. The current 30% tax on crypto profits, combined with the 1% TDS, poses significant difficulties for market players. There’s a strong demand for some form of relief in this regard. Additionally, there is an urgent call for more explicit instructions and signs of progress towards a comprehensive regulatory framework.”

What Can India Learn from Global Models?

Analyzing the approaches taken by nations such as the US, European Union, Hong Kong, and Dubai in governing cryptocurrencies offers enlightening perspectives for India as it develops its regulatory structure.

The crypto sector in the United States has vigorously criticized the SEC’s regulatory plan, which primarily relies on taking enforcement actions. Due to the absence of clear-cut and consistent regulations, this approach has led some token creators and cryptocurrency pioneers to establish their operations elsewhere instead of within the US borders.

In contrast, the European Union (EU) has established comprehensive regulations, including the Markets in Crypto-Assets (MiCA) framework. The primary goal of MiCA is to foster innovation within the crypto industry, all the while ensuring regulatory clarity and transparency.

Hong Kong and Dubai have adopted welcoming attitudes towards cryptocurrencies by establishing transparent regulations that foster innovation, all the while maintaining oversight. Their primary goal is to entice crypto-related businesses and transform into leading international centers for digital assets.

Critics argue that the strictness or leniency of global regulatory frameworks significantly influences market engagement and inventiveness. For instance, the US regulatory approach has been heavily criticized for its perceived inconsistencies and harsh enforcement without clear-cut, standardized regulations.

India could draw inspiration from international models to establish a regulatory framework that fosters invention whilst maintaining conformity and safeguarding investors. Highlighting the functional value of blockchain technology beyond mere conjecture may catalyze the development of meaningful applications in diverse industries.

WazirX Hack: Implications on the Indian Crypto Ecosystem

The WazirX crypto exchange’s recent security breach, leading to a potential loss of around $234.9 Million (roughly Rs 2000 crore), has left the Indian cryptocurrency community disheartened and wondering if tighter government regulations are imminent in response.

As a crypto investor using WazirX, the recent hack has left me and 16 million other users in a state of uncertainty. We are currently unable to withdraw our funds or take any legal action for the next 60 days. The founders of WazirX have promised a reward for recovering stolen assets, but incidents like these significantly hinder the advancement of crypto adoption in India and intensify regulatory scrutiny.

Conclusion: Would India go the Crypto way?

The Union Budget to be presented on July 23 by Finance Minister Nirmala Sitharaman holds great importance for India’s crypto industry. Clear-cut regulations and possible tax concessions may significantly impact the sector’s development in the future.

The Indian government under Modi’s leadership should promote cryptocurrency advancements whilst simultaneously fostering expansion and safeguarding investor interests. By implementing a well-balanced regulatory strategy akin to the EU’s MiCA framework, innovation can flourish while investors are shielded from potential risks. Additionally, exploring the functional uses of blockchain technology in areas such as finance, logistics, and public services will accelerate widespread acceptance and yield significant economic gains.

India holds great promise to emerge as a major player in the realm of cryptocurrencies and blockchain technology by tackling these challenges. Leveraging its vast market opportunities and advanced technological resources, India can flourish in the international digital economy.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-07-22 10:29