As a seasoned analyst with extensive experience in the financial sector, I must say that the Reserve Bank of India’s (RBI) upcoming launch of the Unified Lending Interface (ULI) is a much-needed and timely measure. The Indian government’s response to the menace of Chinese loan apps, which have been exploiting the vulnerable segments of our society, is commendable.

The highest banking authority in India, the Reserve Bank of India, has announced plans for a nationwide rollout of the Unified Lending Interface (ULI), a unifying technological platform open to all banks and financial institutions. This platform will enable these entities to swiftly assess creditworthiness and provide loans to Indian customers.

The Indian government, in collaboration with the Reserve Bank of India (RBI), has unveiled a system similar to the widely-used Unified Payments Interface (UPI) called ULI. This move is aimed at combating the issue of harmful Chinese quick loan apps that exploit Indian users through predatory loans. These apps then convert the earnings into cryptocurrencies to avoid detection.

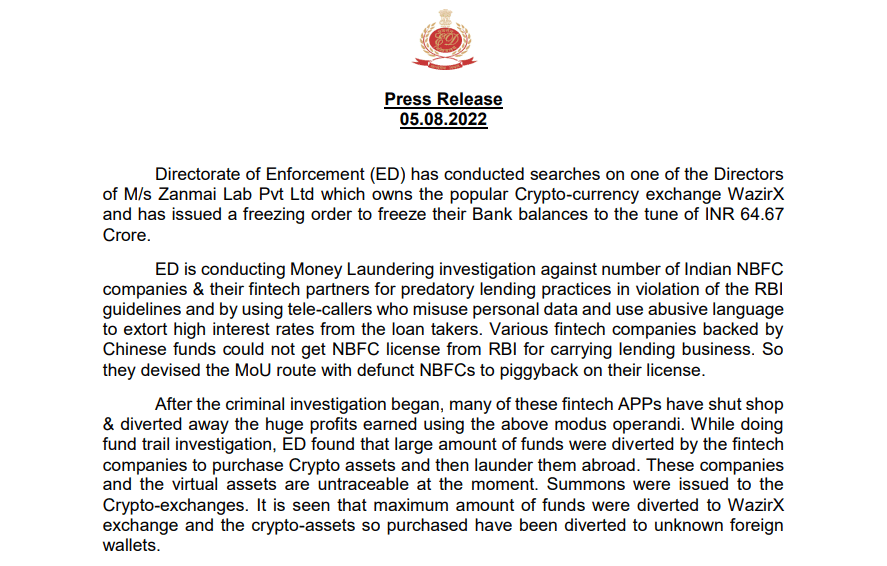

Following investigations by India’s financial crimes agency, the Enforcement Directorate, it was discovered that numerous Chinese fin-tech companies, supported by funds, had been engaging in predatory lending practices through mobile apps. The ill-gotten gains from these activities were subsequently converted into cryptocurrencies. Remarkably, a significant portion of these illegally acquired funds ended up being deposited into the WazirX cryptocurrency exchange, which is currently grappling with a crisis due to hacking incidents causing a shortage of funds.

In an effort to monitor the growing number of Chinese loan applications affecting Indian users, the Reserve Bank of India initiated a trial program in August 2023. The purpose was to explore if a single platform could provide seamless credit to investors while ensuring swift background checks and credit score verifications.

Via ULI (Unified Lending Interface), India aims to unite all legally recognized financial institutions within the nation and their customers on a single public system. This integration is intended to enhance efficiency, security, and transparency in the lending process. Moreover, it serves as a measure to curb the expansion of harmful Chinese loan applications.

The menace of Chinese Loan Apps in India

Since the outbreak of the Covid-19 pandemic, an influx of quick loan applications originating from China have swamped the Indian market, primarily targeting individuals from lower income brackets with promises of swift loan approvals. However, as per Indian investigative bodies, these applications lacked official licenses and employed predatory practices such as short repayment periods (15-20 days) coupled with exorbitant interest rates.

Borrowers who used the app found themselves being pressured by Chinese loan agents to pay off their outstanding debts, with accusations of extortion and intimidation ensuing. The matter was brought to the attention of Indian authorities after a series of suicides among users were linked to threats from these unethical loan agents.

Based on ED findings, Indian authorities initially refused to grant Non-Banking Financial Company (NBFC) licenses to Chinese entities, preventing them from operating in India. In response, some Chinese apps found a workaround by entering into Memorandums of Understanding (MoU) with defunct Indian NBFCs.

An investigation by ED found that representatives from loan apps frequently pretended to be telephone callers, enticing lower-middle-class Indian individuals with attractive loans. Once the victims were lured in, these agents would resort to aggressive, threatening behavior and blackmail tactics to compel them into paying exorbitant interest rates.

It was observed by ED that the gains from these financial crimes, such as fraud, were often turned into cryptocurrencies and a significant portion was deposited into the WazirX exchange. Notably, it was disclosed by Nischal Shetty, co-founder of WazirX, that at least 34% of the Indian Rupee funds of Zanmai Labs Private Limited (the parent company of WazirX) have been frozen by investigative agencies due to ongoing money laundering probes.

Based on RBI’s plans, the Universal Lending Infrastructure (ULI) will be developed utilizing the foundation of the Unified Payments Interface (UPI), India’s swift digital payment system, designed to effortlessly handle inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions via a unified platform. At present, customer data such as credit scores across millions of Indians is scattered among various public and private entities in different regions within India. Through ULI, this information will be consolidated into one centralized system to enable financial institutions to quickly verify customers’ credit scores and approve loans.

The Reserve Bank of India (RBI) has confirmed that UlI will function as a trusted and secure platform for all individuals to obtain home, education, vehicle, personal loans, as well as quick small-amount loans from various banks and Non-Banking Financial Companies (NBFCs). Since the RBI supports both NBFCs and banks, citizens can rest assured that they will not fall victim to exploitative lending practices commonly found in Chinese loan applications. In summary, UlI offers a secure and reliable solution for loans from trusted financial institutions.

Introducing ULI (Unidentified Legal Instrument) into India, a country known for its push towards digital service and banking, could be a pivotal moment. The increasing concerns about exploitative loan apps and their misuse of cryptocurrency exchanges serve as a stark warning about the potential risks within the crypto sector.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-27 12:37