As a seasoned researcher with years of experience tracking global financial trends, I must say that Indonesia’s meteoric rise in the Chainalysis Global Crypto Adoption Index has caught my attention. Having closely followed the crypto landscape for quite some time now, it’s fascinating to see how this Southeast Asian nation is making its mark amidst a dynamic and rapidly evolving digital asset ecosystem.

For the first time, Indonesia has made it onto Chainalysis’ worldwide cryptocurrency adoption index, moving up to the top 3 positions as global crypto activity exceeded the frenzy seen during the 2021 bull market.

Indonesia has entered the global crypto adoption rankings by Chainalysis, rising to third place ahead of Vietnam. This leap forward comes as global cryptocurrency activity has spiked to levels last witnessed during the 2021 cryptocurrency market boom.

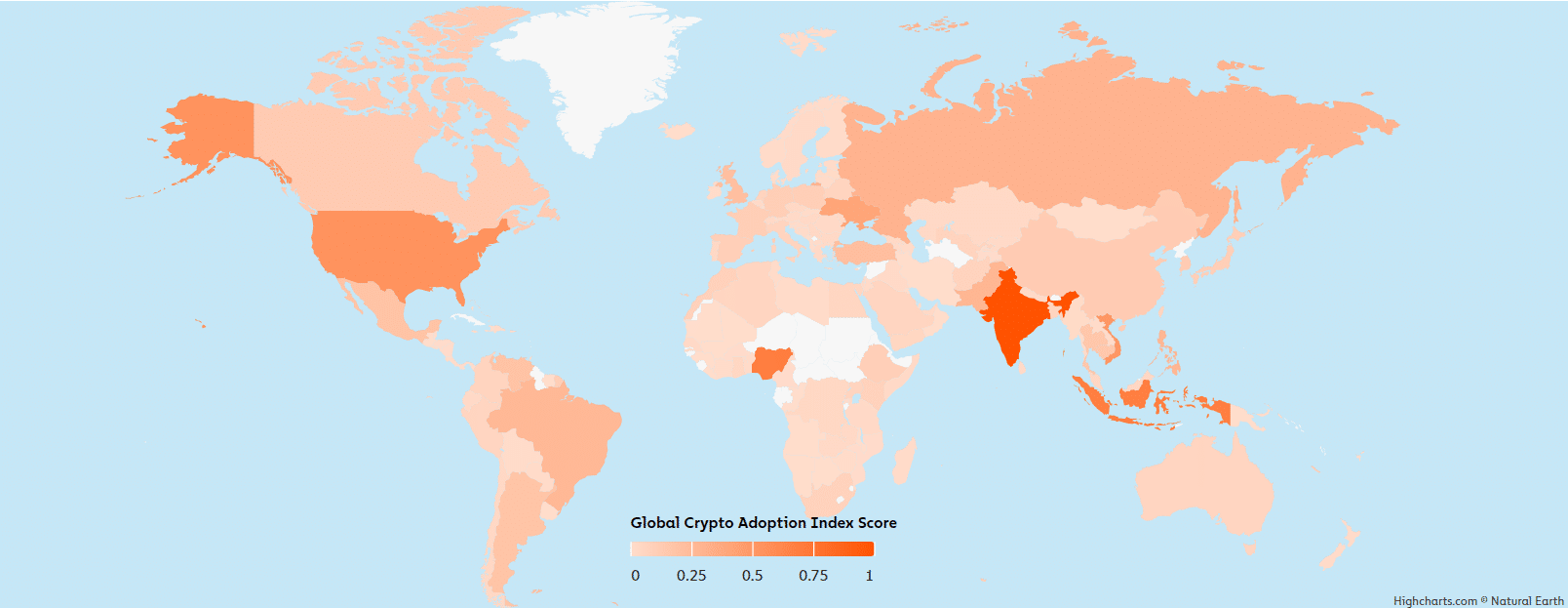

From October 2023 through March 2024, the overall worth of global cryptocurrency transactions noticeably surged, surpassing its prior maximum, as indicated by Chainalysis’ data. This growth pushed Indonesia into third place on the list, with India and Nigeria maintaining their leading positions since 2023.

The rapid increase in adoption is connected to a wider pattern, as cryptocurrency usage expands globally in various income levels. However, high-income nations have experienced a decline in crypto activity since the beginning of 2024.

In the previous year, it was mainly lower-middle income nations that saw significant growth in cryptocurrency usage. Yet, this year has seen an uptick in crypto activities worldwide, including countries of varying economic levels. Interestingly, there’s been a decline in high-income countries since early 2024.

Chainalysis

Indonesia rises in global crypto adoption

Indicating a rise in cryptocurrency usage within Indonesia, there are ongoing initiatives to set up a legal structure for managing digital assets. In April 2024, Indonesia and Australia finalized a deal to create a shared platform for crypto information exchange, designed to enhance tax reporting and traceability of digital assets.

In simpler terms, Indonesia’s financial oversight body, known as the Financial Services Authority, has stepped up its regulations for the cryptocurrency industry. This means that crypto companies will need to participate in a ‘regulatory sandbox’ before they can get licensed by 2025.

According to Chainalysis, the increase in cryptocurrency activity worldwide is due to multiple reasons. The introduction of spot Bitcoin exchange-traded funds in the U.S. has stimulated institutional growth, while the use of stablecoins has grown significantly in regions with lower income, particularly for everyday transactions in Sub-Saharan Africa and Latin America.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-11 17:30