As a seasoned crypto investor with over a decade of experience under my belt, I find myself intrigued by the recent surge of Injective (INJ). The whale activity and increased open interest on major exchanges such as Binance, Bitmex, Bybit, and OKX are clear indicators that the market is bullish on this layer-1 network.

On a blockchain supported by Mark Cuban (Injective), there was a resurgence, reaching its peak in more than two months, as the activity of large investors (whales) grew more frequent.

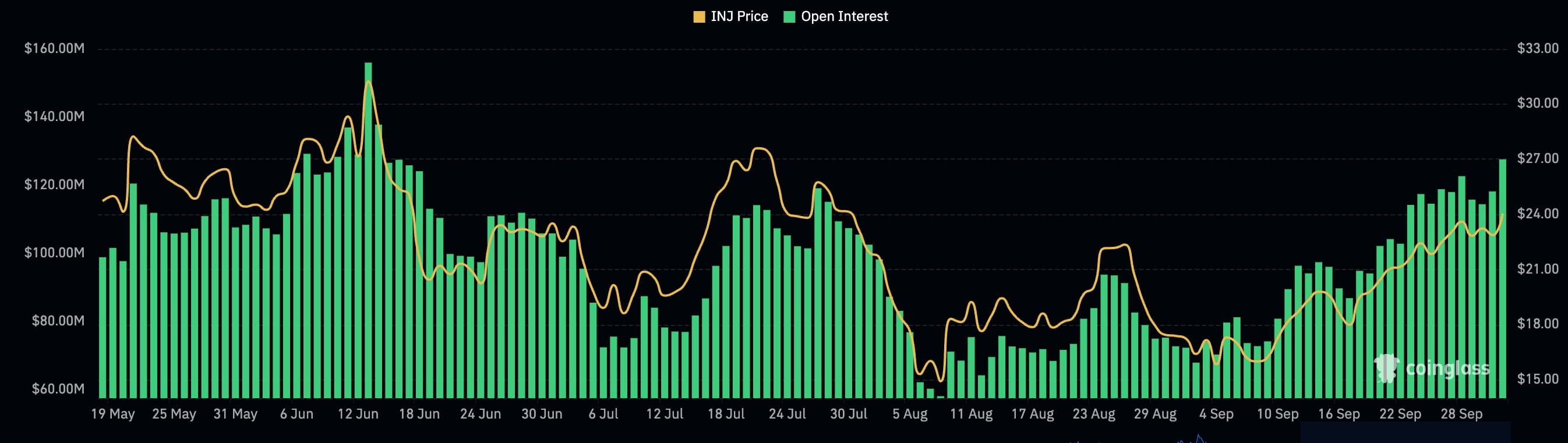

On October 1st, Tuesday, the INJ token surged to $24.87, marking a 10% increase from its lowest point in August. This upward trend occurred concurrently with the futures open interest of the token reaching its peak level since June 14th.

It had an open interest of over $127 million, most of which was in Binance, followed by Bitmex, Bybit, and OKX. The interest was also substantially higher than the September low of $67 million.

Open interest is an essential metric in the crypto industry because it shows the amount of outstanding futures contracts in exchanges. A higher interest level can indicate that a crypto asset is more liquid and in significant demand.

Recently, data from Santiment indicates an uptick in large-scale investor involvement with Injective. This activity has surged by approximately 456%, suggesting that these investors are growing optimistic about the token.

The number of on-chain transactions in its network exceeded 995 million, leading to an increase in injective as well.

995 Million On-Chain Transactions.

Closer than ever to 1 BILLION! ⏳

— Injective 🥷 (@injective) October 1, 2024

Previous week, our network became a part of the Tokenized Asset Alliance, a group that counts firms such as Coinbase and Circle among its members.

As an analyst, I’ve observed a notable disparity in the expansion of Injective’s ecosystem compared to other prominent layer-1 networks such as Sui, Tron, and Solana. This observation underscores a significant challenge that Injective is currently facing.

As reported by DeFi Llama, Injective currently holds a total value locked exceeding $44 million, which is a decrease from its all-time high of more than $77.6 million. Its largest decentralized exchange, Helix, manages approximately $31 million in assets and facilitated transactions worth about $31 million within the past 24 hours.

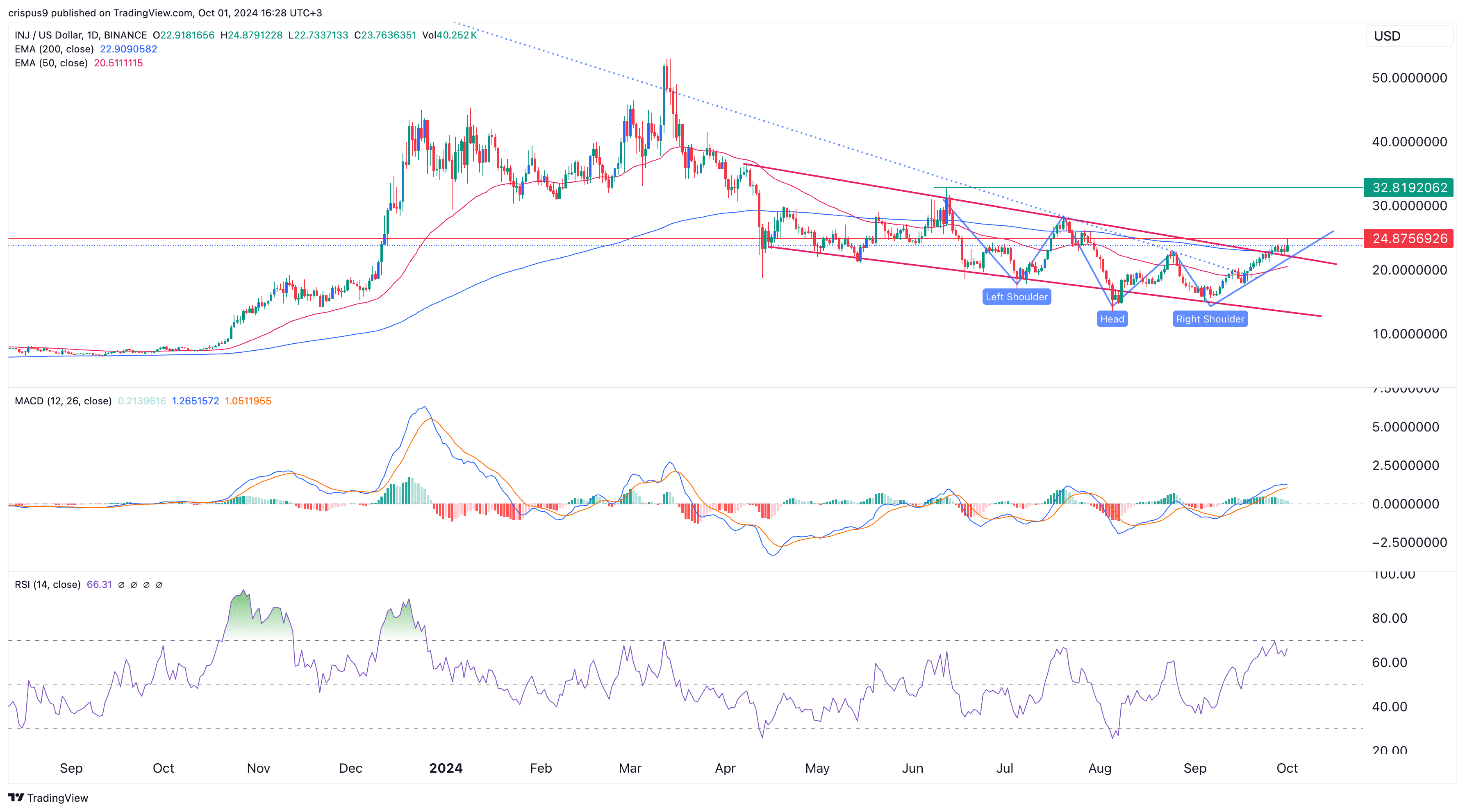

Injective crossed two key resistance levels

On the daily chart, the Injective has climbed higher than its 200-day Exponential Moving Average, a situation that’s typically interpreted as a good or bullish sign.

Additionally, it surpassed the upper boundary of a downward-sloping channel connecting the highest price points since April 8.

The MACD lines have risen above the zero mark, and the Relative Strength Index is nearing the 70 threshold, suggesting it may be overbought. Additionally, an inverted head and shoulders pattern has formed, hinting at potential price increases soon. If this trend continues, $32.81 – its peak from June 12 – will become a key level to monitor for future developments.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2024-10-01 17:00