Ah, the unquenchable thirst of the modern gold rush—Bitcoin ETFs guzzled down a staggering $917 million fresh capital brew, led by the imperious Blackrock’s IBIT swaggering through the gates with bags bulging. Meanwhile, poor Ether ETFs stumbled back into the shadows, losing $23.88 million like a sad poet losing his last bottle of vodka.

Bitcoin ETFs Feast Like Kings: $917M Flush Flows In, Ether ETFs Left Nursing Hangovers

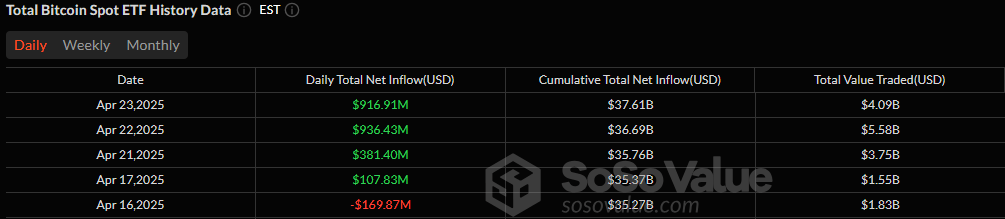

In the grand circus of finance, investors can’t seem to get enough of bitcoin ETFs. Following a day of record-breaking inflows, the U.S. spot bitcoin ETFs welcomed $916.91 million as if it were warm borscht on a cold April Wednesday, April 23—festooning their place on the throne of market affection.

Blackrock’s IBIT swaggered in like a cat with nine lives and a million-dollar ego, snatching $643.16 million—leaving Ark 21shares’ ARKB and Fidelity’s FBTC to fight for scrappy crumbs: $129.50 million and $124.37 million, respectively.

Grayscale’s BTC added a humble $29.84 million to this final act, while Vaneck’s HODL chimed in with a mere $5.28 million, as if timidly whispering from the wings. Only Bitwise’s BITB dared to defy the frenzy, slipping away quietly with a $15.25 million withdrawal—not much, but enough to remind us of life’s little betrayals.

Overall, an extravagant $4.09 billion pirouetted through the market’s dance floor, nudging net assets skyward to $106.39 billion—a spectacle worthy of applause and intrigue alike for bitcoin ETFs. But hold your vodka cheers, for the tale on the ether side was more akin to a bad dream from which one awakens dripping with uncertainty. After a brief flirtation with positivity, ether ETFs sashayed back into the bitter grip of outflows, losing $23.88 million like a disappointed lover walking away in the rain.

Blackrock’s ETHA played the villain, dragging $30.28 million out of the party, while Grayscale’s ETH made a feeble effort with a $6.40 million inflow, not nearly enough to keep the waltz going strong.

The total ether ETF trading volume stood at $432.87 million, with net assets frailly resting at $5.93 billion. As bitcoin ETFs roar and prance forward like a carnival of riches, ether ETFs are left tangled in the cobwebs of doubt and hesitation.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-24 22:30