As a seasoned analyst with over two decades of experience in traditional finance and digital assets, I must say that the rapid adoption of U.S. Bitcoin exchange-traded funds (ETFs) by institutions is nothing short of remarkable. Having witnessed the early days of cryptocurrencies, it’s fascinating to see how these once-skeptical legacy firms have embraced Bitcoin as a legitimate investment option.

Institutional interest in Bitcoin has been attracted by U.S. Bitcoin exchange-traded funds (ETFs), as skepticism from traditional financial institutions initially arose regarding their new cryptocurrency asset class. In simpler terms, institutional investors have shown interest in Bitcoin ETFs offered in the United States, after some traditional companies were initially hesitant about investing in this new type of crypto asset.

Institutions based in the United States have purchased approximately $13 billion worth of shares for Bitcoin (BTC) ETFs since they became available for trading in January, as reported by Ki Young Ju, CEO of CryptoQuant, on October 22nd. Using data from Form 13F filings, a document that U.S. wealth managers submit to disclose their equity holdings every quarter, Young Ju pointed out that around 1,179 institutions have accumulated about 193,064 BTC over the past ten months.

Approximately one fifth of U.S. Bitcoin Spot Exchange-Traded Funds are owned by institutions, who collectively hold about 193,000 Bitcoins according to the data disclosed in their Form 13F filings.

— Ki Young Ju (@ki_young_ju) October 22, 2024

Major players in conventional finance, such as Millennium Management and Jane Street, collectively manage approximately 20% of a $65 billion sum, which is equivalent to about 961,645 Bitcoin (BTC). This substantial investment is distributed across eleven Bitcoin Spot Exchange-Traded Funds (ETFs) provided by BlackRock, Bitwise, Grayscale, Fidelity, and other similar companies.

Increasingly, institutions are embracing Bitcoin Spot ETFs, suggesting an initial hesitance towards Bitcoin investment vehicles was temporary. Asset management experts such as Eric Balchunas and James Seyffart of Bloomberg frequently note that the industry tends to gradually adopt novel financial products over time.

In just under a year since its debut, BlackRock’s Bitcoin product has emerged as the swiftest-growing Exchange Traded Fund (ETF) in the annals of American financial history. Additionally, statistics reveal that BlackRock’s IBIT saw the third-largest investment influxes, comparable to ETFs that have been established for more than two decades.

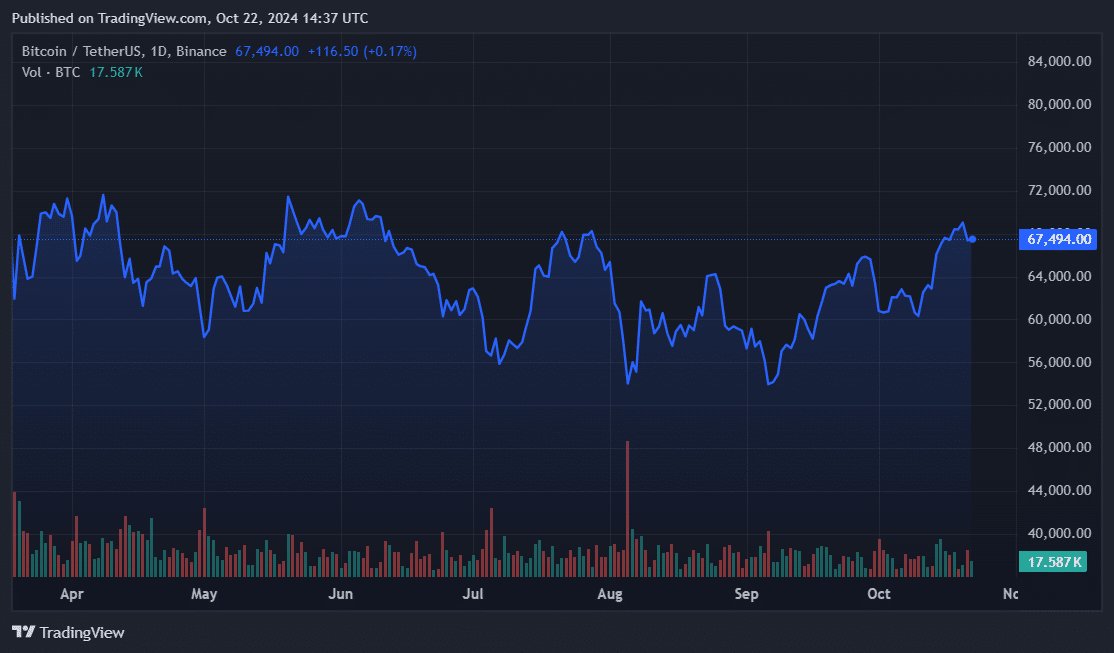

Experts have identified increased demand for a Bitcoin exchange-traded fund (ETF) in specific locations, particularly the United States, as a significant factor driving the anticipated increase in Bitcoin’s price. Currently, one Bitcoin is valued at approximately $67,000 due to a general market adjustment that has momentarily checked Bitcoin’s upward trend.

Some financial firms, such as QCP Capital, are of the opinion that the upcoming U.S. presidential election could cause short-term fluctuations in the Bitcoin and digital asset markets. On the other hand, researchers are anticipating these price movements to calm down and for traditional market patterns to reemerge. The overall feeling among investors is that Bitcoin’s value will surpass $100,000 by 2025, while Bitcoin advocates like MicroStrategy’s Michael Saylor expect its worth to reach an impressive $13 million by 2045.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- The 15 Highest-Grossing Movies Of 2024

2024-10-22 18:24