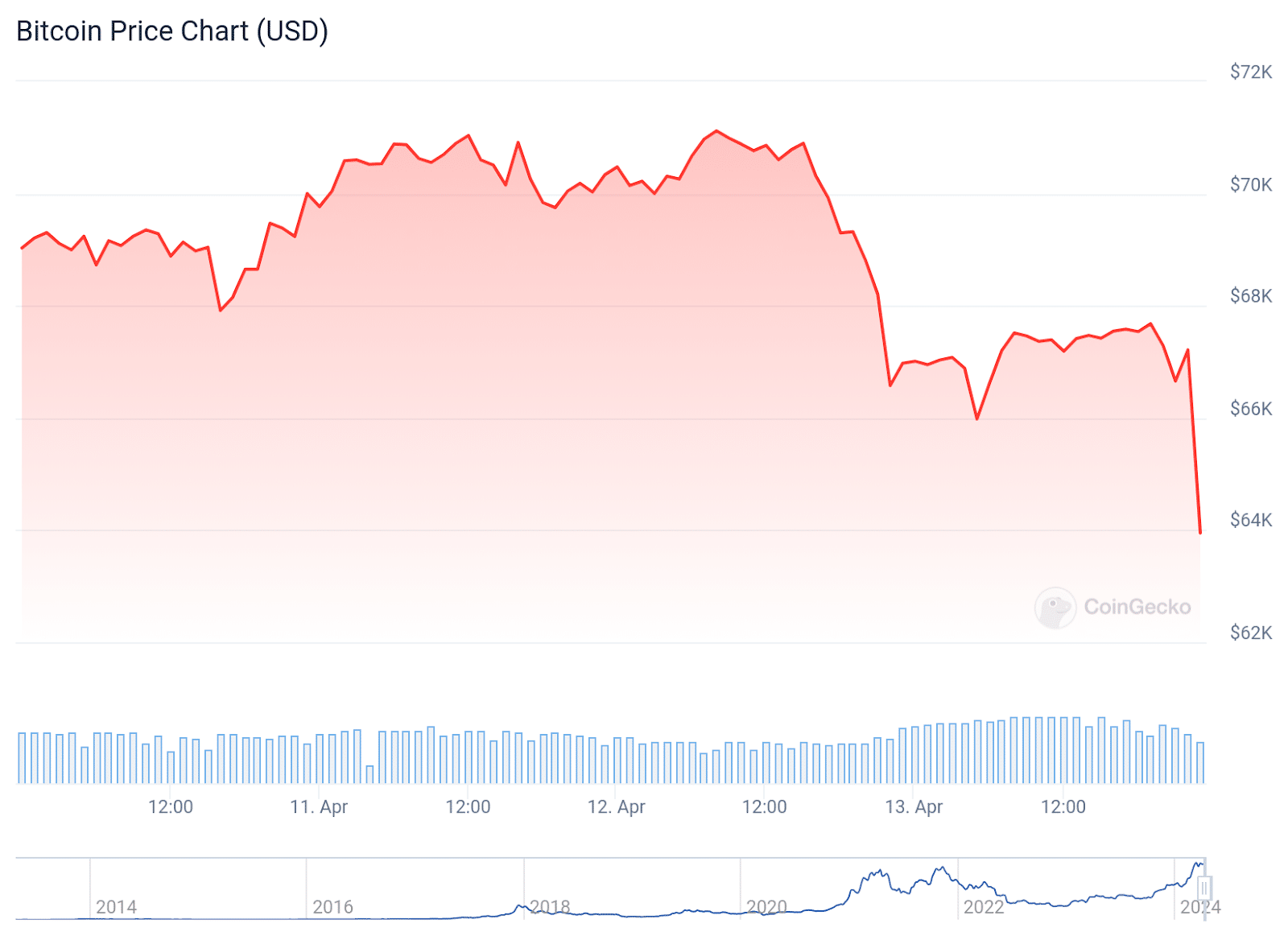

Following the Iranian drone assault on Israel on April 13, the cryptocurrency market responded with Bitcoin (BTC) experiencing a decline of over 8%, resulting in a trading price of $61,514.

An recent amendment signified the ongoing development of a pattern initiated on April 12, which subsequently deteriorated the following day.

Crypto market analysts report that over $860 million worth of assets were sold off in just two days. The value of Bitcoin first dipped from $71,000 to $65,000, and then plummeted further down to $61,000.

Observers believe the initial decline in the market was caused by information released by the US Federal Reserve indicating a reluctance to lower interest rates immediately.

Due to persistent high inflation rates, this position is being shaped; domestically, it creates uneasiness, and internationally, it affects predictions for policy changes.

An alternate expression: The second incident occurred as a result of increasing friction between Iran and Israel, prompting cryptocurrency investors to respond immediately to this development, since conventional financial markets were shuttered over the weekend.

At present, Bitcoin is priced at $64,123, representing a 5% decrease from its value over the past 24 hours. In the context of the past week and fortnight, the cryptocurrency has experienced losses of 7.5% and 8.6%, respectively. Over a 30-day span, the price decline amounts to approximately 6%.

The largest cryptocurrency in terms of market value has dropped 13% from its all-time high of $73,798 reached in March. However, despite this decrease, its current value is over two times greater than what it was at the same point last year.

According to QCP’s experts, the hostile action taken by Iran against Israel sparked significant apprehension in financial markets. As a result, Ethereum (ETH) plummeted to $2,850, while other cryptocurrencies experienced an average decline of around 20-30%.

According to CoinGecko’s latest ranking of the 100 largest cryptocurrencies based on market capitalization, Leo token (LEO), Bittensor (TAO), Celestia (TIA), and Wormhole (W) were the ones that experienced growth over the past 24 hours.

Following April 13, the cryptocurrency sector’s total market capitalization, as reported by the data aggregator, dropped by 5.2%, resulting in a new figure of $2.43 trillion.

The total crypto market cap has fallen by 5.2% to $2.43 trillion today.

Are you buying or selling?

— CoinGecko (@coingecko) April 14, 2024

But despite all this, some analysts say that this drop is normal.

According to Benjamin Cowan, the founder of Into The Cryptoverse, the crypto market has experienced comparable declines in the past. On the other hand, Michael Saylor, MicroStrategy’s Executive Chairman, once again emphasized his belief that Bitcoin thrives during chaotic conditions.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-04-15 04:12