As a seasoned researcher who has witnessed the rapid evolution of the digital asset market, I find myself standing at the crossroads of innovation and regulation with the latest move by the Internal Revenue Service (IRS) towards decentralized finance (DeFi).

The Internal Revenue Service (IRS) in the United States is focusing on the realm of Decentralized Finance (DeFi), by introducing a novel tax regulation that could significantly alter the DeFi platform landscape, effective from 2027. From this date, brokers operating within DeFi will be obligated to gather comprehensive data about users’ transactions, including personal details such as names and addresses, as well as trading activities. This information will be used to issue tax forms akin to those employed in conventional financial markets.

This action is based on the 2021 Infrastructure Investment and Jobs Act and intends to reduce crypto tax evasion by aligning digital asset reporting with conventional tax regulations.

As a researcher delving into the intricacies of the cryptocurrency realm, I’ve encountered robust resistance to this proposed rule from influential figures in the crypto sector and seasoned legal authorities. They’ve underscored formidable hurdles for decentralized platforms that function independently of centralized entities.

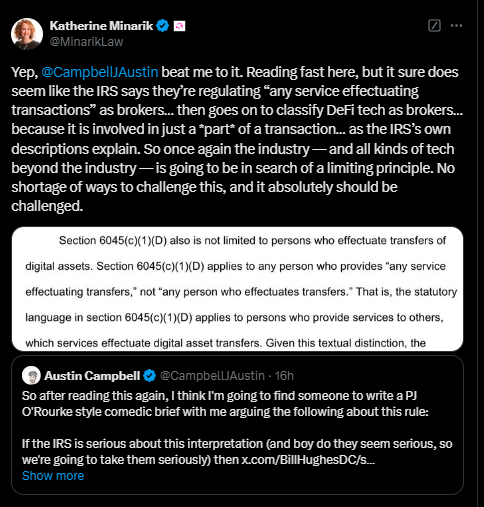

Uniswap’s top legal officer, Katherine Minarik, and CEO, Hayden Adams, have openly expressed their disagreement with the Internal Revenue Service’s methods.

Adams expresses his hope that the rule can be nullified using the Congressional Review Act, underscoring the infeasibility of enforcing conventional broker regulations within decentralized systems.

Bill Hughes, an expert in law from Consensy, characterized the rule as offering “only costs, no rewards.” He cautioned about potential regulatory hurdles that might suppress creativity without any real advantages for either regulators or investors.

For crypto investors, the IRS’s new rule promises increased transparency, potentially making tax reporting for digital assets in a more standardized way. However, making such things mandatory is viewed against the ethos of crypto by many because crypto is all about financial freedom.

Decentralized Finance (DeFi) systems, which usually function without central authorities, might encounter escalating compliance expenses as they endeavor to align with these new regulations. Many smaller platforms, already running on narrow profits, could find it challenging to fulfill the Internal Revenue Service’s (IRS) expectations. This predicament may prompt some platforms to move operations to crypto-friendly locations, while others might be compelled to cease functioning altogether.

The changes could also introduce volatility into the market as the DeFi space adjusts to the stricter regulatory landscape. Investors may experience temporary disruptions as platforms implement new systems to comply with the rules or seek ways to circumvent them.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2024-12-28 12:22