Despite the highfalutin claims of crypto pundits and the wise men of Wall Street, some mischievous signals are winking at us that Bitcoin might just be gearing up for a little tiddly-winks reversal, old sport.

A divergence signal, dear reader, is when our dear Bitcoin’s price shimmies up to a new high, but the indicators—those pesky tattletales—start to slouch about like a bloke at a last chance dance, indicating momentum’s just about to take a powder. And would you believe it? It’s happening right now, in a manner that would make a good detective tip his hat.

Divergence Alarm: Bitcoin’s Ballet of the Downturn? 🎩

The first flutter comes from a technical device in the monthly dance card. Investors, bless their curiosity, often ignore the grander kaleidoscope of monthly charts, preferring the daily dogfight. But this time, the big picture is sneaking up like a cheeky butler with bad news.

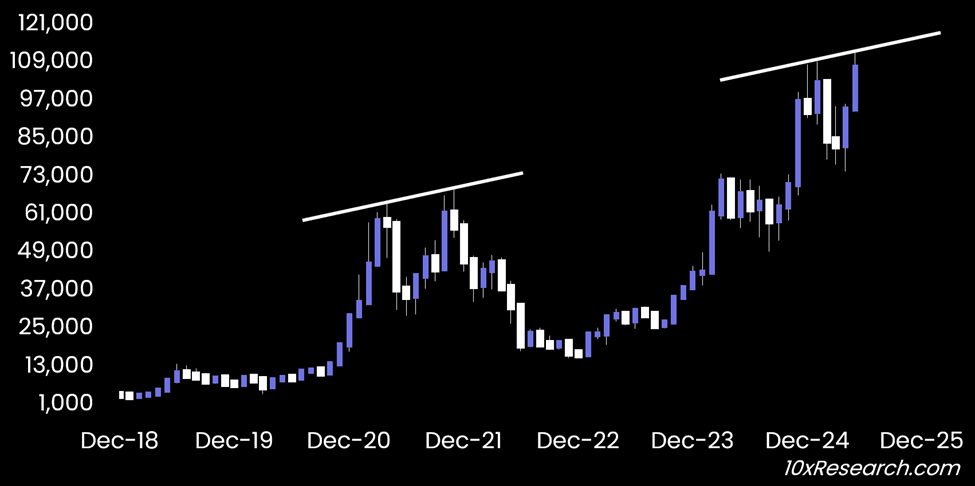

A recent snoop from 10xResearch warns that Bitcoin’s playing hard to get at resistance levels, doing a bit of a déjà vu with 2021’s toe-tapping pattern. The chart shows two peaks, the second being swankier than the first, and now, in 2025, the same little dance is unfolding. Fancy that!

Meanwhile, Professor Hyland’s weekly RSI snooped out bearish divergence, and Mitch Ray, the clairvoyant analyst, noted that Bitcoin’s MACD-H was acting like a crab—going sideways in a bearish manner. These signals, my dear Watson, spell trouble on the horizon, and trouble often comes with a fat wallet or a black eye.

And if that wasn’t enough to turn your crumpet, James Van Straten chimes in with yet another divergence—this time between MicroStrategy’s stock and our beloved Bitcoin. A tale as old as time, or at least as old as November 2021, when MSTR took a 50% nosedive while Bitcoin strutted to $69,000. Now, MSTR has hit the deck again, but Bitcoin keeps on flirting with new highs. Curious, eh?

James, the wiseguy, didn’t go all-in with a conclusion, but his little hint suggests a hiccup—or dare I say, a proper tumble—ahead, reminiscent of the grand cycle up to 2022.

“Bitcoin just threw a masochistic monthly bash, but underneath, it’s as brittle as a cookie. Cracks are blossoming—disparities in price, volatility, and retail shenanigans point to a possible shindig shift. Big shots like MicroStrategy are cooling their jets, and the little coins are slipping below their support stockings. Volumes are vanishing quicker than a soufflé, and the technical signs are oh-so familiar to 2021—just before the whole caboodle came a-cropper,” 10xResearch reported.

Yet, in the land of irony and irony’s cousins, BeInCrypto assures us that some big cheeses—think gaming, healthcare, and retail—are still stockpiling Bitcoin like there’s no tomorrow. They predict that institutional moolah might pour in to the tune of $426.9 billion by 2026, locking up a hefty 20% of Bitcoin’s quirky quantity. Fancy that for a turn in the tide, old bean?

And this, perhaps, is where the plot thickens—these shiny new forces might make the 2025 scene a bit less like a repeat of 2021 and more like a daring new curtain call.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-30 11:21