As someone who has navigated through multiple bull and bear markets, I must say, the energy surrounding Bitcoin right now is electrifying! The all-time high open interest in futures contracts tells me that traders are betting big on Bitcoin’s future price movement, and that bodes well for its momentum.

As Bitcoin hovers around $70,000, could it soon reach $100,000? What role will the upcoming U.S. elections, potential ETF approvals, and overall market mood play in shaping its future trajectory?

Table of Contents

Bitcoin is bitcoining

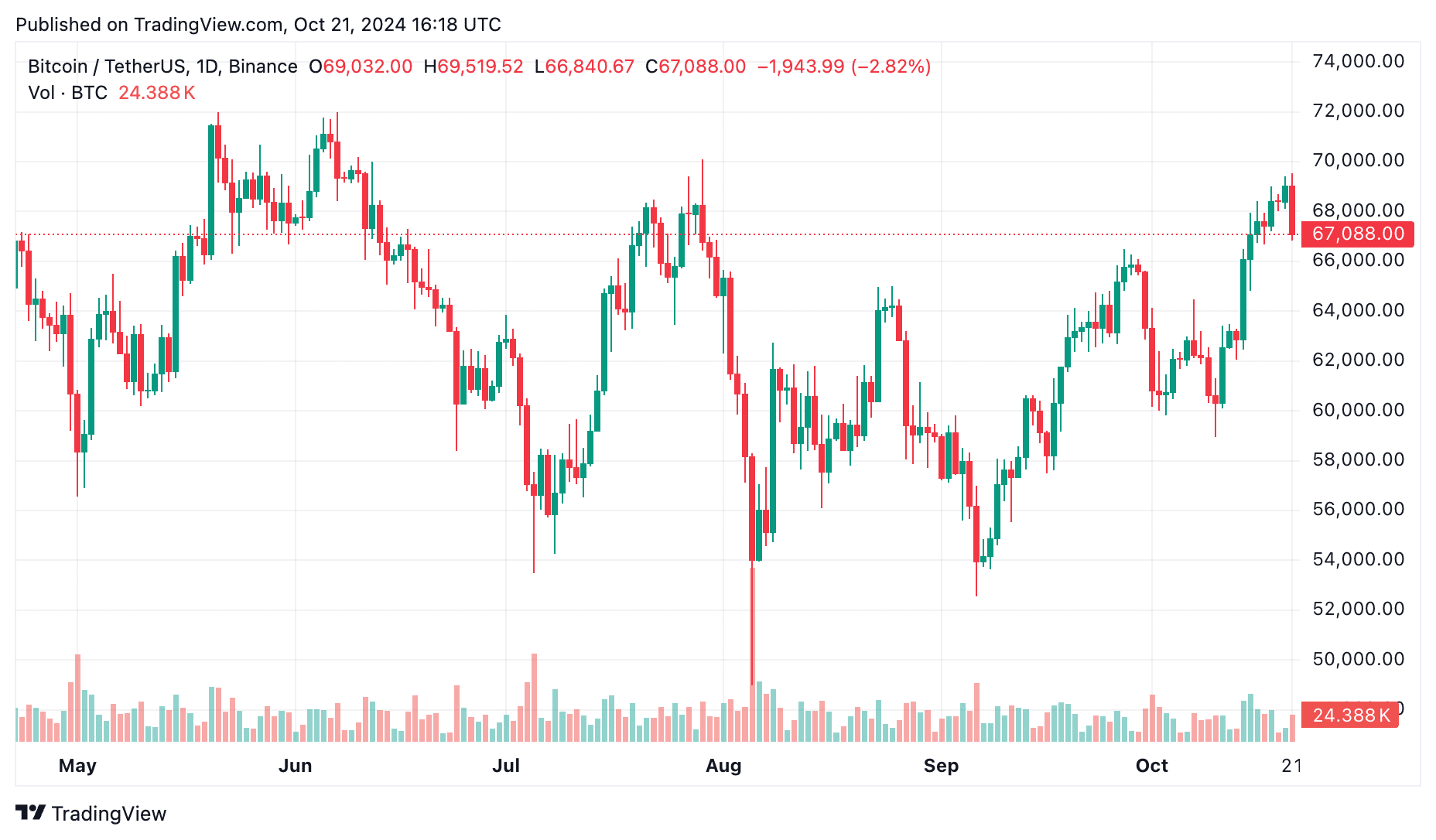

In recent times, Bitcoin (BTC) has experienced a remarkable surge, increasing by more than 2% within the last seven days, fueled by the widespread influence of “Uptober” in the cryptocurrency sector.

Currently on October 21st, Bitcoin is being traded at approximately $67,100. This is a price level not seen since late July, reaching a three-month peak. Interestingly, Bitcoin momentarily reached $69,500 earlier before pulling back due to bearish activity attempting to halt the upward trend.

Rapidly changing market attitudes are evident as well. Currently, the Crypto Fear and Greed Index stands at 63, indicating a surge in “greed,” which is quite different from the intense “fear” that was prevalent on September 7, when it hit a yearly low of 26.

There’s a sense of positive anticipation among investors, particularly as the U.S. presidential election, scheduled for November 3rd, approaches. Notably, former President Donald Trump, known for his pro-crypto policies, appears to be surging in voting surveys.

It’s widely thought that if he wins, Bitcoin could reach unprecedented levels due to his policies being perceived as advantageous for the cryptocurrency sector.

As a researcher delving into Bitcoin’s trajectory, I ponder what lies ahead given the approaching economic milestones and the politically charged landscape. Where could BTC be headed in the near future? Let’s uncover the answers together.

Spot Bitcoin ETFs gain traction as positive changes roll in

A significant victory for the Bitcoin market is anticipated as spot Bitcoin exchange-traded funds (ETFs) could witness increased activity due to a recent adjustment in rules by the United States Securities and Exchange Commission (SEC).

On October 18th, the Securities and Exchange Commission (SEC) gave its approval for both the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange to facilitate options trading for various Bitcoin Exchange-Traded Funds (ETFs). This decision paves the way for improved liquidity and more seamless price fluctuations in the cryptocurrency market.

Notable entities will feel the impact of this adjustment. The New York Stock Exchange (NYSE) has received approval to offer trading options for the Grayscale Bitcoin Trust (GBTC), the Grayscale Bitcoin Mini Trust (BTC), and the Bitwise Bitcoin ETF (BITB).

In other developments, Cboe Global Markets could potentially add options for the Fidelity Wise Origin Bitcoin Fund (FBTC) and the ARK 21Shares Bitcoin ETF (ARKB) to its listings.

These advancements have occurred only a few weeks following the Securities and Exchange Commission’s decision to authorize Nasdaq to list investment options for BlackRock’s Bitcoin Trust (IBIT).

Investment agreements called options provide holders with the privilege (not duty) to either acquire or dispose of a specific asset such as a Bitcoin ETF at a predetermined cost by a specified deadline.

Although no launch dates have been confirmed for these options, experts believe the approval could have a massive impact.

Increased availability of financial products on significant American stock exchanges might broaden the reach of cryptocurrencies, potentially enticing a more extensive array of investors – from large-scale institutions to individual investors.

As an analyst, I find myself in an opportune moment, as the influx into Bitcoin Exchange-Traded Funds (ETFs) has been nothing short of remarkable lately. According to data from CoinGlass, spot Bitcoin ETFs have amassed a staggering $2.13 billion in inflows during the week ending October 18th, swelling the total assets under management to an impressive $52 billion.

Over the past week, Bitcoin ETFs have delivered their best results in approximately seven months, suggesting that investors’ faith in cryptocurrency is growing.

Is a breakout imminent?

With Bitcoin approaching the $70K threshold, numerous analysts are voicing their predictions about the potential direction of the market on various social platforms.

Bitcoin is the “Boring Zone”

According to crypto expert Michael van de Poppe, Bitcoin is currently in a phase he’s called the “Dull Period,” but this isn’t necessarily a cause for concern.

As a crypto investor, I find myself in an interesting position right now. Bitcoin, the digital gold, seems to be cruising through the ‘Boring Zone’. However, this doesn’t mean there isn’t potential for growth. On the other hand, Altcoins are showing signs of reversal, marking the end of what could be considered the longest bear market in history.

— Michaël van de Poppe (@CryptoMichNL) October 21, 2024

As I analyze the current cryptocurrency market landscape, I find myself observing a steady consolidation of Bitcoin around the $68,000 mark. Simultaneously, beneath this surface, there are early indications suggesting an upswing in the recovery process for altcoins.

As an analyst, I find myself drawing parallels with a coiled spring in the current market scenario, as per van de Poppe’s observation. In essence, this suggests that altcoins, having completed what could be considered the longest bear market on record, are poised and ready for a surge of liquidity – much like a spring when released from its coil.

As an analyst, I find myself closely observing what I refer to as the “Consolidation Phase” of Bitcoin’s price movement. During this period, the price remains relatively stable within a narrow range, but it’s important not to underestimate the potential energy building beneath the surface. Historically, such phases have often preceded significant upward swings, as shrewd investors start to re-enter the market once they perceive a solid foundation has been established.

Bullish momentum signals are flashing

Regarding technical analysis, a well-known cryptocurrency expert named Ali is using a particular measure to predict Bitcoin’s upcoming direction.

One of my preferred measures for determining Bitcoin’s direction, known as the MVRV Momentum, has turned positive once more!!

— Ali (@ali_charts) October 20, 2024

Recently, the Market Value to Realized Value Momentum Indicator for Bitcoin, which contrasts its current price with the price at which the majority of Bitcoins were last transacted, has shifted towards a positive or bullish trend.

When this signal turns bullish, it’s frequently a precursor suggesting further increases in Bitcoin value may be on the horizon. In other words, investors tend to keep their Bitcoin, as they anticipate the market will experience an upward trend – a significant psychological aspect influencing price fluctuations.

From my perspective as an analyst, as investor confidence grows and they choose to hold onto their Bitcoin, selling activity diminishes significantly. This reduction in selling pressure makes it easier for the market to maintain an uptrend, causing the value of Bitcoin to steadily increase.

Rising open interest

A significant aspect to consider is the significant increase in open interest for Bitcoin CME Futures, which has reached a record high of $12 billion, according to Maartunn, a well-versed cryptocurrency futures analyst.

Bitcoin: CME Futures Open Interest hits an ALL-TIME-HIGH with $12.0B$BTC #OpenInterest #Futures

— Maartunn (@JA_Maartun) October 20, 2024

The term “open interest” signifies the current count of unresolved future contracts regarding Bitcoin’s price changes. A rise in open interest indicates more investors are making predictions about Bitcoin’s future price fluctuations.

The surge in open interest fits into the broader picture of Bitcoin’s current momentum. Traders are clearly expecting a breakout, likely driven by the macroeconomic events at play.

However, there’s a catch—higher open interest can sometimes lead to increased volatility, especially if a large number of traders are on the same side of the trade, whether bullish or bearish. If the market moves against those positions, it could trigger liquidations, leading to sudden price swings.

U.S. elections and Fed rate cuts

The upcoming U.S. Presidential election on November 5th and the Federal Reserve’s meeting scheduled for the 7th of the same month could have an impact on the fluctuations in the price of Bitcoin, as these macroeconomic events might influence its market dynamics.

Previously elected President Donald Trump, currently ahead in various surveys, is perceived as favorable towards cryptocurrencies. If Trump wins again, it could potentially increase Bitcoin’s value since investors may feel more assured about regulatory consistency and encouragement for the sector.

From my perspective as an analyst, should Kamala Harris emerge victorious, forecasting market reactions becomes a bit more challenging. The reason being, Harris’s views on cryptocurrency remain somewhat unclear at present, which could potentially bring about a degree of market uncertainty.

Additionally, we’re approaching the Federal Reserve’s decision regarding interest rates, which is scheduled for November 7th. It is estimated that there is approximately a 90.5% likelihood they will lower rates by 0.25 percentage points in this meeting.

Reducing interest rates (a rate cut) can increase the amount of available money in the economy, which tends to favor riskier investments such as Bitcoin. Essentially, when there’s more liquidity, it leads to a greater influx of funds into markets. In turn, Bitcoin could potentially see direct advantages from this increased capital flow.

Should Donald Trump secure another term and the Federal Reserve reduce interest rates simultaneously, this dual scenario might potentially fuel a powerful upsurge in Bitcoin’s value surpassing $70,000.

Where could Bitcoin head next?

One crypto analyst believes that Bitcoin’s next target is $98,000. A popular sentiment across the community is that momentum is steadily building, with growing confidence that BTC is ready for its next leg up.

#Bitcoin Next Target: $98,000 🎯

Momentum is building.

Things are starting to smell good for #BTC 🚀— Titan of Crypto (@Washigorira) October 20, 2024

Based on the assessment of well-known crypto analyst Rekt Capital, our current price level falls within the $65,000 to $70,000 zone. He predicts that potential future destinations could range from approximately $90,000 to $160,000.

#BTC

We are here (orange circle)

We will be there (green circle)$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) October 18, 2024

As Bitcoin gains ground near the $70K level, a potential next hurdle might lie at $90K. However, should Bitcoin breach the $90K barrier with substantial force, it could rapidly surge towards $100K and possibly even higher.

When Bitcoin surpasses its previous record highs in trading, there’s often an enthusiastic response from the market that can cause prices to significantly increase within a brief timeframe.

At present, Bitcoin appears to be gaining traction. Yet, investors must stay alert, monitoring both the technical aspects and overall economic signs to predict its future direction. Remember, as usual, trade prudently and never risk more funds than you are prepared to part with.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-10-21 19:33