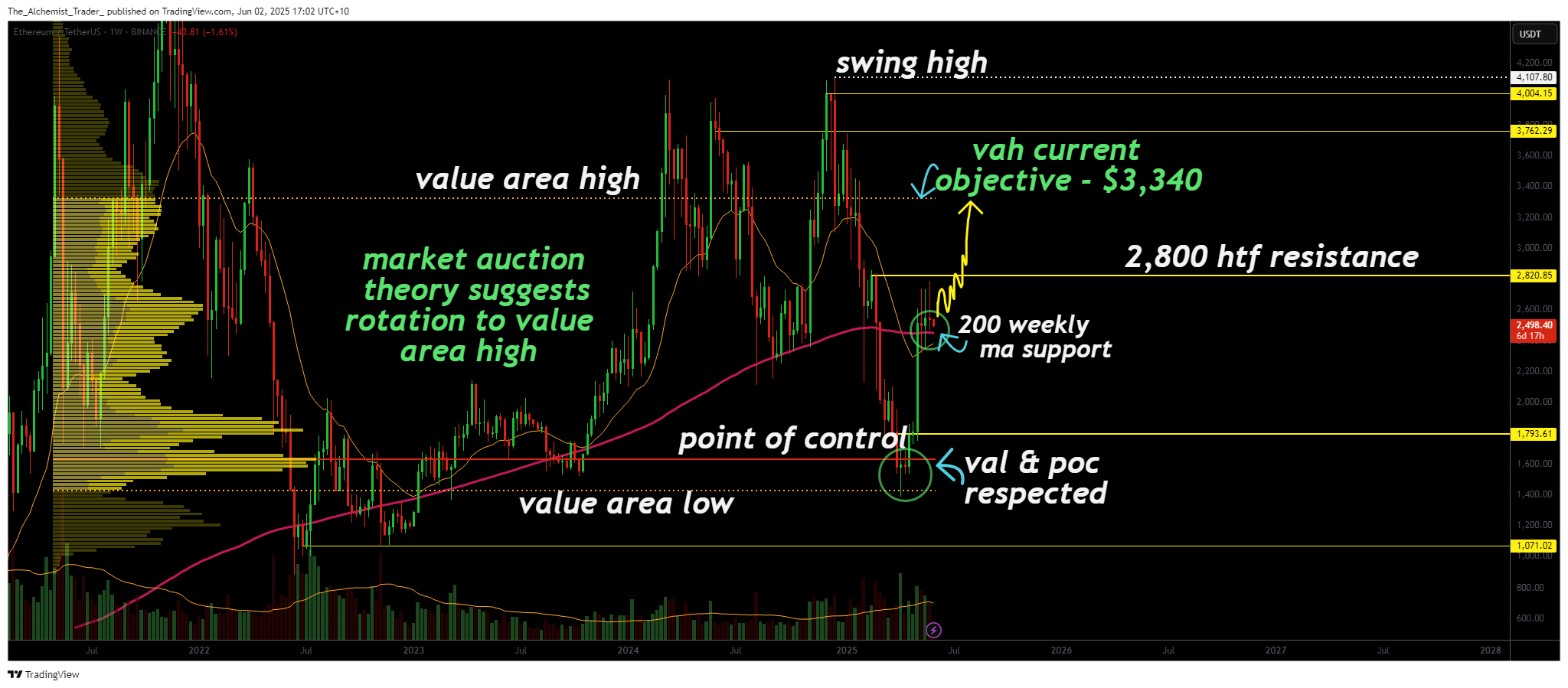

If you’ve ever tried to interpret the cryptic mumblings of a crystal ball, you’ll love this. Ethereum is lounging comfortably above its 200-week moving average—imagine a snooty aristocrat sitting in a vintage armchair—after smashing through a support zone that, frankly, I didn’t even know was support until now. With volume looking more excited than a puppy at a treat jar, and the pattern holding firm, it seems like we’re on the cusp of a market cruise toward a lofty $3,340. Buckle up!

Enter the Market Auction Theory—a fancy way of saying that prices like to dance between two points: what they’re worth at the moment (low) and what they might be worth later (high). Ethereum’s price, smack in the middle, was considered a bargain at between $1,400 and $1,600. Basically, everyone was looking around, grinning, saying, “Hey, this is undervalued,” just before it decided to jolly well rally like a kid on Christmas morning, reclaiming its favorite spot and vaulting above that 200-week average. Who knew technicals could be so dramatic?

Key technical points (or: what the nerds are watching)

- 200-Week Moving Average Acting as Support: Yep, it’s still standing like your grandma’s favorite rocking chair—solid, dependable, and making all the bulls feel special.

- $2,800 High Time Frame Resistance: The last big hurdle before Ethereum gets its medal and runs straight to the $3,340 promised land.

- Market Auction Theory Rotation in Play: The price has already made its journey from the “cheap seats” at the value area low to the POC (that’s fancy talk for “most traded point”) and now has its eyes set on the high—like a dog staring at the treat jar.

The 200-week line isn’t just some number on a chart; it’s like the secret password at the crypto club. Institutions—those fancy folks who wear matching suits and wave around big money—pay attention to it. Ethereum holding above this line after a breakout? That’s like your cat finally sitting on your keyboard after ignoring you all afternoon—powerful and unmistakably confident. It’s building a sturdy base for the next big leap, and frankly, it’s about time.

So once Ethereum blinks and pushes past $2,800 with some real volume behind it—think: more excitement than a crowd at a Messi game—the next stop is that $3,340 peak everyone’s whispering about. That’s the “overvalued” sign in the amusement park, the point where traders say, “Okay, maybe it’s a bit much,” before the market figures out what’s what next. It’s like the climax in a mystery novel: almost there, but still a few surprises away.

And let’s not forget volume. It’s like a popularity contest—when more people want a thing, the price nods along. Since the breakout from the cozy $1,600 neighborhood, trading volume has been skyrocketing—like birthday candles on a cake—telling us that fresh money is eager to jump in. As long as that demand keeps pressuring resistance, Ethereum could become the town’s favorite again.

What’s next? The crystal ball says…

If Ethereum stays above its trusty 200-week support and finally yells “Let’s do this!” at $2,800 with volume to match, then yeah, expect a trip up to $3,340. It’s like the market is auditioning for a role in a blockbuster—full of drama, volume, and just a hint of chaos. The full auction rotation? Pretty much guaranteed in the foreseeable future. So keep your eye on the prize, and maybe, keep the snacks nearby—because this rally looks like it’s just getting started. 🚀💰🔥

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Silver Rate Forecast

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Every Upcoming Zac Efron Movie And TV Show

2025-06-02 16:02