This text discusses the current state of Polygon (MATIC) and its comparison with other blockchains like Solana (SOL). Some users believe that MATIC’s lack of retail-driven use cases and its price action during the bear market suggest that its current performance might just be a phase. Others view the current market as a precursor to an “alts season” where alternative cryptocurrencies could see gains.

The current downtrend in MATIC‘s price may indicate either a short-term correction leading to a bullish run or continued bearishness. Expert opinions vary on the potential direction of MATIC based on several factors, including market sentiment, technical analysis, and fundamental news.

Table of Contents

MATIC, the cryptocurrency represented by Polygon, made a big entrance into the market with ambitious plans. Its primary objective was to address Ethereum‘s (ETH) scalability challenges and deliver quicker and more affordable transactions using its layer-2 solution. However, despite these inspiring objectives, MATIC has suffered significant price declines from its peak values.

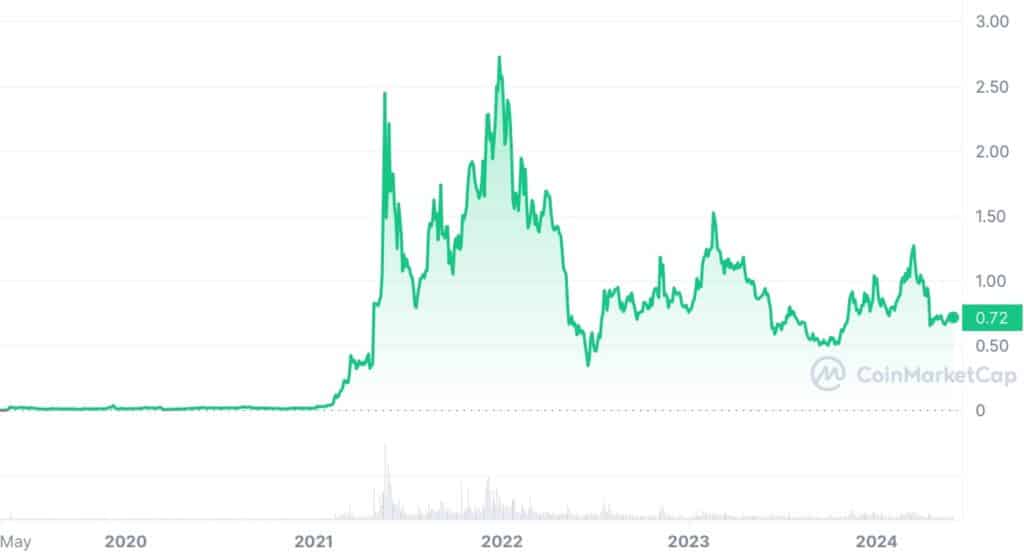

Matic, which reached a high of $2.92 in December 2021, is currently priced at $0.71 – a significant decrease of approximately 76% as of May 29. This decline is noteworthy considering the recent bullish momentum in the larger crypto market where numerous leading cryptocurrencies have experienced substantial growth.

As a crypto investor, I’ve noticed that Polygon, or Matic Network as some call it, underwent the Napoli upgrade not too long ago. The main goal of this upgrade was to boost its scalability and performance. However, despite these improvements, the price action for MATIC hasn’t been encouraging. Instead, I’ve seen bearish trends and substantial sell-offs from investors.

Today, as a researcher participating in Napoli Hard Fork, I’m thrilled to announce that Polygon Proof of Stake (PoS) has activated the first-ever Rollup Improvement Proposal (RIP) – RIP-7212. This groundbreaking development introduces a new precompile for the secp256r1 curve on our network!

— Polygon | Aggregated (@0xPolygon) March 20, 2024

In this piece, we delve into the reasons behind MATIC‘s subpar performance in the article, discussing if it’s really “defunct” or just going through a period of stabilization before making a comeback.

How is Polygon (MATIC) performing?

Let’s delve into an analysis of Polygon (MATIC) versus its competitors, Arbitrum (ARB) and Harmony, by examining key metrics such as total value locked (TVL), user engagement, transaction volumes, and decentralized applications (dApps) activity.

TVL

As a blockchain analyst, I would describe Total Value Locked (TVL) as the overall sum of funds committed to a blockchain’s smart contracts. Imagine it as the combined worth of assets that users have deposited into the blockchain system. A larger TVL signifies increased trust and higher usage within the network.

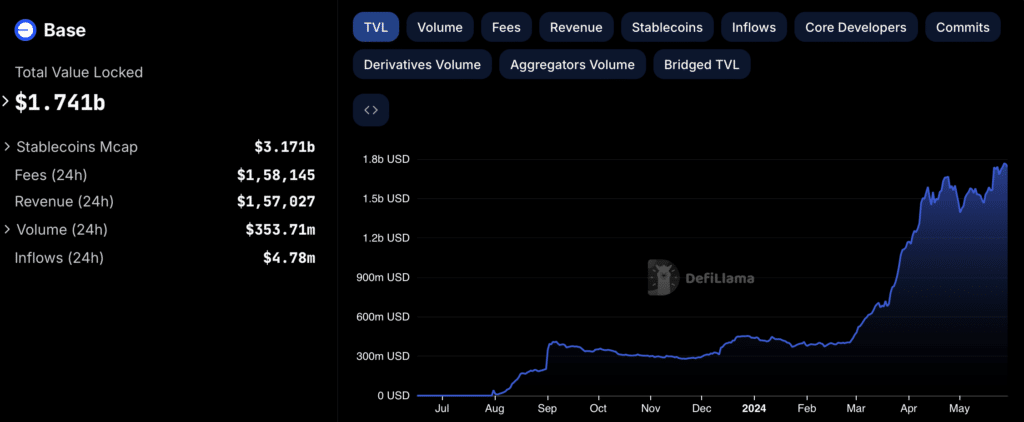

As a DeFi analyst, I’d like to note that, according to DeFi Llama, the TVL (Total Value Locked) in Polygon reached $971.38 million by May 29th. This position ranks Polygon as the 11th largest blockchain by TVL. However, it’s essential to put things into perspective and compare it with its competitors.

As a crypto investor, I’d say: Among the Layer 2 solutions I’m following, Arbitrum is currently leading with a total value locked (TVL) of $3.12 billion and ranking fifth. Base comes next with a TVL of $1.741 billion and a seventh place ranking. Polygon, on the other hand, is lagging behind with a decreasing trend in its TVL.

Let’s examine the relationship between the market capitalization and total value locked (TVL) for Polygon and Arbitrum. This comparison provides insight into how the market perceives the worth of each blockchain in relation to its TVL.

The market capitalization of Polygon is nearly seven times larger than its total value locked (TVL), represented by a ratio of 6.93. Conversely, Arbitrum’s ratio stands at only 1.02, suggesting a relatively balanced evaluation between its market cap and TVL.

The high ratio of Polygon indicates that although investors hold a positive outlook towards its future prospects, the amount of value currently secured within the network is comparatively smaller than its current market capitalization.

The difference between expectations and reality could signal that investor faith is primarily rooted in anticipated future expansion instead of present use and acceptance within the system.

User activity and transactions

User activity

As a crypto investor, I’m always interested in understanding the user activity of different blockchain networks to gauge their potential growth. One way to measure this is by looking at the number of unique active wallets (UAW). Based on data from Dapp Radar, in the past 30 days up until May 29th, Polygon has had approximately 6.76 million UAW. This places Polygon third in terms of UAW, with more users than Arbitrum’s 5.78 million and Base’s 2.74 million.

An abundant population of actively involved users is typically a sign of a thriving and committed community, essential for the enduring prosperity of any blockchain project.

Transaction volumes

From May 29th onwards, Polygon has handled a total of 55.75 million transactions over the past 30 days, an impressive figure. In comparison, Arbitrum managed 23.98 million transactions, while Base recorded 19.47 million during the same time frame. Nevertheless, let’s delve further into these numbers.

DApps volume

DApplications, or Decentralized Applications, function similarly to mobile apps yet they operate on a blockchain platform. Their significance lies in fostering high levels of user interaction and facilitating substantial transaction activity, rendering them indispensable components within any given blockchain infrastructure.

Over the past month, up until May 29th, Polygon’s total volume of transactions in decentralized applications (dApps) reached an impressive figure of $7.91 billion. However, this number pales in comparison to Arbitrum’s staggering $30.42 billion and Base’s respectable $8.64 billion.

As a researcher examining the data, I’ve noticed an intriguing finding. Although Arbitrum processes fewer transactions, its decentralized applications (dApps) volumes surpass both Base and Polygon’s. Similarly, Base’s dApps volume is slightly more substantial than Polygon’s.

Based on the data analyzed, it appears that Arbitrum could be handling transactions with greater values or more complex activities, while Polygon, in spite of having a larger number of transactions, may be processing smaller-scale deals.

Mixed sentiments on Polygon: Reddit weighs in

As an analyst, I’ve been monitoring a Reddit thread discussing Polygon. The collective sentiment among participants is diverse, with some expressing bullishness regarding its future prospects while others voice apprehensions about its recent developments and market standing.

Several individuals remain optimistic about Polygon’s prospective progress, even following a decline in its current pricing. They view MATIC as a “hidden powerhouse,” harboring significant growth possibilities.

Some users possess significant quantities of MATIC, purchased at various price levels, and have deposited these tokens to generate passive income through staking. The process of staking MATIC on the blockchain can potentially bring returns of approximately 3%, making it an attractive method for many users to amplify their token holdings gradually.

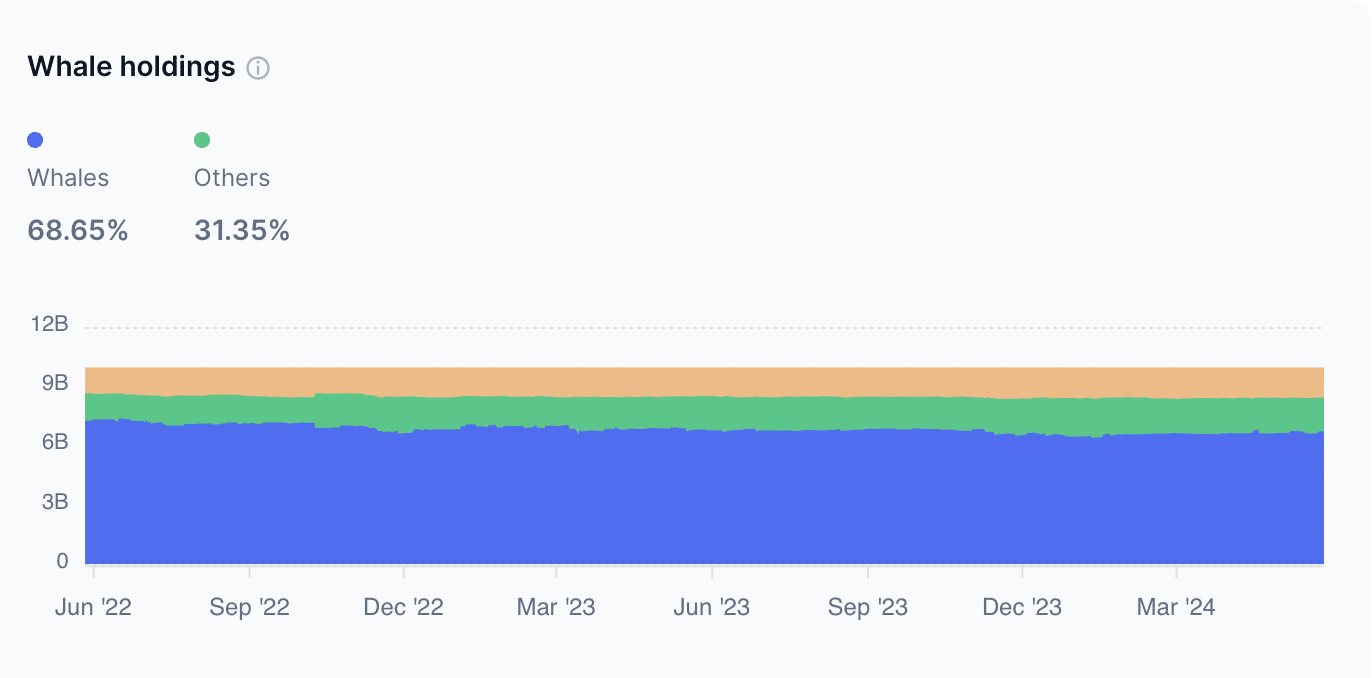

Despite Polygon’s recent underperformance compared to other cryptocurrencies, some users have raised valid concerns. They’ve observed a drop in MATIC‘s value while other digital assets experienced growth, causing disappointment and raising questions. This downturn is believed by certain users to be the result of large investors occasionally selling off their MATIC holdings in large quantities. These mass sell-offs generate increased supply and subsequently put downward pressure on the token’s price.

As Polygon faces increasing comparisons to other blockchains such as Solana (SOL), new hurdles emerge. Solana has experienced a significant uptick in usage due to niche applications like meme coin transactions. In contrast, MATIC, the fee token for Polygon, hasn’t discovered a comparable retail-driven use case yet.

Some people note that MATIC‘s price fluctuations adhere to its market trends. They bring up how MATIC hit rock bottom before many other tokens during the previous market downturn, implying that its recent performance could simply be part of its normal cycle.

As a researcher studying market dynamics, I’ve come across the perspective that investor focus can frequently pivot towards emerging projects, potentially overshadowing older ones. To maintain relevance and avoid being overlooked, it becomes crucial for these established initiatives to persistently innovate.

The majority of users hold a positive outlook, regarding the present market as a sign of an upcoming “altcoin rally.” In this scenario, coins such as MATIC could potentially experience growth. Once the cryptocurrency market expands beyond Bitcoin (BTC) and popular meme coins, the focus may return to projects boasting solid foundations, like Polygon.

What do experts think?

Among the views of experienced analysts regarding Polygon, there is just as much diversity as the general population’s perspective. Let’s explore the insights of some seasoned observers on MATIC‘s present situation and potential future developments.

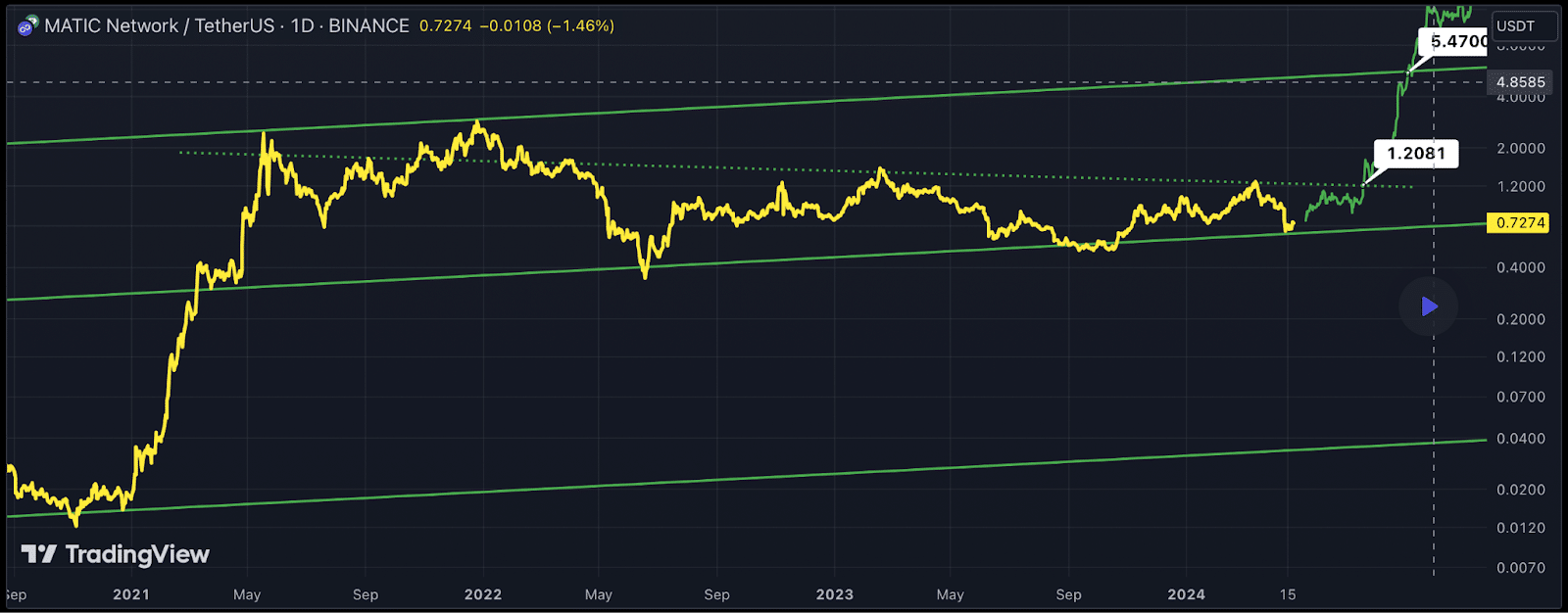

In a recent examination on TradingView, crypto analyst Bixley expressed optimism towards Polygon (MATIC), suggesting that its price is presently hovering near a key trend line above the $0.7 mark. This placement is significant because a breach of this trend line could indicate an imminent price breakout.

If the trend line holds for MATIC, there’s a risk of a price decrease. But Bixley is hopeful, anticipating that MATIC will surpass this resistance, triggering an uptrend instead.

As a researcher studying the cryptocurrency market, I’ve noticed some striking similarities between the price trends of MATIC and Ethereum during their early stages. If these parallels continue to hold true, then MATIC might be on the verge of experiencing significant growth, much like Ethereum did in its formative years.

As an analyst, I identified several potential price points in my evaluation of Bixley’s asset based on its current market value. The initial target sits at $1.2, which signifies a significant 70% escalation from the present price. Subsequent targets reach as high as $5.4, reflecting an impressive 650% surge.

While Bixley holds a positive outlook, not every expert agrees. In fact, one analyst brought up a red flag: a “death cross” has appeared on MATIC‘s weekly chart.

As a researcher studying the cryptocurrency market, I have observed that a death cross occurs when a short-term moving average falls beneath a long-term one. Typically, this indicator points towards bearish trends. Based on my analysis of MATIC‘s price movements, I predict a potential 70% decrease. If this were to occur, the price of MATIC would dip below $0.2.

To add another layer to the conversation, Twitter users have shared their perspectives on MATIC.

As a crypto investor, I’d like to share my perspective on Polygon’s recent performance and its long-term potential. Although it hasn’t shown significant gains lately, I firmly believe in the value this project brings to the table. Overlooking Polygon based solely on its current performance could be a missed opportunity for future growth.

As a researcher studying the cryptocurrency market, I’ve come across a tweet that poses an intriguing question: could we be seeing the end of the road for certain altcoins? With each market cycle, some coins experience remarkable growth only to eventually lose steam and fail to reach previous all-time highs once more.

In the dynamic realm of cryptocurrencies, it’s essential to consider various viewpoints before making well-informed decisions. Be sure to utilize extensive data for your judgement. And a crucial reminder: never risk more funds than you are prepared to potentially lose.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-29 16:49