Ah, Solana (SOL), that brave digital creature, has puffed itself up by 13% just this past week—like a cat who’s caught a particularly feisty mouse. The RSI and EMA lines, those ever-watchful guardians of market mood, still nod their approval. Yet, beneath this seeming jubilation lurks an uneasy hesitation, a stalling just shy of the $136 summit, as if SOL has paused to catch its breath before either diving or soaring.

Meanwhile, the BBTrend indicator has taken a nosedive sharper than a Bolshevik on a slippery Moscow street, signaling that the tempestuous winds of trend strength are calming and volatility is slipping away like an uninvited guest. This lull, a waltz of indecision and looming consolidation, leaves SOL at a crossroads: will our daring protagonist charge onward or retreat into the shadows of a pullback?

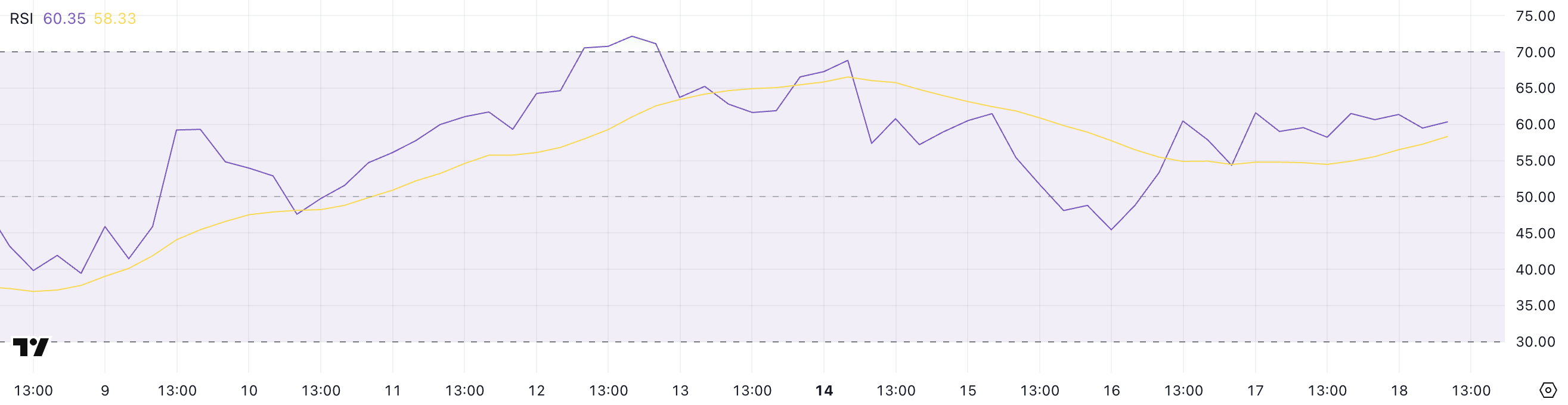

SOL RSI Shoots Up, Then Decides to Take a Tea Break ☕🐾

Once timid at 45 barely two days past, Solana’s RSI now sits at an audacious 60.35—a jump worthy of a surprise party. Yet, since yesterday’s fanfare, it has mellowed into a complacent pose, as if savoring the moment rather than charging ahead.

This plateau suggests Solana’s been busy teasing the bulls, edging ever closer to the ‘overbought’ realm without quite crashing the velvet rope event. The market seems to be folding its arms, patting its chin, considering its next move… or perhaps just catching its breath before another pirouette.

For those enchanted by mysterious oscillators, the RSI dances gracefully between zero and a hundred. Above 70, it screams “party’s over, time to sell!” Below 30, it whimpers, “buy me, I’m cheap!” At 60.35, our dear SOL flirts with the angels but remains grounded—for now.

This delicate balance speaks of cautious optimism mixed with the faint aroma of doubt—a volatile cocktail indeed.

BBTrend Trips Over Its Own Feet as Volatility Evaporates 🕺💨

From a lofty perch at 17.5, the BBTrend indicator has tumbled down to 5.69 in just four days, like a drunk trying to remember where he left his boots.

This sharp fall spells calm after the storm, with the wild swings giving way to a lull—perhaps a break before the next thunder, or simply exhaustion from the dance.

While BBTrend refuses to pick sides, its plunge hints that the once-proud rally is growing weary. Our Solana may be settling in for a cozy pause or an awkward indecision fit, unsure whether to advance or retreat.

This enigmatic creature, BBTrend, spies on Bollinger Bands, the market’s mood rings, to gauge the vigor of trends. High values shout confidence from rooftops, while low values whisper secrets of hesitation and quiet markets. At 5.69, Solana lounges comfortably in the subdued patio of uncertainty.

Without another gust of volatility, our unpredictable hero may find itself confined to a dull, predictable range—essentially market purgatory.

Golden Cross Approaches, But $136 Wall Is Like a Soviet Bureaucrat—Unyielding

The EMA lines, ever loyal, continue their bullish chant with short-term averages tiptoeing above the long-term ones—a subtle nod to hope and fervor. A golden cross glimmers on the horizon like a tempting mirage, hinting that the market might still bless this tale with a happy chapter.

Yet entrenched like a grizzled bureaucrat, the $136 resistance remains unbreached, blocking Solana’s path with all the stubbornness of a cat refusing to come inside on a rainy day.

To shed some light, Tracy Jin, COO of MEXC, offered their prized insight to BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A cocktail of favorable technical setups and institutional tailwinds—like the debut of spot Solana ETFs in North America—has nourished this short-lived rally. The token’s reclaimed crown in decentralized exchange activity and swelling total value locked add fuel to this narrative.”

Should Solana muster a volume-backed leap over the $136 battlement, eyes might turn toward the shimmering goals of $147 and beyond. Fail, however, and the tale may twist toward $124’s comforting embrace, a perilous step indeed.

Regarding Solana’s next moves, Jin proffered a warning:

“Despite recent ups, SOL’s fate hangs on fragile threads of broader liquidity. A dash of macro shock or Bitcoin tantrum might hush this rally faster than you can say ‘recession.’”

Fall beneath $124, and the slide could accelerate to $112, or—dare we whisper it—drag SOL into the gloomy $95 territory, a place only the brave dare tread.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-19 02:01