In the dusty corners of the crypto world, the Solana price is about to form a death cross pattern, a grim harbinger of more downside as its decentralized exchange volume, active users, and revenue take a nosedive. It’s like watching a slow-motion train wreck, but with more zeros involved.

Solana (SOL) token has plummeted to $159, its lowest level since the fateful day of November 6, and a staggering 46% drop from its lofty heights in February. It’s as if the crypto gods decided to play a cruel joke on the faithful.

This crash, dear reader, has unfolded as the ecosystem grapples with major challenges, all while the meme coin prices are doing the limbo—how low can they go? The total market cap of all SOL meme coins has tumbled from a robust $25 billion in January to a mere $9.8 billion. Tokens that once brought joy, like Dogwifhat, Official Trump, and Pudgy Penguins, have shed billions in value, leaving behind a trail of tears and broken dreams.

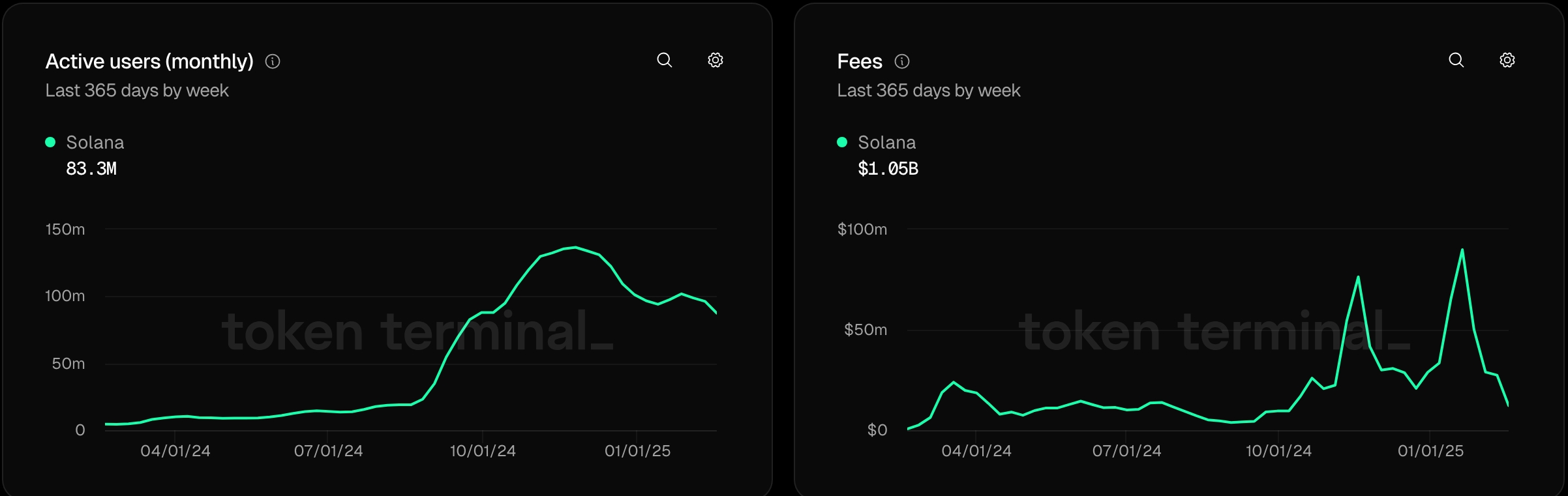

And what of the internal metrics, you ask? TokenTerminal data reveals that the number of active users has dropped to 87.3 million, the lowest level since October 7. This is a far cry from the November high of 137 million. It seems some Solana users have decided to cash out, perhaps to buy a nice cup of coffee instead.

As if that weren’t enough, Solana’s revenue has also dipped below the $1 million mark per day. On February 14, it managed to scrape together $978,000, a far cry from this year’s peak of $44 million. Talk about a fall from grace!

The decentralized exchange industry is also feeling the pinch as the Solana meme coins plunge. Its DEX volume has dropped by 36% in the last week to $16.7 billion, trailing behind Ethereum’s $18.3 billion and BSC’s $16.9 billion. It’s like being the last kid picked for dodgeball.

Solana price forecast

The daily chart reveals that the SOL price has been on a strong bearish trend since peaking at $295.28 on January 19. It formed a double-top-like chart pattern at $263, with a neckline at $169, its lowest swing on January 13. It has already dropped below that neckline, a clear sign that the bears have taken over the playground.

Solana has also formed a death cross pattern, which occurs when the 200-day and 50-day Weighted Moving Averages cross paths. The Percentage Price Oscillator is also moving downwards, like a sad song on repeat.

Thus, the outlook for the SOL price is decidedly bearish, with the next point to watch being at $110, the lowest swing from August last year. This target is about 30% below the current level. A break above the $200 level will invalidate this gloomy forecast, but until then, it’s a wild ride!

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Maiden Academy tier list

2025-02-24 16:59