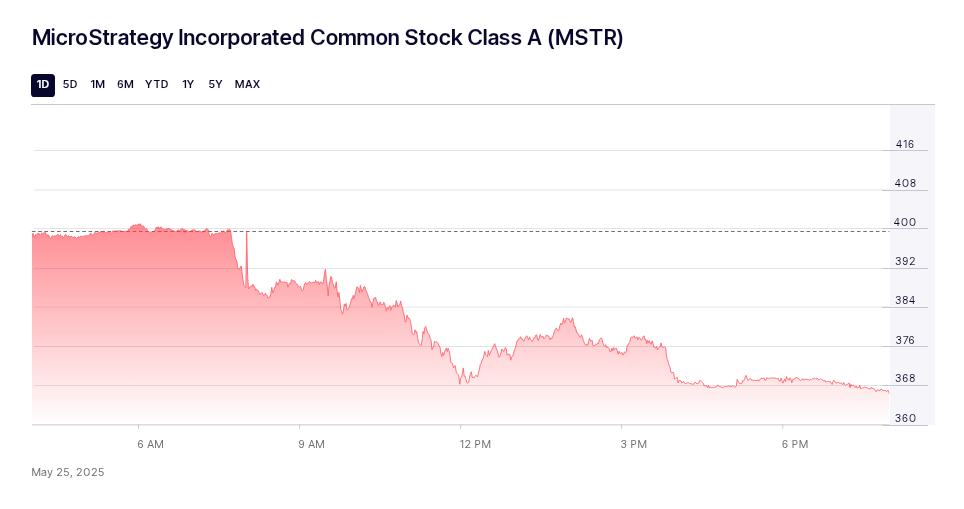

According to our ever-so-dramatic market watcher, Sir Chartist, Strategy’s stock (MSTR) is in for a bit of a theatrical performance. Picture this: a steep plunge before an exhilarating rebound. Sir Chartist suspects the shares could tumble down to a humble $350 before they snap back like a rubber band to $700. Yes, dear readers, a quick dip followed by a rise that could send your heart racing. All part of the grand plan, apparently.

The Prime Setup for a Little Breakdown (Don’t Get Too Comfortable!)

Now, Sir Chartist isn’t exactly a fan of subtlety. He’s noticed MSTR has slipped below its 9-day exponential moving average (not the most glamorous of terms, but we soldier on) and its 20-day simple moving average. These lines are now playing a game of “let’s get closer” in a bear-ish pattern. And when that happens, the short-term momentum often disappears faster than a party guest who doesn’t want to help with the dishes. April’s optimistic green candles? Gone. Enter: heavier selling.

Let’s break down this chart on $MSTR.

At the end of this thread I will give my opinion on it as of TODAY!

As traders and chartists, knowing and STUDYING charts is KEY to success.

Let’s have a look

THREAD

— SIR CHARTIST (@ChartBreakouts) May 24, 2025

Volume Trends Could Be the Dramatic Climax

Sir Chartist is keeping a close eye on a potential panic-driven drop to $350. Oh, the drama! If sellers are controlling the show, volume spikes on those oh-so-red days will tell the tale. But after a sharp drop, if we see a decrease in selling volume and a surge of glorious green, that could mean we’ve hit the bottom. Then, it’s a grand finale of buying volume outpacing the sellers. Oh, how the tables turn.

Equity Raise and Bitcoin Buy Plans: A Love-Hate Relationship

Ah, Strategy (formerly MicroStrategy) has grand plans to raise $2.1 billion through a stock sale. This delightful cash infusion will be spent on… wait for it… more Bitcoin. Now, on one hand, adding more BTC could boost the stock price later on. But don’t get too carried away – fresh shares hitting the market may cause some short-term grief. Sir Chartist, ever the pessimist (but we love him for it), says this dilution is part of why he expects the initial dip.

Past Patterns Hint at a Glorious Rally (Maybe?)

Sir Chartist also reminds investors of a breakout from a previous sideways channel. It was like a quiet, subtle waltz that led to a dazzling 100% gain with hardly a breath of pullback. He’s optimistic that history, while not quite a perfect dancer, will probably find a way to do a similar performance once the stock hits its next low. A repeat rally? He thinks it’s likely. After all, history doesn’t repeat exactly, but oh, how it loves to rhyme.

Cautionary Views Add a Dash of Spice

But wait, there’s more! Crypto analyst Ali Martinez has also weighed in. He spotted a TD Sequential sell signal on MSTR’s weekly chart – a little ominous signal that usually precedes a dip. And while Strategy’s recent Bitcoin buy (7,390 BTC for a cool $765 million) did nudge the stock above $400 earlier this week, even that shiny purchase couldn’t prevent the bearish signals. How’s that for a plot twist?

So, to sum it up in the most delightful manner: Sir Chartist is predicting a quick, dramatic drop to $350, followed by a grand rally. He’s relying on his beloved moving averages, volume shifts, past breakouts, and the ever-intriguing pull of Bitcoin. Stay tuned for the show, darlings.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-05-26 01:45